Barrick Gold’s hostile US$17.8 billion (A$24.8 billion) takeover bid for US rival Newmont Mining could result in the disposal of Australian mines worth around US$4.5 billion.

If the all-share takeover offer revealed this week actually goes ahead, it will create the world’s largest gold producer with a monstrous estimated market cap of US$42 billion.

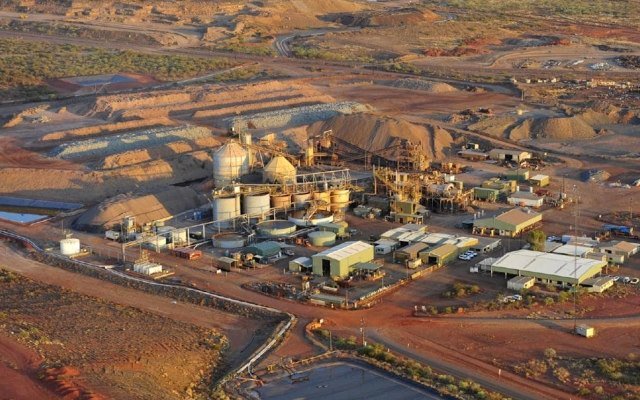

According to the latest reports, the proposed merger could also leave Australian assets including the Super Pit gold mine in Kalgoorlie and the Boddington gold mine in Western Australia’s south west up for grabs.

Newmont fights back

Newmont said its board would review the deal but is so far convinced its previously announced US$10 billion bid to acquire Canada’s Goldcorp offers better benefits.

Newmont chief executive officer Gary Goldberg told media at the BMO Metals and Mining Conference in Florida on Monday he was “shocked” and “perplexed” with the non-sensical offer, which was 8% below the company’s closing price on Friday.

“We’d been having discussions with Barrick … about doing something together more broadly in Nevada and to see this approach just doesn’t make sense to me,” he said.

Mr Goldberg said he hopes the company can go ahead with its Goldcorp buy and still work with Barrick.

“These are not mutually exclusive options. We can do both things and it doesn’t have to go through some negative premium,” he said.

“We’ll take it under consideration with our board and in due time, come back with a response,” Mr Goldberg added.

If Barrick’s offer is successful, Newmont’s tie-up with Goldcorp will not go ahead.

“We as a team can’t wait until after Newmont and Goldcorp merge because we don’t want Goldcorp’s lower quality assets in our portfolio,” Barrick chief executive officer Mark Bristow said in a presentation earlier this week.

Mr Goldberg said he doesn’t know what Mr Bristow’s basis is for thinking Goldcorp is not a good deal.

“We’ve laid out a path towards achieving US$2.5 billion in additional value for our shareholders through this transaction.”

“This is something we can do and still work constructively, if they still choose to do that at Barrick, to deliver the synergy values in Nevada,” he said.

Mr Goldberg has also claimed that Newmont had previously looked at acquiring both Barrick and Africa-focused producer Randgold Resources, which merged with Barrick last year, but “couldn’t see the value potential” at the time.

However, he told media the company hadn’t ruled out hitting back with an offer for Barrick.

“I think at this stage all options are open and we’ll see where we go,” Mr Goldberg said.

Australian cast-offs

Mr Bristow told media the company had already had “many discussions with interested parties” over the Australian mines, which would no longer be considered key assets if the bid for Newmont is successful.

“There’s a very good chance some Australian operators will be involved and what I can tell you is there are some very good Australian operators,” he said.

Evolution Mining (ASX: EVN) chief executive officer Jake Klein said at the Florida conference that his company would “certainly be interested if [Barrick] decided to dispose of those assets”.

Market rumours have suggested Evolution could likely be challenged for the assets by other local producers Newcrest Mining (ASX: NCM) and Northern Star Resources (ASX: NST).

In addition to the Super Pit and Boddington assets, Newmont holds the Tanami gold mine in the Northern Territory. Together, the three mines produce about 1.8 million ounces of gold per year and have a net asset value of about US$4.5 billion (A$6.27 billion).

Barrick conference call on Newmont offer

Barrick’s chief executive officer Mark Bristow presents the offer for Newmont to shareholders: