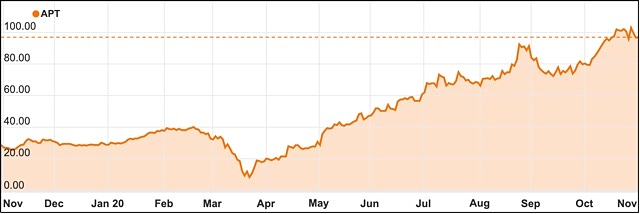

What odds would you put on Afterpay (ASX: APT) shares hitting $200?

Probably very steep odds and you would probably be right – particularly after the buy now pay later stock was caught in the market downdraft on Friday and fell 3.1% to $96.46.

However, it would be wise to remember that Afterpay has made a habit of proving the pundits wrong and of building a business model that has built a very loyal customer base in a short space of time.

After all, how many people do you know who have a bank account that go around and urge their friends to open one – which is the sort of unscripted, word of mouth growth model that has been working for Afterpay, despite doubts about its business model ramping up debts levels.

Growing through word of mouth

Sure, if you take a snapshot of Afterpay as it stands today the stock looks tremendously overvalued.

The company lost $23 million on revenue of $519.2 million in the past year, which hardly supports the current share market valuation of $27 billion.

What that snapshot doesn’t take into account, of course, is the pace that the company is growing at in both its core BNPL business both in Australia and offshore and the way it can leverage its growth by offering different services to its customers.

Customer base doubled in a year

In its latest quarterly update Afterpay showed that it had doubled its customer base over the year to more than 11.2 million active users, primarily through aggressive expansion in the United States.

Underlying sales more than doubled for the September quarter to $4.1 billion, which means it could hit as much $16.4 billion in merchant turnover for the 2020-21 financial year.

While those numbers certainly justify a technology growth premium, they still may serve to justify the current share price rather than any further share price appreciation.

Can Afterpay do banking?

What if you were to assume for a moment that Afterpay could reproduce its excellent execution in BNPL into banking services?

It is an intriguing possibility after Westpac (ASX: WBC) joined up with Afterpay to offer banking services, including cloud-based banking.

Afterpay said it will launch its new banking service to more than 3.2 million Australian customers by the June quarter next year, but there is very little to stop it pushing the Westpac cloud-based banking service globally to its 11 million customers, or even work through offshore banks.

Afterpay-branded savings and transaction accounts will be linked to existing customer accounts, with a “minimum viable product launch” targeted for the June quarter next year.

One of the advantages of the product is that it offers an alternative to conventional banking products and can be easily scaled internationally because it uses cloud-native technology.

Australia and New Zealand a test bed for products

Afterpay has long used its experience in Australia and New Zealand as a test bed for international expansion and customers here are using the service more frequently over time as the number of merchants on offer increases.

The best Afterpay customers in Australia and New Zealand transact more than once a week and use about 26 merchants, numbers that are being mirrored overseas as well.

Afterpay is also on track to continue expanding in Europe with its acquisition of Pagantis set to be finalised this year and it also has a base in Singapore which will be used to drive growth throughout south-east Asia.

Is $200 a pipe dream?

So, is a $200 share price a pipe dream or an achievable aim?

Well everything would need to go right for that sort of share price to come into view but stranger things have happened with technology stocks given their ability to grow so quickly once their core product offering is established.

Going against such a dream is the fact that Afterpay shares are already arguably priced to perfection and that the BNPL space is not one that will simply be left alone for the original players to enjoy, with global giants including PayPal already on the scene and even the big four Australian banks beginning to offer BNPL styled credit cards.