The softening-up exercise for the huge Jansen potash project in Canada’s Saskatchewan province has begun.

After years of delays and potash market uncertainties, along with opposition from some shareholders and (not surprisingly) the powerful Canadian potash industry, BHP Group (ASX: BHP) has sent about as strong a message as possible that it is about to approve what is expected to be a further US$5.7 billion ($7.47 billion) to begin development.

Today two senior BHP executives, chief economist Huw McKay and manager potash economics Paul Burnside, produced a 56-page presentation laying out the pro-case for Jansen as a new major supplier to the world’s fertiliser market.

This follows Canadian news reports in recent weeks that BHP has been in discussions with global major Nutrien in regard to a potential partnership.

Canadians have signalled they could work with BHP

Nutrien, formed in 2018 by the merger of Canada’s largest fertiliser feedstock miners, Potash Corporation of Saskatchewan and Agrium, has signalled recently that the market could absorb Jansen’s output if produced in a “disciplined” way.

These discussions reportedly included Nutrien being the operator or, alternatively, just taking a stake in the planned mine.

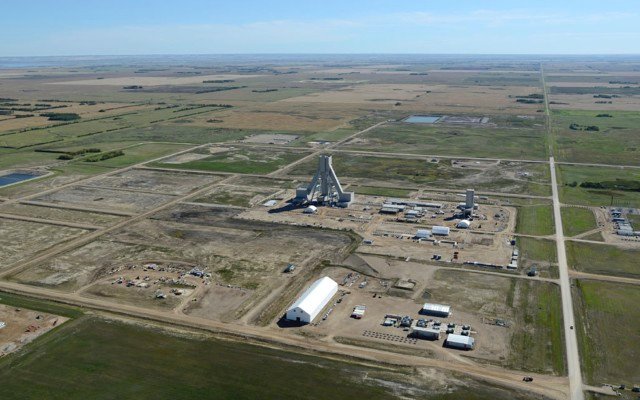

BHP has already spent about US$4.5 billion on the project, which covers 9,600sq km and is located 140km east of Saskatoon, Saskatchewan’s largest city.

The company says Jansen potash is suitable for direct application or for use in multi-nutrient fertilisers.

The project will have an initial annual capacity to produce around 4.4 million tonnes of potash per annum with an estimated mine life of 100 years.

Mining muriate of potash deep underground

The mine will produce muriate of potash mined from deep underground, unlike the plans of Australia’s emerging potash producers who will extract the more highly priced sulphate of potash from brine in old salt lakes in Western Australia.

BHP has already sunk two 1,000m-deep shafts at Jansen.

The Melbourne BHP briefing today was also told that the company is reviewing two options for its export port, one being Vancouver, the other a greenfield site.

It was also indicated that a final investment decision is only a few months away.

The significance for BHP is that potash will be a new, major pillar in its operations.

BHP would join major global players

And it will be rubbing shoulders with the world’s major, and so far, dominant, potash producers.

Apart from Nutrien, these include North America’s Mosaic, Germany’s K+S, China’s Qinghai Salt Lake Potash, Israel’s ICL Group, Belaruskali from Belarus and Russia’s EuroChem and Uralkali.

The BHP presentation pushes the concept of a fourth wave for potash, occurring in the late 2020s and early 2030s, neatly fitting in with Jansen’s development timing.

The company sees the present-day global market for muriate of potash of about 70 million tonnes per annum growing to as high as 97mtpa by 2035.

Potash demand has, according to BHP’s research, outpaced other markets — up 4.5-fold since 1960, compared with a crop outputs increase of 3.5-fold and global population growth of 2.5-fold.

Need to improve soil nutrients globally

The previous three waves — that is, increased demand surges and supply — were firstly the development of the Saskatchewan deposits in the 1960s, secondly the 1990s reorientation of production after the collapse of the Soviet Union and the reorientation toward exporting potash, and thirdly the economic recovery after the 2008 global financial crisis.

But there are still big caps in crop yields — with US farmers producing the highest yields of corn, rice and soybeans, with yields in Brazil, China and (particularly) India lagging well behind.

The company argues that these latter countries could catch up using more scientific fertiliser application.

But BHP said soil nutrient balance in all regions, including North America, is already poor — and deteriorating.