Blackstone Minerals (ASX: BSX) has received firm commitments to raise up to $22.6 million for a major drilling program at its recently-acquired Mankayan copper-gold project in northern Philippines.

The oversubscribed raising will involve a single tranche placement of 289.8 million shares to Australian and international sophisticated and institutional investors, priced at $0.078 each—representing a 14.3% discount to Blackstone’s last closing price and a 9% discount to the five-day volume-weighted average price.

A $5m cornerstone investment from Macquarie Bank, which has had a presence in the region for more than 20 years and is a major Philippines investor, will underpin the placement.

Share Purchase Plan

Blackstone will also offer eligible shareholders the opportunity to subscribe for up to $30,000 of new shares as part of a $2m share purchase plan (SPP) at the same price.

The company will use funds from the placement and SPP for exploration at Mankayan that will include a 50,000-metre drilling program, geophysical surveys and further field work, as well as metallurgical and geotechnical work.

Investment managers Evolution Capital and Wallabi Group acted as joint lead managers for the raising and Argonaut the co-manager.

IDM International Merger

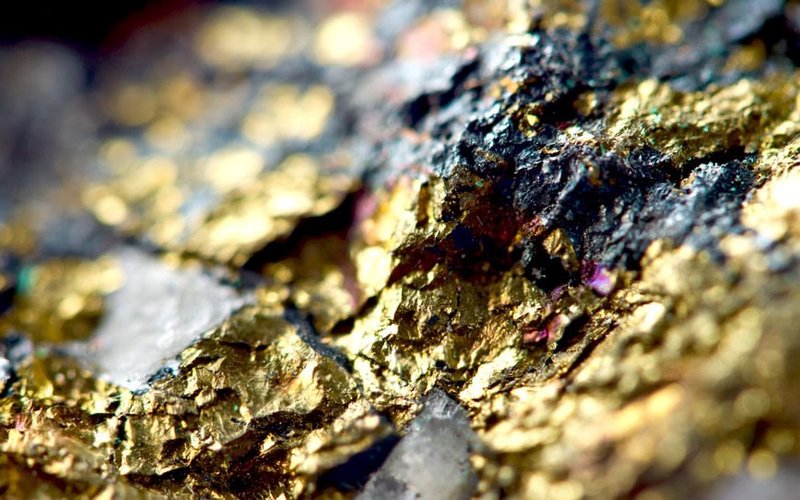

Blackstone’s capital raising follows its completion of an all-scrip merger with IDM International in June to acquire Mankayan, thought to be one of the world’s largest high-grade undeveloped copper-gold porphyry systems.

The project is situated within a world-class mineral district and comprises a large mineralised system with a high-grade core and an orebody that is open to the north, south and at depth.

Best historical intersections have been 911m at 1% copper equivalent (0.51% copper and 0.63 grams per tonne gold) from 156m including 253m at 1.43% CuEq (0.73% copper and 0.89g/t gold) and 543m at 1.08% CuEq (0.46% copper and 0.79g/t gold) from 262m including 277m at 1.43% CuEq (0.50% copper and 1.19g/t gold).

The Philippines offers a pro-mining environment and the IDM team holds the social licence to operate in the region, while Blackstone expects its advanced Ta Khoa nickel project in Vietnam will offer operational efficiencies through shared exploration techniques, development strategies and mining equipment.

‘Globally Significant Asset’

Blackstone managing director Scott Williamson said the capital raising would help commence exploration at the company’s newest asset against a backdrop of a historically tight copper market and record gold prices.

“We are delighted to have now completed this transformational merger, which has given us an exciting and globally-significant asset—I can say with conviction that assets like Mankayan are highly sought after and attract the most credentialled investors,” he said.

“We welcome Macquarie to the register and we look forward to growing this project with the support of a shareholder base that understands the potential of the Philippines and its endowment of large, high-grade and world-class copper-gold systems.”