Australia’s big banks have pushed the ASX 200 to a record close of 7847 points after more signs of lower inflation in major economies caused a global relief rally.

With interest rates now looking almost a certainty to fall in the big markets of the US, Europe and Australia, investors celebrated hard with a fresh high for the already high prices Commonwealth Bank as a sign of the euphoria.

Commonwealth Bank (ASX: CBA), the second biggest stock on the ASX behind big miner BHP (ASX: BHP), set the scene with a record high of $121.55 before ending with a 1.8% gain to $121.45.

For a stock that is already being touted as overvalued, that is a big vote of confidence and the rest of the market celebrated in a similar fashion.

With the financial sector up more than 2% for the day and an amazing 6.7% for the month, the vote is in for the financial stocks having the most to gain through falling interest rates.

This sector was not alone, however, with a clean sweep only disrupted by a slight fall in industrials as even defensive stocks such as healthcare rallied along with traditional growth sectors.

US and European officials signal lower rates around the corner

The rally came hot on the heels of comments by US Federal Reserve chairman Jerome Powell who clearly signalled that policymakers are closer to viewing price pressures as subdued.

“When we do get that confidence — and we’re not far from it — it’ll be appropriate to begin to dial back the level of restriction,” Powell said as he answered questions from the Senate Banking Committee in his second day of semi-annual testimony to Congress.

Powell was backed up by European Central Bank president Christine Lagarde who said she and her colleagues aren’t “sufficiently confident” at present to commence monetary easing, but a window may open soon.

Banks the best proxy for falling interest rates

Local banks were seen as the best proxy to play the easing financial conditions with recent results revealing a combination of strong customer activity, lower bad and doubtful debts and better-than-feared margins as competition for lending and deposits falls.

That is seen as a strong positive for the banking sector, although technology also rose strongly, up 0.8%, on the back of continuing positivity around artificial intelligence which helped to produce all-time highs on the S&P 500 and the tech heavy NASDAQ.

That saw the closest to an artificial intelligence bellwether in the form of US chipmaker Nvidia soar a further 4.5% to a record high of $US926.69 a share, equal to an incredible market capitalisation of $3.5 trillion.

There was plenty of local stock specific action to watch as well with Magmatic Resources (ASX: MAG) shares rising an impressive 37.8% after Fortescue Metals (ASX: FMG) took a 19.9% stake in the New South Wales copper-gold explorer.

Dual-listed lender Virgin Money (ASX: VUK) saw its shares add an exciting 32.9% to $4.08 after it snared a $5.7 billion takeover bid from large UK credit union Nationwide.

Hub24 (ASX: HUB) shares added 2% to hit a record high of $41.76 after the wealth platform company remained confident of strong long-term growth.

Small cap stock action

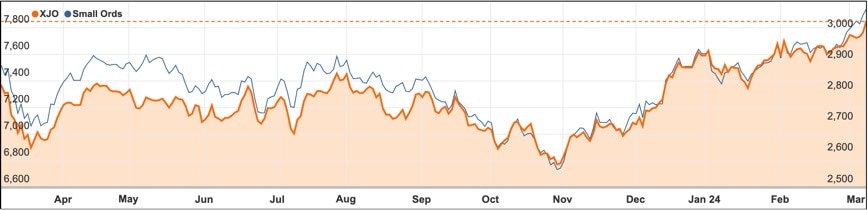

The Small Ords index rallied 2.08% for the week to close at 3073.7 points.

Small cap companies making headlines this week were:

Algorae Pharmaceuticals (ASX: 1AI)

Algorae Pharmaceuticals announced the development of its Algorae Operating System (AlgoraeOS) platform, leveraging AI to predict combination drug targets for biopharmaceutical development, in partnership with University of New South Wales experts, aiming for a Q3 launch this year.

The platform utilises machine learning, deep learning, and artificial neural networks to analyse a vast database of curated medical and scientific information for AI-driven drug discovery.

Algorae aims to monetise the platform by identifying fixed-dose drug combinations for internal development or licensing, adopting a “techbio” business model gaining traction in the US, as seen with companies like Recursion Pharmaceuticals and Relay Therapeutics.

The platform will be powered by Gadi, the most powerful supercomputer in the Southern Hemisphere, offering unprecedented computational capacity for data analysis.

Data acquisition is ongoing, with future plans to expand the team and refine the AI platform’s predictive capabilities, supported by a grant from the Commonwealth Scientific and Industrial Research Organisation.

Mitre Mining Corporation (ASX: MMC)

Mitre Mining Corporation announced a significant resource increase at the Cerro Bayo silver-gold project in southern Chile, doubling the resource to 50.2 million ounces at 311 grams per tonne silver-equivalent, following the acquisition of the project and a thorough review of existing drilling data.

The increase is attributed to a detailed re-sample and re-logging campaign, particularly focusing on the Delia vein, alongside the utilisation of existing underground mapping and assay data.

Concurrently, Mitre has initiated its maiden drilling program targeting further resource updates in the second half of 2024, aiming to extend known mineralization boundaries and enhance shareholder value through resource growth.

