Boss Energy’s (ASX: BOE) board has made the much-anticipated final investment decision for the restart of its Honeymoon uranium project in South Australia.

The decision allows the company to accelerate engineering, procurement and construction – ensuring the project remains on track for first uranium production in late-2023.

The forecast $113 million capital cost of the development (including contingency) will be fully-funded by Boss after a $125 million capital raising via a share placement and share purchase plan in March.

Boss also holds a strategic 1.25 million pound uranium stockpile valued at approximately US$59.38 million (A$82.6 million) based on the current spot price of around US$47.5 a pound (A$66.1/lb).

Project re-development

The board’s endorsement of the project’s re-development comes ahead of managing director Duncan Craib’s appearance at next week’s World Nuclear Fuel Market conference in Canada, which will also be attended by world-leading uranium customers and power utilities.

“This final investment decision puts us firmly on track to be Australia’s next uranium producer,” Mr Craib said.

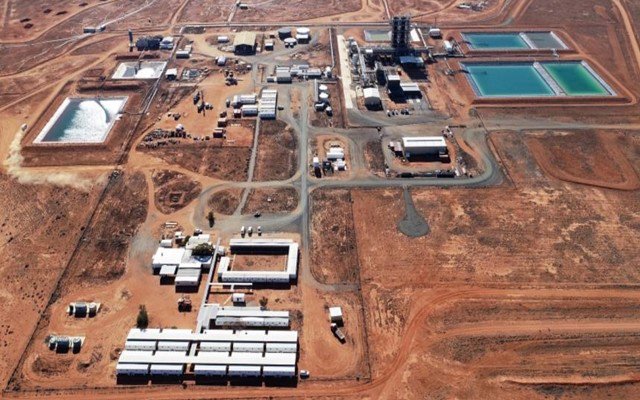

“We are fully permitted and fully funded with no debt, we have extensive infrastructure in place, our front-end engineering (FEED) studies are finished, and we are ready to order key equipment and start construction.”

He said the company would be in an “extremely strong negotiating position” with utilities and would be able to capitalise on the looming uranium supply deficit.

Technically and financially robust

The Honeymoon FEED study outlined a technically and financially-robust project, with cost estimates which remain unchanged from an enhanced feasibility study released in mid-2021.

That study found Honeymoon would have a 47% internal rate of return (IRR) at a uranium oxide price of approximately US$60/lb (A$83.55/lb).

It would have a nameplate production of 2.45Mlb uranium oxide per annum at an all-in sustaining cost (AISC) of US$25.60/lb (A$35.65/lb) over the mine life.

Potential exists for Boss to extend the operation beyond its initial 11-year mine life through the development of near-mine satellite deposits.

“Since completing the FEED study, we have made rapid progress on several fronts to minimise the lead time between the final investment decision and first production,” Mr Craib said.

“This includes a successful recruitment program, which has allowed us to build a highly experienced senior management team.”

Several long lead items have also been ordered and detailed engineering is underway.