Barton Gold Holdings (ASX: BGD) (OTCQB: BGDFF) has launched a $15 million capital raising to accelerate the development of its Tunkillia, Tarcoola, and Wudinna projects in South Australia, alongside a refurbishment of the company’s mothballed Central Gawler processing mill.

Barton will issue 12 million new shares at $1.25 each to a host of North American institutional precious metals funds led by US asset management company Franklin Templeton, which has committed to investing $11.25m in return for an approximate 3.8% initial interest in Barton’s expanded equity capital structure.

On completion of the placement, the company will offer a $2.5m share purchase plan to eligible existing shareholders that will issue a further 2 million shares.

Numerous Work Programs

Barton will use proceeds of the capital raising will for an 18,000 metre reverse circulation upgrade drilling campaign at Tunkillia’s high-value starter pits which the company modelled to yield approximately $1.3 billion operating free cash over the first 2.5 years.

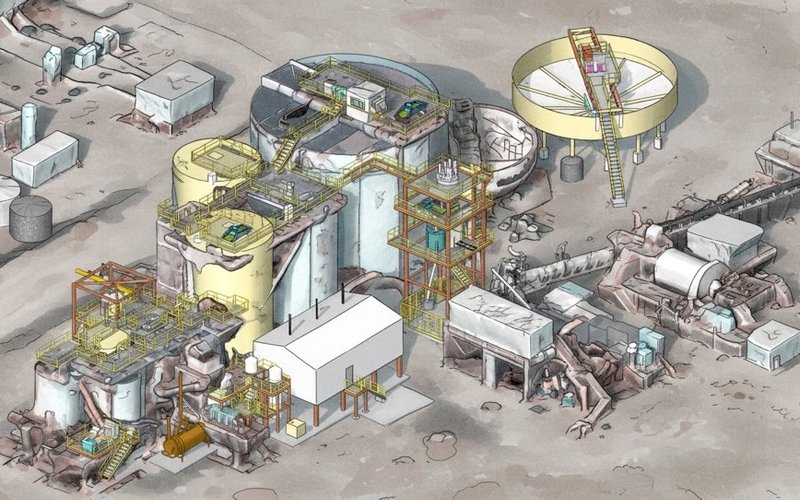

Diamond drilling at the Tolmer high-grade silver discovery within Tarcoola will investigate controls on the mineralisation and guide follow-up targeting, while Barton will commence a definitive feasibility study for a restart of the Central Gawler Mill by the end of 2026.

The Wudinna project added 279,000 ounces of gold mineralisation to Barton’s regional resource base and the company will apply some of the new funds towards a long-term exploration program for five additional tenements it acquired after the project’s acquisition.

Barton expects its pro-forma cash balance on completion to be approximately $23m.

Next Stage of Evolution

Barton managing director Alexander Scanlon was happy with the market’s response to the placement.

“We are greatly honoured to have Franklin Templeton’s support as we pivot to the next stage of our company’s evolution and target a re-rating of our equity profile to that of a ‘producer’ with a strong, self-funded growth pathway,” he said.

“We are proud of how hard our team has worked over the past five years to lay the foundation for large-scale regional gold production in order to create and preserve maximum future shareholder value.”

Canaccord Genuity (Australia) will act as lead manager and work with Barton’s internal equity capital markets initiatives to support the placement, which the company reserves the right to increase the size of if needed.