Market wrap: bull market broadening as ASX 200 hits record close

WEEKLY MARKET REPORT

The bull market in Australian shares is continuing to broaden, with gold, lithium and iron ore miners all helping to push the ASX 200 to a record closing high on Thursday.

While the big banks have already rallied hard, rising resource prices helped the miners to join the action with the ASX 200 closing up 1% to 7896.9 points – beating the previous record close of 7847 points which was set on March 8.

At one stage the market hit an intraday record of 7901.2 points, helped along by optimism about falling interest rates later this year which also propelled shares in the banking, property and retail sectors.

Dividends might be helping the market along

The payment of some large dividends by companies including Telstra, BHP and Commonwealth Bank likely also added to investor firepower, with possibly more than usual transferring the cash into their broking accounts to get more of the positive market action.

BHP (ASX: BHP) added 1.4% to $44.27, Rio Tinto shares (ASX: RIO) were up 0.7% to $121.76

and shares in Fortescue Metals (ASX: FMG) rose a hefty 2% to reach $25.70.

The mining rally was solid, with lithium stock Pilbara Minerals (ASX: PLS) up 2.1% to $3.83, fellow battery minerals company Liontown Resources (ASX: LTR) saw its shares rise 2.6% to $1.17.

Gold on the rise

Gold stocks were also buoyed by the rising gold price, with the giant Newmont (ASX: NEM) seeing its shares rally 3.3% to $53.71, leading the sector higher.

Despite February’s retail sales data coming in slightly weaker than expected at 0.3% month-on-month, most retail shares were also firmer.

Myer (ASX: MYR) shares added 1.2% to $0.82, Harvey Norman (ASX: HVN) shares were up 2% to $5.15 and Wesfarmers (ASX: WES) shares enjoyed a 1.2% rally to $68.40.

There was some stock specific action too, with Ramsay Health Care (ASX: RHC) shares adding 0.4% to $56.51 despite negative broking reports about lower tariff increases for its French Hospitals.

Beach Energy (ASX: BPT) shares added an impressive 3.7% to $1.84 after telling investors it would axe 30% of its staff in a restructuring plan.

Small cap stock action

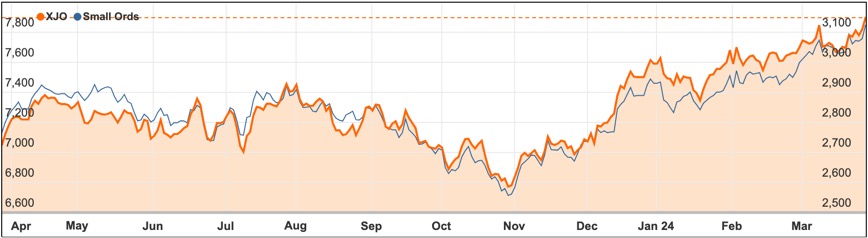

The Small Ords index rallied 2.04% for the week to close at 3123.6 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Allup Silica (ASX: APS)

Allup Silica’s Sparkler project in Western Australia has produced high-purity silica exceeding industry standards, making it suitable for use in photovoltaics and high-tech manufacturing, as shown by test work from CDE Global.

The testing indicated a silicon dioxide purity of 99.84% without needing magnetic separation, highlighting the sand’s value for specialised industries by reducing contaminants like ferric oxide, aluminium oxide, and titanium dioxide.

According to chairman Andrew Haythorpe, these results are a crucial step forward in refining the process circuit design for the Sparkler project, aiming to improve product consistency, reduce costs, and potentially increase the project’s estimated mineral reserves.

Silica sand, essential for making specialty glass in photovoltaic cells and mobile screens, benefits from purity in enhancing product quality, as impurities can degrade transparency and efficiency.

Additionally, recent sampling at the Cabbage Spot project has revealed areas with high-purity silica sand, indicating potential for high-tech uses and marking a major advancement in Allup Silica’s exploration efforts.

Peppermint Innovation (ASX: PIL)

Peppermint Innovation has secured three new contracts with MASS-SPECC Co-operative Development Centre and Co-operative Health Management Federation in the Philippines, totalling $53,000, through its subsidiary Peppermint Bizmoto Inc.

The contracts involve developing API services to integrate co-operative member applications with existing systems, aiming to streamline accounting, registration processes, and health insurance operations, enhancing user experience and operational efficiency.