The drilling campaign will focus on high-priority brownfields targets within a 3km radius of the processing plant, including Pegaso 7, Cristal and extensions of high-grade resources at Taitao, Coyita and Delia, with an aim to explore potential bulk tonnage open pit targets.

The Cerro Bayo project, with over 15 years of production history and more than 45Moz of silver and 650,000oz of gold produced, was acquired by Mitre in late February and the company is optimistic about transforming into a significant silver-gold exploration entity.

Barton Gold’s (ASX: BGD)

Barton Gold increased its Tunkillia project’s JORC mineral resource estimate (MRE) to 1.5 million ounces of gold, following an aggressive drilling campaign that added a new 115,216oz gold resource at the Area 51 deposit.

The company conducted around 8,663 meters of drilling to identify the new deposit, contributing to a total addition of approximately 530,000 ounces of gold to Tunkillia’s MRE over the past 12 months

The updated MRE underpins Barton’s plans for economic analyses and the exploration of neighbouring high-grade targets like Area 191 and Tarcoola, aiming to enhance the project’s economics and support development stages.

The Area 51 MRE is based on 72 drill holes, and exploration has identified a continuous halo of mineralisation around the deposit, with significant findings reported from drilling campaigns in 2022 and 2023.

Barton’s total attributable gold resource has grown by about 8% to 1,575,000 ounces, with the Area 51 deposit positioned as a key asset for future development approximately 530km northwest of Adelaide in South Australia’s Gawler Craton.

AdAlta (ASX: 1AD)

AdAlta’s Phase I extension study of AD-214 for treating fibrotic diseases has demonstrated the drug’s safety, tolerability and bioavailability at a dose set for upcoming Phase II trials, particularly targeting idiopathic pulmonary fibrosis (IPF).

The study confirmed AD-214’s positive pharmacokinetics (PK) and pharmacodynamics (PD) profiles, showing consistent drug availability and target receptor engagement across multiple doses without the development of drug tolerance or significant levels of antidrug antibodies (ADAs) that could impair efficacy.

These findings address pharmaceutical partners’ concerns, paving the way for Phase II studies by ensuring the drug maintains its therapeutic function over time.

AdAlta is now preparing to share these results with potential partners to secure a licensing or financing deal for advancing AD-214 into Phase II clinical trials, aiming to offer a new treatment option for IPF patients.

This progression marks a significant milestone for AdAlta and promises a return on investment through the development of AD-214.

Immuron (ASX: IMC)

Immuron’s clinical trial in the US showed promising interim topline results for IMM-124E (Travelan) in preventing moderate-to-severe diarrhea caused by enterotoxigenic Escherichia coli (ETEC), demonstrating that a single daily dose can be effective.

The phase 2 trial, designed to suit US troops’ needs in developing countries, found a 36.4% protective efficacy against moderate-to-severe ETEC-induced diarrhea and a significant 83.3% reduction in the need for early antibiotic treatment in the Travelan group compared to placebo.

Travelan, a first-in-class oral antibody therapy, has shown potential as a prophylactic medicine against travelers’ diarrhea, with plans to discuss a phase 3 registration strategy with the FDA.

The treatment aligns with the US military’s high priority to protect deployed personnel against infectious enteric diseases, which are major threats to their health and preparedness.

Currently, Travelan is available in Australia as a therapeutic good, in Canada as a licensed natural health product and in the US as a dietary supplement for digestive tract protection.

Brightstar Resources (ASX: BTR)

Brightstar Resources achieved the first gold pour from the Selkirk Mining JV at the Menzies gold project in Western Australia, marking a significant achievement in the company’s growth strategy with 38.7kg of gold doré produced.

The gold pour follows the successful completion of a maiden mining campaign at Selkirk, where approximately 1,500 tonnes of high-grade ore was processed, contributing to the JV’s goal to exploit the deposit’s estimated 11,500 ounces of gold at 2.15g/t.

This venture with BML Ventures, which covers all capital, mining, and haulage costs, aims to generate revenue to support further exploration and development activities, including a new pre-feasibility study for Menzies and the exploration of nearby targets.

Brightstar sees substantial exploration upside at Menzies, citing historical production figures and the potential for further discoveries, such as the Link Zone.

Proceeds from Menzies gold production will also fund the development of Brightstar’s Cork Tree Well project and the refurbishment of the mill at its Laverton gold development.

The week ahead

Given the current head of steam in markets, the coming week will be notable for any indications of continuing weakness in US inflation.

They should get some strong data to work from with statistical releases covering consumer, producer and international trade prices, with investors looking for subdued measures for core consumer and producer prices that exclude food and petrol prices, given such an outlook would bring lower official interest rates into view.

Also of interest will be US retail sales and industrial production numbers, with factory output expected to be weak in January due to tough winter weather but the US consumer expected to remain resilient.

China is always of interest for Australian investors and this week it is releasing figures on credit, lending and home prices following on from the National People’s Congress.

The other main thing to watch out for on the local market is for a host of companies to start trading ex-dividend, which has the potential to surprise the unwary.