The cratering US economy and President Donald Trump pushing to delay the November election proved far too much for the Australian share market, which sagged as much as 2.6% on the news.

By the close on Friday the benchmark ASX 200 was still down a hefty 2% – the biggest fall since June 25 – as the prospect of the US economy shrinking by a third in the second quarter slashed a broad swathe through the value of miners, banks, and energy stocks.

That is the biggest and fastest US economic slump ever recorded and combined with worsening news on continuing infections and deaths from the COVID-19 virus both locally and around the world, it was a nasty dose of harsh reality for stocks.

All sectors down as market falls below 6000 points

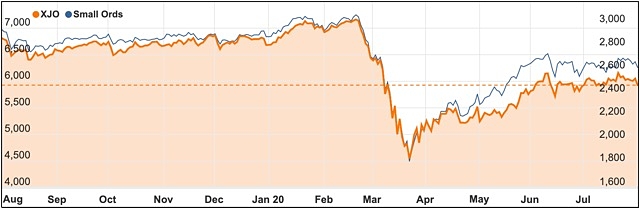

Every single sector declined as the ASX 200 shed 123.3 points to close at 5927.8 points.

The only tiny ray of hope was that despite losing 1.6% for the week, the ASX 200 still managed to eke out a skinny 0.5% gain for July and has now risen for four straight months – although the lead in to August leaves a lot to be desired.

The US profit reporting season was fairly bleak too and showed that many companies were looking to reduce staffing levels even further, with cuts to be made across the board rather than just in companies exposed to discretionary spending.

Jobs still being shed in the US

That means that consumer spending could come under real pressure as more people lose jobs and the employment outlook may not bounce back for a protracted period of time.

Some analysts are even talking about a double dip recession in the US.

Local energy stocks were the hardest hit on the Australian market, with the sector crunching down by 3% as oil prices plunged.

It wasn’t a much prettier picture for the big financial stocks, which had their worst session in more than five weeks.

AMP profit cut in half

The sector lost a collective 2.8% with AMP (ASX: AMP) clearly leading the way downwards after forecasting a halving of its first half profit.

Shares in the big fund manager lost 12.8% to $1.47 after it signalled a significant underlying first half profit decline as the pandemic really began to bite.

Westpac (ASX: WBC) was the worst of the big four banks, falling 3.3% to $17.09, while Commonwealth Bank (ASX: CBA), National Australia Bank (ASX: NAB), and ANZ (ASX: ANZ) each fell by between 2.2% and 2.8%.

It was a similar story for the big miners, with BHP (ASX: BHP) falling 2.9% to $36.75, Rio Tinto (ASX: RIO) down 2.4% to $102 and Fortescue Metals (ASX: FMG) falling off its record high to finish down 0.8% to $17.41.

Not even the defensives could put on a show with giant blood products group CSL (ASX: CSL) leading the way down by shedding 1.6% to $270.10.

There were only a couple of positives for the day with Super Retail Group (ASX: SUL) jumping up by 9.5% to $8.88 after flagging an unexpectedly stable full year profit due to strong sales during the virus lockdowns.

That news also helped fellow retailer Harvey Norman (ASX: HVN), with shares up 3.6% to $3.72.

The Australian dollar also continued its impressive performance, buying almost US72.2c.

Small cap stock action

The Small Ords index fell 2.26% this week to 2633.7 points.

Small cap companies making headlines this week were:

SUDA Pharmaceuticals (ASX: SUD)

Australia’s Therapeutic Goods Administration has granted approval to SUDA Pharmaceuticals for its ZolpiMist oral spray, which is designed for treating short-term adult insomnia.

The cherry-flavoured oro-mucosal spray is made of zolpidem tartrate, which is a non-benzodiazepine marketed as tablets under the brand name of Ambien or Stilnox.

These tablets are already available via doctor prescription for short-term treatment of insomnia in adults.

SUDA claims its oral spray is an easy-to-use alternative route of administration by delivering a dose via one or two sprays into the mouth. Additionally, clinical trials showed the spray delivered more rapid sleep onset compared to tablets.

The company’s chief executive officer Dr Michael Baker said the company would begin commercial sales in the “foreseeable future”.

Venus Metals (ASX: VMC)

Gold explorer Venus Metals had a big news week after drilling at the Sovereign prospect within the Youanmi gold joint venture with Rox Resources returned high-grade gold.

At Sovereign, drilling expanded the known mineralisation with best assays of 10m at 3.64g/t gold from 79m, including 2m at 10.64g/t gold from 82m; and 4m at 2.68g/t gold from 116m, including 1m at 5.43g/t gold from 118m.

