Berkut Minerals (ASX: BMT) has executed an agreement with Superior Resources (ASX: SPQ), Diatreme Resources (ASX: DRX), Syndicated Metals (ASX: SMD) and private entity Carnaby Resources Ltd to scoop up a large ground position in Queensland’s Mt Isa region, which includes the historic Tick Hill operation that had an average grade of 22.5 grams per tonne gold.

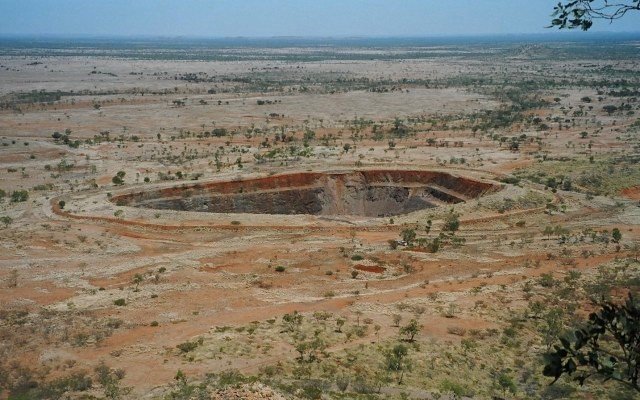

Under several heads of agreements, more than 320 square kilometres of tenements will be transferred to Berkut including the historic Tick Hill operation that produced 511,000 ounces of gold at 22.5g/t.

Gold production at Tick Hill only reach a 235m depth and occurred between 1991 and 1995.

Previous near-mine drilling at Tick Hill has returned notable intersections of 2m at 104.2g/t gold, 3m at 84.8g/t gold and 2m at 40.2g/t gold.

Additionally, the Tick Hill tailings dam has a small JORC resource of 630,000t at 1.08g/t gold for 22,000oz.

“The company is excited to be acquiring this extensive, high-quality brownfields land package in Queensland,” Berkut managing director Neil Inwood said.

“There is a well-defined exploration plan for Tick Hill and the broader area, which is being consolidated for the first time in 20 years,” Mr Inwood added.

Via the various agreements, Berkut will acquire 100% of the Tick Hill mining leases which encompass 4sq km and between 82.5% and 100% of the remaining 319sq km of tenements in the region.

According to Berkut, this will be the first time in over 20 years that the land package has been amalgamated.

Regional exploration at the Mt Isa package has identified Grassano which is a large iron oxide, copper, gold target where rock chips returned up to 114g/t gold.

Other prospects include Duchess which historically produced 205,000t copper at 12.5%; Ivanhoe where drilling unearthed up to 11m at 2.7% copper; and Nil Desperandum, which has generated intersections up to 19m at 2.3% copper, 0.6g/t gold and 6m at 5.2% copper and 0.8g/t gold.

Western Australian tenements

As part of the deals, Berkut will also secure 972sq km of tenements in WA that are prospective for gold, base metals, nickel and platinum group elements.

The tenements include Malmac which covers 810sq km in the northern Yilgarn and Throssel which hosts 162sq km of tenements about 70km north of Gold Road Resources (ASX: GOR) and Goldfields Ltd’s 6.2Moz Gruyere gold deposit.

Deal terms

To cement its ownership of the extensive landholding, Berkut will issue the vendors a total 21.1 million shares, with Diatreme to receive 7.2 million, Syndicated Metals 5.1 million, Superior Resources 2.4 million and Carnaby 6.4 million.

Under a separate share sale agreement, Berkut will acquire the entire issued capital of Carnaby, with its vendors to also receive 6 million, five-year options that are exercisable at $0.09 and 3 million five-year options exercisable at $0.10.

Berkut will be renamed Carnaby Resources to reflect its new direction.

To top up its cash reserves, Berkut has also received $1.6 million in commitments for a 20.5 million share placement at $0.078 each.

The placement will be offered to existing and new sophisticated investors, with funds raised to add to the company’s existing $3.3 million in cash – giving Berkut $4.9 million in cash to fund an “aggressive” exploration program.

“The company is in a strong funding position to pursue a focused and aggressive exploration program,” Mr Inwood noted.

“The addition of Peter Bowler and Rob Watkins to the board will also strengthen the company both technically and commercially,” he said.

Shareholders will get to vote on the deal and proposed company changes at a meeting in late April.

Investors reacted positively to Berkut’s acquisition news – sending its share price up almost 33% to reach $0.105 by midday.

Meanwhile, Syndicated Metals’ and Superior Resources’ share prices were unchanged at $0.005 and $0.006, respectively, while Diatreme’s rose 7.14% to reach $0.015.