In one of the biggest deals seen on the Australian exchange for many years, the Chemist Warehouse Group will arrive as a new listing after merging with Sigma Healthcare.

With the combined group valued at around $8.8 billion, it is set for rapid international expansion and will arrive as a top ASX 200 company and be close to a top 100 stock and be one of Australia’s largest listed retailers.

Sigma Healthcare (ASX: SIG) directors said the company would raise $400 million as part of the merger, which is underwritten by Goldman Sachs, to bring together its wholesale and franchise pharmacy business with Chemist Warehouse’s 600 store “big box” pharmacy network.

The deal will be subject to competition regulatory approval by the Australian Competition and Consumer Commission (ACCC) but in a bullish analyst call, Chemist Warehouse chief executive officer Mario Verrocchi said the potential for offshore expansion was to “infinity and beyond” – a reference to the famous Buzz Lightyear quote from the film Toy Story.

He forecast robust expansion within Australia other than in Victoria where it is already a dominant presence and also in China and Europe where Chemist Warehouse has the beginnings of a retail network.

Merger will combine executive and board positions

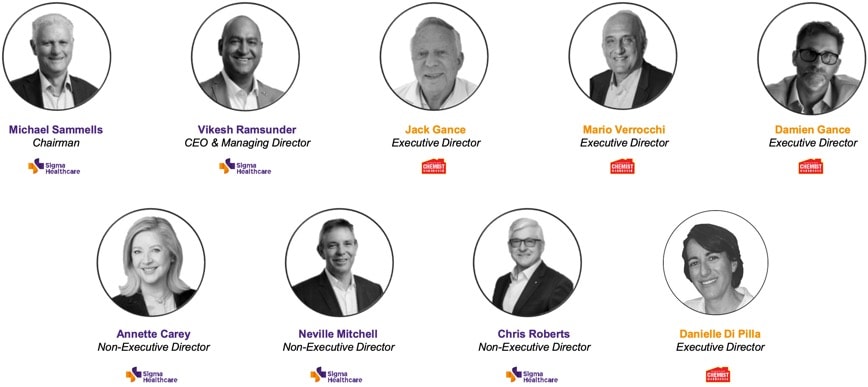

Should the merger proceed as planned, Mr Verrocchi would continue to run the Chemist Warehouse business and two Chemist Warehouse executives, Damien Gance and Danielle Di Pilla, will join the merged company board.

Ms Di Pilla is the niece of Mr Verrocchi and the sister of David Di Pilla, who through HMC Capital holds a stake of 19% of Sigma and helped to inspire the merger.

Sigma directors would also join the board of the broader company, which is expected to come together in the second half of next year once competition and other regulatory issues have been addressed.

The Sigma directors that would continue include Neville Mitchell, Annette Carey and Chris Roberts. Mr Roberts used to be the CEO of Cochlear (ASX: COH) and sits on the current board as a representative for HMC.

After the merger, Chemist Warehouse shareholders – including its two billionaire founders, Jack Gance and Mario Verrocchi – would own 85.75% of the combined group and share a $700 million payday.

Sigma would buy all of the shares in Chemist Warehouse, with Mr Verrocchi, Mr Gance and his brother, Sam Gance, together holding 49% of the larger group.

They will all hold their shares in escrow, stopping those shares from being traded until later in 2026.

The other 200 Chemist Warehouse shareholders will collectively own 37% of the group and will be able to buy and sell shares, which will help to give the merged group a total free float of around 47%.

That would greatly assist in the merged group getting important inclusions in ASX 200 and ASX 100 lists and, therefore, put it on the radar of index funds and other fund managers who would be keen buyers.

Best chemist in Australia

Chemist Warehouse is by far the most impressive pharmacy business in Australia, with total sales of around $7.9 billion and compound annual sales growth of 10% over the past five years and even higher before then.

The margin on earnings before interest and tax (EBIT) is an impressive 15% and with just 54 stores overseas in New Zealand, China and Ireland, there is plenty of room for international expansion.

The most compelling thing about the merger though is that it combines the undoubted retailing and marketing skill of the Chemist Warehouse chain with Sigma’s modern distribution, infrastructure and logistics capabilities.

Pharmacy Guild not happy

Other than an investigation by the ACCC looking at competition concerns, the merger has been strongly opposed by the Pharmacy Guild of Australia, which tries to regulate the ownership and location of pharmacies within Australia.

Both Sigma, which supplies Amcal pharmacies and Chemist Warehouse get around those issues by running a franchise model so the pharmacies within their chains are still actually owned by individual pharmacists.

The new shares will be issued at 70c a share, an 8.2% discount to Sigma’s last traded price.