Investors continued to bail out of bank stocks, dragging the ASX 200 index lower despite some positive news for the big miners on the back of a stronger copper price.

The strong rally in bank share prices that saw most of them hit multi-year highs just a week ago is nothing but a memory now, with the financials sector shedding a hefty 1.8%, pushing the ASX 200 index down 15.8 points, or 0.2% to 7713.6 points.

A series of bank stock downgrades by Macquarie proved to be real life kryptonite for bank share prices.

National Australia Bank (ASX: NAB) shares were crunched by 2.8% to $33.50, Westpac (ASX: WBC) shares fell 3.8% to $26.47, ANZ Bank (ASX: ANZ) shares were off 3.8% to $28.68 and Commonwealth Bank (ASX: CBA) shares were the best of a bad bunch, falling 1.1% to $116.22.

Just as quickly as the booming bank shares of last week pumped up the ASX 200, these bank share falls were more than enough to drag the index down further after it has traded sideways all week following a Wall Street inspired 1.8% rout on Monday which caused a retreat from record share prices.

Markets may be ahead of the rate fall curve

Of course, Australia has largely been responding to moves in the world leading US share market, which itself seems to be searching for direction, with the main positive being the perceived wisdom that the US Fed will cut official interest rates by June.

Should that hope prove to be illusory – and it wouldn’t be the first time markets have got ahead of themselves in anticipating good news – some of the share price premiums still baked into the big US stocks could evaporate like mist on a summer morning.

There is also the bigger question of how low and for how long interest rates will fall when this much anticipated easing cycle finally arrives, with the future, as always as unknowable and mysterious as the optimism or otherwise of investors.

At the moment, US anticipation of a rate cut by June is as close to a certainty as markets get with an implied 70% chance but there is always the possibility of disappointment.

Big miners rise on bullish copper outlook

It wasn’t all bad news on the market with the other side of the ASX dumbbell, the big miners, doing plenty of heavy lifting on the back of a rally in the price of copper.

As you would expect, both BHP (ASX: BHP) and Rio Tinto (ASX: RIO) which are big copper producers felt the love, with BHP shares up 2.7% to $43.06 and Rio Tinto shares up 1.9% to $119.19.

The fact that Chinese copper smelters were flagging possible production cuts didn’t hurt, given the generally bullish case for copper because of the electrification of global transportation.

There was plenty of other stock specific news happening beneath the falling banks and rising big miners.

Gina Rinehart maintains the Midas touch

One of the more interesting was a rapid rise in the share price of Arafura Rare Earths (ASX: ARU), a company best known as being backed by Australia’s richest person Gina Rinehart.

The stock raced up 76.9% to 26¢ after trade was halted on Wednesday before the announcement of a federally backed $840 million package of loans and grants to help the explorer develop its Northern Territory mine and refinery.

Myer boss welcomed

There was also a big vote of confidence in department store Myer’s (ASX: MYR) new executive chair Olivia Wirth, with the former Qantas (ASX: QAN) executive’s appointment being met with a 7.6% share price rise to 85.5¢.

Not so cheerful were shareholders in Aussie Broadband (ASX: ABB) when its shares dropped 18% to $3.50 after it lost a white-label deal with Origin Energy.

That was good news though for shareholders in fellow telco provider Superloop (ASX: SLC), which upgraded its earnings guidance and saw its shares rise 24.8% to $1.31 on the news.

Shares in Appen (ASX: APX) fell 17.1% to 80¢ after New Jersey-based Innodata withdrew its $154 million bid for the company a day after news of the confidential takeover offer was revealed.

Small cap stock action

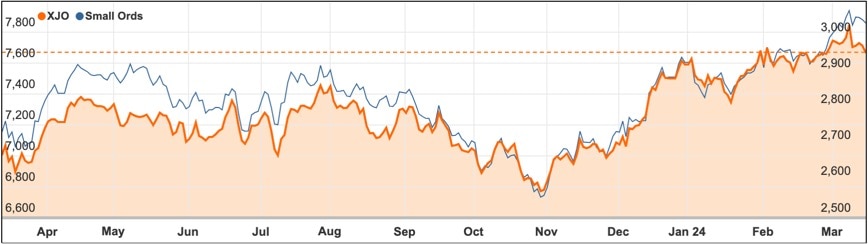

The Small Ords index fell 1.11% for the week to close at 3039.7 points.

Small cap companies making headlines this week were:

Peppermint Innovation (ASX: PIL)

Peppermint Innovation has seen positive outcomes from its strategic focus on enhancing its artificial intelligence (AI) and customer experience (CX) operations in late 2023, including securing several global AI and CX contracts.

The acquisition of XPON Technologies’ subsidiaries, XPON Digital (now Peppermint Intelligence, PINT) and Holoscribe Australia, has bolstered Peppermint’s capabilities, leading to PINT securing key contracts, including an expanded partnership with Amnesty International for digital campaigns.

Peppermint Innovation has also seen contract renewals from other clients, such as Informa Connect and Action Against Hunger, attributing success to the strategic acquisition that expedited the company’s growth and integration of AI and CX into its services.

PINT is developing an innovative AI-driven platform to match skills and needs, automating the entire user journey, which showcases the application of their AI and CX enhancements across various projects.