Over at the Venus’ 30%-owned OYG joint venture (also with Rox), drilling at the Grace prospect uncovered a 49m wide zone of mineralised gold.

The zone was made up of two main intervals: 25m at 2.39g/t gold from 173m, and 24m at 1.04g/t gold from 145m.

Rox managing director Alex Passmore said the “impressive, high-grade results” at Grace were “exciting” as was the thick zone that was intersected which demonstrates the potential for “significant tonnages”.

Respiri (ASX: RSH)

As Respiri’s market expansion continues, the company revealed this week it anticipated revenues from its wheezo device and software subscription could reach $8 million in 2021.

Respiri designed the wheezo device to monitor wheeze and link the data back to a digital health platform via a mobile app.

The revenue guidance for 2021 of between $6 million and $8 million was arrived at after Respiri’s board finalised a review into the company’s revenue generating commercial contracts.

This included the recently announced agreement with Cipla and the market dynamics forecasts for driving wheezo penetration.

Respiri chief executive officer Marjan Mikel said facilitating market penetration of its asthma management solution was a “heightened awareness” in asthmatic patients of effectively managing their disease – particularly in the potential impact COVID-19 could have.

Pureprofile (ASX: PPL)

Following its strategy to reduce costs and simplify the business, Pureprofile posted a 220% increase to its closing cash balance at the end of the June quarter.

The company’s closing cash balance for the period was $1.7 million – up from the March quarter’s $764,000.

Boosting this cash balance was a 500% rise in net cash from operating activities to $1.5 million.

Pureprofile attributed the improved cash position to a reduction in operating and software development expenses combined with the receival of $264,000 from the Australian Government’s JobKeeper scheme.

Tesoro Resources (ASX: TSO)

Explorer Tesoro Resources has grown its flagship El Zorro gold project by pegging up 156 new concessions that host similar geology.

The concessions cover 285sq km and once granted are expected to boost Tesoro’s landholding in the region by 360%.

Additionally, Tesoro said the concessions combined with the existing El Zorro project would give the company control over the majority of the prospective belt that hosts mineralisation similar to the Ternera prospect.

“With the benefit of our understanding of gold mineralisation at Ternera, the Tesoro team has identified over 55km of strike immediately north and south of the existing El Zorro concession holdings,” Tesoro managing director Jeff Reeves said.

Drilling at Ternera is underway and following up on previous intersections of 86.45m at 2.29g/t gold (198g/m gold), including 23m 7.2g/t gold; 98.3m at 1.58g/t gold (155g/m), including 30.3m at 3.03g/t gold; and 84.3m at 1.3g/t gold (110g/m), including 4m at 8.5g/t gold.

Chesser Resources (ASX: CHZ)

West Africa gold explorer Chesser Resources has unearthed multiple “spectacular” high-grade and broad gold intersections at its Diamba Sud project in Senegal.

The intersections were made at the Area D target with better results of 48m at 6.70g/t gold from 24m, including 10m at 25.14g/t from 62m; and 38m at 4.63g/t gold from 8m, including 4m at 18.30g/t from 30m.

Another hole uncovered 55m at 4.27g/t gold from 16m; and 36m at 2.93g/t gold from 6m including 10m at 6.13g/t from 16m.

Chesser noted that mineralisation remained open to the south-west, north-east and north-west.

The company’s managing director and chief executive officer Mike Brown described the results as “exceptional and rare”.

Results received to date from several targets have given Chesser an “excellent platform” to continue exploring Diamba Sud.

The week ahead

August begins with a long list of economic releases but it will probably be the continuation of the US profit reporting season and some Australian profit results that will be influential.

Naturally, progress of COVID-19 will also play a part with only news of further vaccine successes likely to be seen as a positive.

Home prices are expected to be lower when CoreLogic releases its numbers on Monday, led down by Melbourne and Sydney.

There are also purchasing manager surveys to look out for and ANZ job numbers which are likely to be poor due to the Melbourne lockdown.

The biggest event for the week is the Reserve Bank board meeting on Tuesday and while there is unlikely to be any changes to interest rate settings, the latest economic comments will be interesting.

Other things to watch out for during the week are consumer confidence numbers, retail trade and international trade data, with Friday’s Reserve Bank Statement on Monetary Policy and its detailed forecasts for the economy also of interest.

Overseas, the main thing to watch for is US releases, with the emphasis of most statistics likely to be their effect on the increasingly shaky jobs market.