Bigtincan posts strong results following expanded contracts and new customer wins

Bigtincan revealed a 102% growth in cash receipts after locking in new software customers during the December quarter.

Global software solutions company Bigtincan Holdings (ASX: BTH) has revealed strong growth during the December quarter with customer cash receipts doubling and new contracts on the books.

The company today released its latest quarterly results, posting a 102% increase in customer cash receipts from $4.5 million in December 2018 to $9.5 million.

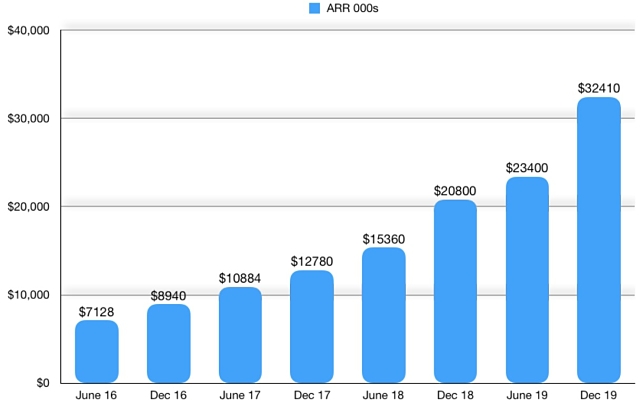

Annualised recurring revenue (ARR) also grew 55% to $32.4 million with Bigtincan stating it is “on track to deliver 30-40% organic revenue growth” by the end of the 2020 financial year in June.

New deals

Bigtincan provides a leading artificial intelligence-powered sales enablement automation platform that is designed to “help sales and service teams increase win rates and customer satisfaction”.

In early December, the company secured a $2.8 million contract with Paris-based multinational cosmetic chain Sephora to deploy its Zunos platform across multiple sites globally, starting with the United States.

Other customer wins during the second quarter included Mastercard, Brown Brothers, American Ortho, Waters Corporation, Invatae, W.L Gore and Disys.

Bigtincan also invested in the expansion of human resources in the US, product development in Australia, Israel and the US, and system infrastructure in the US and Europe.

In addition, it inked a deal with Databricks to use the latter’s data science and AI technology platform to add value to Bigtincan’s product offerings.

“This quarter Bigtincan continued to achieve strong growth delivering 55% ARR growth over the previous corresponding period, with new customers wins and expansion in existing enterprise customers, as well as making the investments that are needed to support Bigtincan’s growing customer base,” Bigtincan co-founder and chief executive officer David Keane said.

Bigtincan’s annualised recurring revenues.

He said another highlight of the quarter was the completion of the company’s acquisition of Xinnovation Inc, which added “new people, technology, geographic and vertical market coverage”.

Bigtincan also completed the integration of Asdeq Labs, which was acquired in September.

Cash payments rose 39% to $10.4 million, which the company said included working capital changes and acquisition-related activities.

By the end of December, Bigtincan had $27.4 million in cash and cash equivalents.

Bigtincan shares were up more than 20% to $0.84 on the results by early afternoon trade.