Weekly review: Biden president and Republican Senate the perfect market recipe

WEEKLY MARKET REPORT

Could a Joe Biden presidency and a blocking Republican Senate be the perfect recipe for global share markets?

So far, the evidence is fairly strong that this gridlock scenario is hitting just the right spot for investors with the Australian market up an impressive 4.4% for the week even before there was absolute clarity about the electoral outcome.

The reason this seems to be the dream scenario is that Biden’s more controversial economic policies such as tax rises for the wealthy, big spending plans and regulatory reforms now seem certain to be blocked in the US Senate but he also now seems set to replace Donald Trump as President, resulting in a more stable and predictable White House.

In particular, Biden is seen as being a safer pair of hands for handling delicate trade and foreign policy issues.

Election dispute drags ASX 200 back from 6200 mark

On Friday the ASX 200 added a healthy 50.6 points, or 0.8%, to close at 6190.2 points after briefly rising above the 6200 level before President Trump‘s claim about widespread voter fraud cooled investor sentiment.

Stronger metals prices also played a part in the rally, boosting mining stocks.

The US dollar weakened as the chances of a Biden win increased which helped to push up metal prices, with gold producers also benefitting from a more dovish tone in a speech from Federal Reserve Chair Jerome Powell.

Newcrest Mining (ASX: NCM) was a good example, adding 3.5% to $30.72.

BHP (ASX: BHP) finished up 1.3% at $34.67 and Rio Tinto (ASX: RIO) rose 1.6% to $93.40, while Fortescue Metals shares (ASX: FMG) was not so lucky, falling 0.5% to $16.55.

Tabcorp shares fly on private equity rumours

One of the more surprising performances came from betting giant Tabcorp (ASX: TAH), which rose a mammoth 15.8% to $4.10.

Despite the company hosing down speculation that it was being targeted by private equity buyers, investors decided that it was better to be safe than sorry and continued to bid strongly for Tabcorp shares.

Investors like the outlook for Macquarie and News Corp

Other stocks that moved due to news included Macquarie Group (ASX: MQG) which was up 2.3% to $135.45 on a better than expected first-half result.

Macquarie’s net profit was down 32% to $985 million and impairments more than tripled to $447 million, mainly due to the effects of the COVID-19 pandemic.

While management was cautious about providing much of a forecast, investors took the interim dividend of $1.35 a share as a good sign the underlying results could strengthen from here.

News Corp (ASX: NWS) was another stock to rise on good news, up 13.7% after the media giant released a first quarter update that showed a 10% drop in its revenue to US$2.12 billion.

That result was weighed down by the sale of News America Marketing, but the company’s digital segments showed strong earnings strength.

While it probably didn’t move the market at all, some reassurance was provided by the Reserve Bank’s improved outlook for the Australian economy, with the central bank upgrading forecasts for household consumption, unemployment and public demand.

Small cap stock action

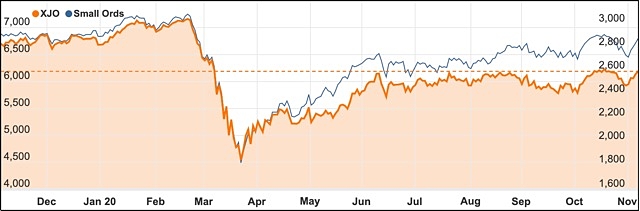

The Small Ords index rose a stunning 5.18% to close the week on 2878.2 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Investigator Resources (ASX: IVR)

Silver explorer Investigator Resources has unearthed what its managing director Andrew McIlwain describes as “eye-watering grades” during early drilling at the Paris project in South Australia.

This week, Investigator received assays from the first nine holes out of 276 drilled to-date.

Highlight results were 7m at 551g/t silver, including 4m at 916g/t silver; 10m at 328g/t silver; and 14m at 206g/t silver, including 5m at 412g/t silver.

Incannex Healthcare (ASX: IHL)

Incannex Healthcare revealed positive data from pre-clinical in vitro studies using its IHL-675A drug against sepsis-associated acute respiratory distress syndrome (SAARDS), which is the leading cause of death in COVID-19 patients.

Compared with cannabinoid-only treat,emt, Incannex’s IHL-675A, which is a combination of CBD and hydroxychloroquine, was far more affective against the cytokine inflammatory response that results in SAARDS.

Results showed IHL-675A outperformed CBD by 109% to 767%.

Adveritas (ASX: AV1)

Ad fraud mitigation software company Adveritas continued its strong sales momentum during the September quarter.

Adveritas posted an 80% rise in subscribers for tis TrafficGuard Freemium product. Meanwhile, customer number increased 25% with Adveritas having 50 revenue generating clients by the end of the September period.

Higher customer numbers were attributed to a strong conversion rate, with Freemium customers upgrading to the Land and Expand product.

Strategic Elements (ASX: SOR)

Pooled development fund Strategic Elements has raised $5.1 million to advance its subsidiaries’ technologies, while also seeking “further acquisitions in Australian innovation”.

Its subsidiary Stealth Technologies also had big news this week with a collaboration with US-based Planck Aerosystems to develop a system that enables drones to launch and land on Stealth’s autonomous vehicles.

Planck has agreed to provide Stealth access to its autonomous control engine software, which will be integrated into Stealth’s autonomous security vehicle technology. The parties will then look to commercialise opportunities and potential applications for the integrated technology.

Osteopore (ASX: OSX)

Bone healing medical technology company Osteopore has beefed up its board with the appointment of former ResMed executive Carl Runde as chief financial officer.

The appointment followed Osteopore inking an exclusive distribution agreement enabling LMT Surgical to market and sell its 3D printed bioresorbable bone scaffold healing products within Australia and New Zealand.

Osteopore chief executive officer Khoon Seng Goh said the company was “excited” to secure a quality and reputable distributor like LMT.

Pharmaxis (ASX: PXS)

Australian pharmaceutical company Pharmaxis will expand its reach in the US market after securing Food and Drug Administration approval for its Bronchitol drug (mannitol) for use as an adjunct therapy in cystic fibrosis sufferers.

US FDA approval paves the way for Pharmaxis to sell the product in the country, which is already available in Australia, Russia and Europe. The US commercial launch is scheduled for the next quarter.

Pharmaxis plans to use sales revenue for the drug to bankroll research and development of its lead drug candidate PSX-5505 in treating bone marrow cancer myelofibrosis.

Synertec Corporation (ASX: SOP)

Engineering product and solution provider Synertec Corporation has successfully completed a joint pilot program using Sichuan GreenTech Environment’s environmentally-friendly composite dry powder technology in treating and repurposing hydrocarbon drilling mud as well as other toxic sludge and wastewater that would ultimately end up in landfill.

Synertec has an exclusive worldwide licence to market the composite dry powder, with an initial focus on Australia.

The company is seeking international patent protection for the technology.

The week ahead

Obviously, the continuing clarification of the US electoral result will remain a key point in the coming week, as Democrats seemingly tighten their grip on winning the White House.

There is every chance of continued volatility and court actions until an eventually result is confirmed.

In terms of economic results, the big releases for the week are inflation numbers for both the US and China.

Locally, the main things to watch out for are consumer sentiment, credit and debit card lending and – to show how quickly things can change – overseas arrivals and departures.