Boss Energy (ASX: BOE) is pushing ahead with restart plans at its Honeymoon mine in South Australia as it moves to capitalise on the fast-moving rise in uranium prices.

The company has selected Perth-based Process E&I as a key EPC (engineering, procurement and construction) contractor for Honeymoon.

This covers the electrical, instrumentation and control system at the mine, including instrumentation controls and electric engineering, as well as back-office services such as team integration, data management and document control.

Process E&I’s portfolio has included the Cobre Panama copper-gold-molybdenum mine in Panama, the Tianqi lithium hydroxide plant in Western Australia, mine and plant for Syrah Resources (ASX: SYR) at its Balama graphite mine in Mozambique and a copper smelting plant in Zambia.

Plan to capitalise on uranium market ‘at the moment of our choosing’

Honeymoon is positioned as the next uranium mine to come on line in Australia, with the uranium market now drawing investor attention.

The spot price last night hit a nine-year high at US$43.75 per pound.

This came on the news that Toronto Venture exchange listed Uranium Royalty Corporation had bought 300,000 pounds of uranium oxide to add to its stockpile, which now stands at 648,068lb.

That buy follows Sprott Physical Uranium Trust now owning 26.9 million pounds of uranium oxide and generating reports that it will send the uranium price much higher.

Boss chief executive officer Duncan Craib says the company is pushing ahead on “multiple’ work streams, all in parallel, to minimise the lead time between the final investment decision stage and start of production.

“We are making project preparations on several fronts to ensure we can capitalise on the rapidly turning uranium market at the moment of our choosing,” he said.

One of the few uranium projects ready to go

Boss notes that it has one of the few uranium projects ready to participate in the early stages of the new uranium bull market.

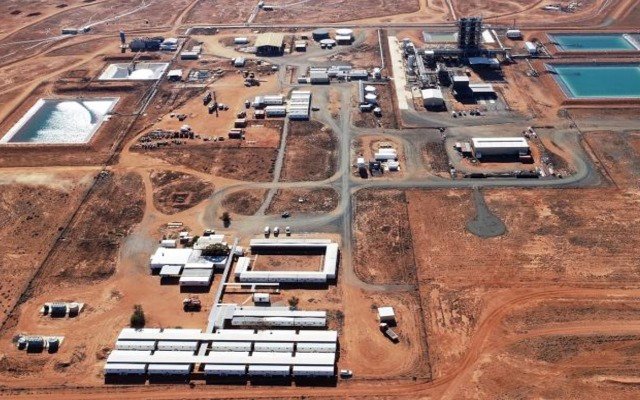

“We are already the most advanced of all the non-producing Australian uranium projects, with a production plant and key infrastructure in place,” Mr Craib said.

The company has been identifying, addressing, and positioning the Honeymoon project to be Australia’s next producer of up to 3.3 million pounds per annum.

Honeymoon contains a fully permitted uranium mine with $170 million of established infrastructure including a plant in good condition under care and maintenance.

It is located in the uranium friendly jurisdiction of South Australia and the project holds approved heritage and Native Title mining agreements.