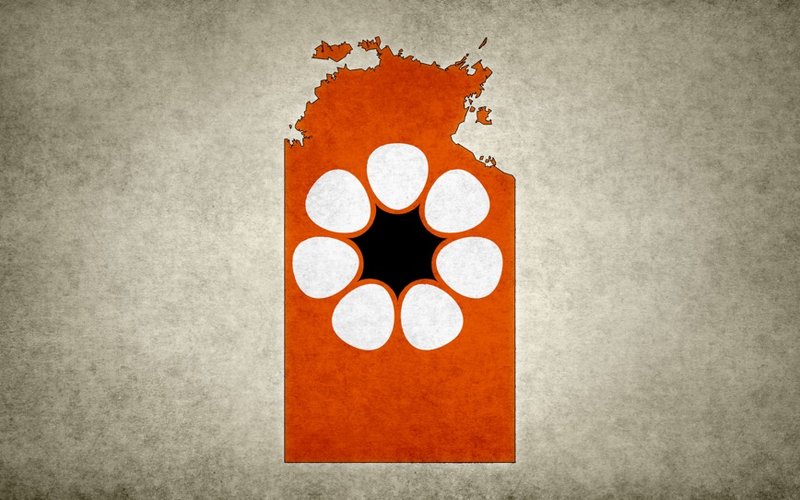

Central Petroleum (ASX: CTP) has inked a deal to supply up to 21.9 petajoules of gas from its Mereenie field in the Northern Territory to major retailer AGL Energy (ASX: AGL).

The new gas sale agreement, signed together with Central’s private joint venture partner Macquarie Mereenie Pty Ltd, spans a three-year period and is expected to commence upon the expiration of a current deal with Incitec Pivot (ASX: IPL) at the start of 2020.

Central chief executive officer and managing director Leon Davaney said securing a blue-chip customer such as AGL demonstrated market confidence that the Mereenie production assets can provide a reliable source of gas supply for domestic customers.

“This is an exciting step in our continuing supply into the east coast from our Northern Territory production facilities,” he said.

While Central has a 50% contractual obligation for gas supply under the new deal, the company said it expects to be allocated the majority of the revenue during the first two contract years under “portfolio balancing arrangements” with Macquarie.

In addition, Central said the new agreement is expected to lift the company’s average portfolio gas price.

Joint venture arrangements

To support ongoing investment in Mereenie field production, Central has agreed on a package of commercial arrangements with Macquarie.

The ‘portfolio balancing’ arrangements, in which Central will benefit from the majority of gas sales in the first two years of the AGL deal, is intended to equalise monthly sales volumes from the Mereenie field.

A second arrangement involves a portion of Central’s current overlift imbalance being gradually returned through a 2.4PJ gas purchase deal spread over the next three years (consistent with the term of the AGL agreement).

“The package of [Mereenie joint venture] commercial arrangements support new investment in Mereenie field production capacity to deliver the AGL Energy GSA, as well as new gas sales into an east coast market that remains structurally short for term gas supply,” Mr Devaney said.

“Importantly, these arrangements facilitate Central’s current refinancing and farm-out activities,” he added.

Incitec partnership

Signed in June 2018, Incitec’s deal at Mereenie involved the supply of gas to be delivered via the Northern Gas Pipeline from the start of commercial operations (which occurred in January) until the end of December 2019.

This deal expiry coincides with the commencement of supply to AGL from 1 January 2020.

However, Central remains partnered with Incitec, an Australian fertiliser supplier, under a separate 50:50 joint venture deal at the Range gas project in Queensland’s Surat Basin.

In August, the duo announced a 2C contingent gas resource of 270PJ of coal seam gas at the project, far exceeding the original estimate of 150-180PJ of potentially recoverable resources.

An upcoming pilot well program and pre-final investment decision activities at the Range project are expected to lead to a conversion of the 2C resource to certified 2P reserves.

In today’s update, Mr Devaney said 2020 was “shaping up to be a very exciting year with a number of big goals set for exploration and the Range gas project”.

By afternoon trade, Central shares were up 3.57% to $0.145.