MASS-SPECC and Co-operative Health, which links over 825 health providers and almost 58,000 policy holders, reflect Peppermint’s expansion and deepening relationships in the sector.

Peppermint’s managing director Chris Kain highlighted the importance of these contracts in extending Peppermint’s footprint in digital transformation initiatives within these organisations, offering potential revenue from transactions and additional services through their electronic money issuer wallet.

The partnerships underscore MASS-SPECC’s commitment to digitalising and expanding its membership base, with Peppermint benefiting from transaction fees and the provision of ongoing service and maintenance.

Many Peaks Minerals (ASX: MPK)

Many Peaks Minerals has agreed to secure an 85% interest in a promising exploration area in Côte d’Ivoire, West Africa, through a series of corporate transactions aimed at acquiring a 100% stake in a joint venture between Turaco Gold (ASX: TCG) and Predictive Discovery (ASX: PDI).

This joint venture holds the rights to four mineral permits in an area with recent gold discoveries and over $6.1 million spent on previous explorations across 1,275 sq km.

The acquisition includes the Ferke gold project, featuring the Ouarigue South discovery and the Odienne project, both of which have shown significant gold mineralisation and are supported by systematic geochemical coverage and high-resolution geophysics.

Executive chair Travis Schwertfeger emphasised the exploration success foundation provided by the Ferke and Odienne projects, with multiple targets identified for follow-up, including extension targets, leveraging the team’s extensive experience in West African gold discovery and development.

Many Peaks plans to commence with auger drilling and surface geochemistry at these projects to define drill targets further, aiming to expedite exploration based on existing work and capitalise on the region’s potential within the Leraba gold trend.

Mitre Mining (ASX: MMC)

Mitre Mining has made a noteworthy discovery at the Cristal target within the Cerro Bayo project in Chile, uncovering outcropping silver-gold vein extensions with grades reaching up to 32,849 grams per tonne silver and 298.6g/t gold.

The vein, extending over 700 meters and situated near Mitre’s processing facility, is considered a high-grade feeder structure that could notably enhance Cerro Bayo’s global resource, highlighting the region’s untapped potential.

Exceptional rock chip and channel sample results have revealed silver equivalent assays as high as 39,481g/t, indicating the presence of bonanza-grade mineralisation.

The discovery is in addition to high-grade historic drill intercepts and follows a resource review that doubled Cerro Bayo’s estimate to 50.2 million ounces at 311g/t AgEq.

Interim executive director Ray Shorrocks emphasised the discovery’s potential to positively impact the project’s growth and underscored the high prospectivity and opportunity for rapid resource expansion at Cerro Bayo.

McGrath (ASX: MEA)

Australian property agency McGrath received a takeover proposal from Knight Frank Australia and Bayley Corporation, aiming to position Knight Frank as a leader in Australia’s real estate sector.

The offer gives McGrath shareholders the choice between $0.60 cash per share, an unlisted scrip option, or a combination, valuing McGrath at approximately $95.5 million.

The valuation represents a premium over McGrath’s recent trading price, with the cash option serving as the default.

McGrath plans to delist from the ASX if the acquisition proceeds, and founder John McGrath intends to accept the scrip option for his shares, continuing as chief executive officer.

The McGrath board, holding about 48.1% of the company, has recommended shareholders approve the deal, highlighting its benefits to stakeholders and alignment with McGrath’s growth plans.

The week ahead

Despite a lack of trading days due to the extended Easter break, there is plenty for investors to watch out for during the four trading days next week.

Here in Australia the main highlight will be the release of the minutes from the Reserve Bank’s (RBA) March 18-19 monetary policy meeting while there will also be speeches by RBA Assistant Governors Christopher Kent and Brad Jones to examine for any hints of a change to Governor Michele Bullock’s current neutral stance on official interest rates.

Also of interest to traders will be the inflation gauge from the Melbourne Institute which is out on Tuesday along with important home price and job advertisement figures.

All three measures are useful in confirming the likelihood of any interest rate cuts later in the year.

For offshore markets the Chinese purchasing managers’ indexes will be interesting and in the US Federal Reserve chair Jerome Powell is speaking on Wednesday.

Another factor to watch will be the enthusiasm or otherwise of local investors to plough in their arriving cash dividends to buy more shares.

An estimated $3.9 billion will be rolling into bank accounts during the week, with most guesses being that around 10% of investors use dividend investment schemes, with the rest making their own minds up as to whether to invest more, pay down debt or spend the dividend cash.