Oil and gas junior Byron Energy (ASX: BYE) has found signs of hydrocarbons while drilling an offshore exploration well on the Cutthroat prospect in the US Gulf of Mexico.

The company today reported its South Marshall Island 58 (SM58) 011 well, which has been drilled to a measured depth of 10,875 feet (3,314.7m), encountered the hydrocarbons in line with pre-drill expectations in the primary O Sand target at 10,435ft (3,180.6m).

Logging tools have indicated a gross thickness of 300ft (91.44m) measured depth, starting from the top of the O sand to the current drilled depth, with no evidence of water seen to this depth.

Byron said based on the logs, the O sand appeared to be a “very high quality and well-developed reservoir”.

Byron chief executive officer Maynard Smith said the company is confident this result from the 011 well will “lead to a commercial development on SM58”.

“This result vindicates the high effort that was put into the seismic processing, which was used to define and drill the Cutthroat prospect,” Mr Smith added.

Casing to be set before drilling continues

Later on Monday, Byron announced it will set casing on the well at a measured depth of 10,890ft (3,319.3m) prior to drilling ahead to the planned total depth of 11,466ft (3,494.8m).

It said the decision was based on the outstanding result achieved thus far in the well, with the casing to be set across the very thick upper O sand accumulation to “ensure its protection and to optimise the cement job across the entire pay interval”.

Byron also plans to acquire further electrical logs “over the next several days”, which will aid in identifying the exact hydrocarbon type and liquids content.

The well will then be deepened to its planned total depth to evaluate the lower O sand.

Mr Smith said the company looks forward to getting the upper O pay sand “safely behind pipe”.

“The result that has been achieved at the 011 well will lower the risk and enhances the upside of our Steelhead prospect, which will be drilled next year,” he added.

Cutthroat prospect

Byron’s SM58 011 well is drilling the Cutthroat prospect, targeting the “highly productive, normally pressured” O sands which have produced 16.5 million barrels of oil and 85 billion cubic feet of gas on Block SM58 since production began in 1964.

The prospect lies up-dip from the Shell’s SM58 9ST1 well, which logged more than 500ft (152.4m) of high quality, wet O Sand pay in the late 1980s.

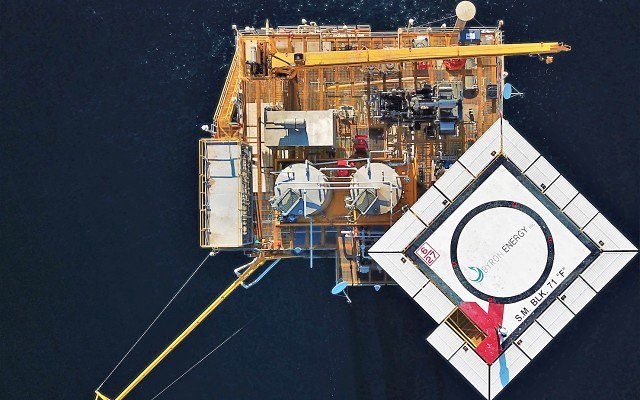

It is also very similar in trapping style to the productive SM71 F1 and F3 wells drilled by Byron in 2016.

Byron has calculated a prospective resource for Cutthroat of 7.8MMbbo oil and 18Bcf gas on a gross basis, using an average O Sand thickness of 175ft and historical O Sand recovery factors.

Byron holds 100% of the operator’s rights, title and interest in the SM 58 Block to a depth of 13,639ft (4,157.2m) and bears the full cost of the 011 well.

Below 13,639ft subsea, the company has a 50% working interest under a pre-existing exploration agreement. However, all drilling opportunities on the block to-date are above this subsea level.

In addition, Byron holds a non-operated 53% working interest in associated existing producing assets, the SM58 E1 well and the SM69 E platform.

By midday trade, Byron shares were up 19.57% to $0.28.