Queensland and Northern Territory explorer Blue Energy (ASX: BLU) wants the federal and Queensland governments to build a Bowen Basin southern gas pipeline that could unlock 15,000 petajoules (PJ) of discovered gas to provide vital “timely and reliable” energy supplies to the eastern coast of Australia.

The company said the recent crash in oil prices could see exploration fall and an east coast gas shortage develop in less than three years.

Meanwhile, the company has begun a pre-feasibility study on a Bowen Basin fast-start gas fired power generation plant which it says would provide flexible, reliable and dispatchable electricity to “a fragile North Queensland grid”.

The case for tapping discovered gas and ensuring supply for domestic and industrial users on Australia’s east coast is outlined in the company’s report for the quarter ended 31 December 2019.

The gas shortage was identified by the March gas opportunities report issued by the Australian Energy Market Operator (AEMO).

That report predicted a shortage in eastern states from 2023.

Blue Energy said it had drawn the attention of the two governments to Queensland’s Northern Bowen Basin as the largest onshore, discovered gas resource — and one that remains undeveloped and not connected to the east coast domestic gas market.

Gas supply crunch could happen before 2023

Blue Energy said the AEMO report did not take into consideration what could happen with previous commitments to develop gas projects following the recent collapse in oil prices.

These projects, termed by AEMO “anticipated developments”, underpin gas supply to the east coast of Australia from 2023.

“Failure of any of these anticipated developments to eventuate will leave the southern states in a precarious energy position sooner rather than the expected 2023 forecast,” the report noted.

AEMO needed to address the effects of the oil price crash and the drought in capital spending (capex) by the oil and gas companies, Blue has argued.

“The east coast gas market is dependent on more drilling (capex), largely by the LNG players, to provide our domestic gas supply,” the reported added.

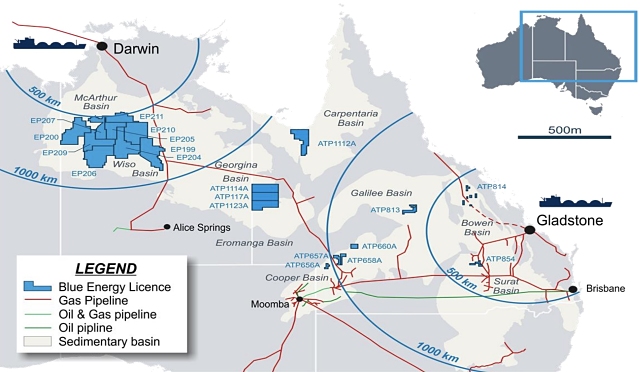

Blue Energy controls 97,655sq km of ground and is operator of all the acreage held — and has uncontracted gas reserves and a resource base of 3,942PJ.

It holds ground in three proven basins (Bowen, Surat and Cooper/Eromanga) and in two emerging basins, Wiso and South Georgina.

Most advance, sizeable gas resource available

The quarterly report argues that, with “shovel-ready” infrastructure projects being critical to the economic recovery from the COVID-19 pandemic, a single, multi-user pipeline running 500km from Moranbah connecting to the Gladstone/Wallumbilla pipeline would be capable of delivering up to 300 terajoules per day to the domestic market.

The northern Bowen Basin has “the most advanced, sizeable gas resources that can be delivered to meet the shortfalls predicted by AEMO,” the company said.

“Government sanction and funding of the line is required to facilitate natural gas and energy field developments in the northern Bowen Basin.”

Assessing the potential power generation

Blue Energy continues to assess the potential for the development of gas fired, peaking electricity generation.

This could involve seven unconnected gas properties within its ATP 814 tenure in the Bowen Basin.

Those properties range from south of Moranbah up to Newlands in the Northern Bowen Basin.

The company is looking specifically at those properties with proximity to high voltage electricity transmission and substation infrastructure.

Blue believes that reliable dispatchable electricity generation will be required to augment the “massive” roll-out solar and wind energy projects in Queensland.

The comes against a background where traditional coal-fired base load power plants are becoming less economic to run and maintain.

This potential project would be in addition to providing natural gas for the southern, pipeline-dependent, market and the northern market of Townsville.