The company views AI as a crucial element in a global economic “super cycle,” with ambitious plans to become a leading AI-powered lender in the Philippines, leveraging its newly acquired AI and CX expertise for business growth and platform optimisation.

LBT Innovations (ASX: LBT)

LBT Innovations has launched its APAS PharmaQC technology, designed for automated imaging, analysis, and interpretation of microbiology culture plates, marking a significant advancement in pharmaceutical manufacturing by providing an automated alternative to the standard manual reading process.

This development follows successful primary validation testing with AstraZeneca, demonstrating the technology’s capability to meet pharmacopeial standards, highlighted by the generation of significant data, including over 35,000 plate images and a zero false negative rate.

The technology, requiring no additional regulatory approvals, is now ready for global sales, with AstraZeneca planning a secondary validation within its manufacturing processes.

LBT’s APAS PharmaQC aims to support the biopharmaceutical industry’s shift towards evidence-based automation, improving data integrity and process efficiency by using artificial intelligence for microbial growth detection and offering better traceability and quality control in sterility monitoring.

The partnership with AstraZeneca on this $1 million project underscores the commitment to advancing microbiological quality control and anticipates a swift commercialization trajectory as the technology is introduced to potential customers at global conferences.

Arafura Rare Earths (ASX: ARU)

Arafura Rare Earths’ project to establish the first integrated rare earths mine and refinery in Australia’s Northern Territory has been significantly advanced thanks to a new $840 million funding commitment from the federal government.

This financial backing, announced by Prime Minister Anthony Albanese during a visit to the NT, is set to catalyse additional investments from international financiers and commercial banks in the Nolans project operated by Arafura.

Situated 125km north of Alice Springs, the project is anticipated to generate over 200 construction jobs and sustain more than 125 permanent positions post-construction, with the company aiming for at least 20% of these roles to be filled by local Indigenous people.

Aurum Resources (ASX: AUE)

Aurum Resources discovered additional high-grade gold intercepts from its drilling activities at the BD tenement within the Boundiali project in West Africa, highlighting significant findings such as 73m at 2.15 grams per tonne gold from 172m including 1m at a bonanza 72.11g/t from 188m.

These results, from four diamond drill holes spanning 275 meters of strike, include several notable high-grade sections, contributing to the optimistic outlook for the project’s gold potential.

The latest assays extend the promising mineralization observed in the first reported hole and cover a substantial portion of the known target area, suggesting the presence of a large, high-grade gold system within economically viable mining depths.

Aurum’s exploration efforts, totalling over 6,000 meters of drilling to date, aim to delineate a maiden gold resource by the year’s end, marking a significant milestone in the project’s development.

The company’s inaugural drilling campaign, employing self-operated diamond rigs, has identified new gold targets and advanced understanding of the mineralization’s structural control within the BD tenement.

Qantm Intellectual Property (ASX: QIP)

Qantm Intellectual Property has received a preliminary takeover offer from Adamantem Capital, proposing to acquire all shares at $1.187 each, amounting to a transaction valued at approximately $254 million, which is considered superior to a previous offer by Rouse International.

The offer, structured as an all-cash scheme with an option for up to 50% in scrip, comes amid heightened interest in Qantm, following the company’s positive financial performance.

Qantm, which debuted on the Australian Stock Exchange in 2016, operates through major brands in the intellectual property sector, including Davies Collison Cave, a leading patent and trademark firm in the Asia-Pacific.

The company has shown significant financial improvement, reporting a 25.7% increase in EBITDA to $17.3 million for the December half and a net debt reduction to $21.7 million.

This financial turnaround has sparked Adamantem Capital’s takeover interest, highlighting Qantm’s robust revenue growth, improved financial discipline, and stronger balance sheet.

Pentanet (ASX: 5GG)

High-speed internet specialist Pentanet has extended its GeForce NOW alliance with Nvidia, now including New Zealand in its serviceable territory and retaining exclusive distribution rights in Australia.

Since launching in January 2021, Pentanet has grown its GeForce NOW membership to over 530,000, supported by infrastructure in Perth and Sydney.

The company’s managing director, Stephen Cornish, highlighted the solid base of paid memberships covering initial costs and the potential for significant future growth in the cloud gaming market.

Pentanet’s Q2 results showed a 52% quarter-on-quarter growth in paid gaming memberships, driven by a new membership tier, marketing efforts, and new content, including its launch on the Optus SubHub platform.

Nvidia’s VP of GFN, Phil Eisler, commended Pentanet for creating a deeply-engaged cloud gaming community in Australia, delivering high-performance gaming experiences.

The week ahead

Once again central bankers are at the heart of market movements this week, with our own Reserve Bank being joined in making and revealing its interest rate decision by the US Federal Reserve Open Market Committee (FOMC), the Bank of Japan and the Bank of England.

Out of that group only the Japan decision is expected to possibly herald any change but the remarks of all of these central bankers will be closely examined for any commentary around the potential timing of interest rate cuts and comments about progress on inflation.

Here in Australia the main statistical release will be the labour force survey on Thursday, which is expected to show a recovery in job creation that could herald a sight retreat in the unemployment rate from near two-year highs of 4.1% to 4% with the labour force participation rate expected to remain very high.

China is expected to announce that the Lunar New Year holiday period led to strong retail spending in February

The main US releases to watch for include figures on the current account, manufacturing, existing home sales, and purchasing manager indexes.