CCP Technologies hatches commercial upswing in 2019

CCP Technologies is looking to raise $750,000 to help boost its commercial aspirations to potentially generate up to $7.5 million worth of revenue later this year.

Food industry revolutionary CCP Technologies (ASX: CT1) says it is entering 2019 with a string of commercial projects in its pipeline; projects which the IoT company intends to monetise to the tune of around $7.5 million given current market conditions.

CCP wants to expand the coverage of its technology-powered supply-chain innovation – a digital “tag”, that can track and record a variety of environmental factors that allow perishable food to remain commercially-viable and thereby prevent huge amounts of food wastage – currently a huge issue that is threatening food security on a global scale.

In its most recent announcement, CCP said it intends to raise a further $750,000 at 1.2 cents per share to help boost its commercial aspirations and potentially generate up to $7.5 million worth of deals later this year.

The company said it will open its latest capital raising round next week with new shares to be issued soon after in early February.

According to CCP chairman Leath Nicholson, CCP has secured agreements with global firms such as Vodafone with sales channels broadening for the upcoming year including an agreement with Dicker Data – one of Australia’s largest hardware distributors.

“We were buoyed by independent research which outlined our company’s comparative strengths,” said Mr Nicholson.

Furthermore, CCP has reasserted that 67% of its impending deals refer to “large enterprise opportunities” that exceed $250,000 in contract value.

Customer growth

On the ground, its products are gradually being rolled out to increasingly more customers, aiming to fortify real-time monitoring of their supply chains. This will build on CCP’s current client base of more than 100 customers and more than 210 sites across Australia, the US and Singapore.

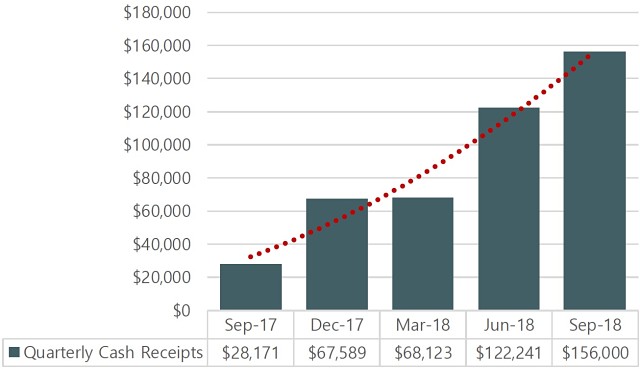

“Our revenue has grown by more than five and a half times over the 12-month period to September 2018 – to reach $156,000 for the last quarter,” said CCP’s chief executive officer Michael White, speaking at the company’s AGM in November last year.

Revenue growth for CCP Technologies in 2017-18.

“Our customer contract value now exceeds $1.1 million. This has increased by an average of 20% per quarter over the same period. With this increase in revenue, we have seen a reduction in our cash burn.” he said.

Advanced solutions

As part of its recent and intended future growth, CCP has turned towards the world’s most avant-garde technology – blockchain – to advance its business and supply-chain improvements.

Paper-based systems are cumbersome, prone to error, missing information and falsification, which is leading to food companies seeking out blockchain-powered solutions in ever greater numbers to improve through-chain transparency and accountability.

According to industry feedback and CCP’s extensive product testing, real-time monitoring of perishable food temperature ensures quality control and extends shelf-life – a caveat that is highly valuable in a world where it is estimated that up to 30% of perishable food is wasted each year.

CCP’s blockchain-powered business impetus comes not only from a logistics perspective but also from a financial one. First Growth Funds (ASX: FGF) made a strategic investment in CT1.

FGF invests across different assets and classes which includes blockchain and digital currencies invested in CT1 to fund growth and product expansion offering with blockchain solutions. As IoT and blockchain solutions mature, industry analysts expect this advanced technology to transform supply chain management by adding security, speed, and transparency.

New revenue sources

Refrigeration is an essential part of every developed economy. The global cold chain market size was valued at US$147.55 billion in 2017 and is expected to expand at a CAGR of 15.0% from 2018 to 2025.

CCP told Small Caps there is no provider of a proactive fully-managed refrigeration service to the cold chain industry in Australia. The company is proposing to develop a proactive managed cold chain services model as a part of its plan to introduce new revenue sources.

“We anticipate revenues and customer contract value to rise substantially over the next six months as trials with a number of large national and global companies are successfully concluded,” White said.