Avanco Resources (ASX: AVB) has reported positive results from the Pedra Branca East pre-feasibility study, facilitating the immediate start of a definitive feasibility study to advance the project.

Pedra Branca East will add 24,000 tonnes of annual copper production, with the option for a further 10,000 tonnes from Pedra Branca West. With 14,000 tonnes of annual production already being forecast from the operating Antas Mine, this will help Avanco realise it’s ambition of becoming the next mid-tier copper producer.

Key Highlights:

- Pre-Feasibility Study (PFS) demonstrates the viability of a large-scale standalone underground mining operation at Pedra Branca East (PBE).

- Financial modelling of the PFS findings provide sufficient confidence for Company to commence infill drilling for reserve definition, as part of the Definitive Feasibility Study (DFS)

- PFS main conclusions:

- 1.2Mtpa production for 24,000t Cu and 16,000oz Au per annum

- NPV7 estimated at $200 million with a 34% IRR

- Estimated $368 million LOM net cash flow o Pre-production CapEx $158 million

- Estimated C1 costs, approximately $1.30/lb10 assuming a conservative copper prices of $2.65 to $2.95/lb and BRL:USD rate of 3.20.

- Surface infrastructure is mostly in place, including Access roads, bypass road around Vila Feitosa, Office complex, facilities and communications, and ROM pad.

Commenting on the study, Tony Polglase, Managing Director of Avanco said:

“Pedra Branca is the company’s second and larger project. The Pedra Branca East pre-feasibility study has returned positive results, providing the confidence to advance immediately to a definitive feasibility study. Our vision is clear, to be the next-mid-tier copper company, and the development of Pedra Branca will get us there. I am encouraged by the results and look forward to advancing the project.”

Avanco’s Pedra Branca – Pre-Feasibility Study

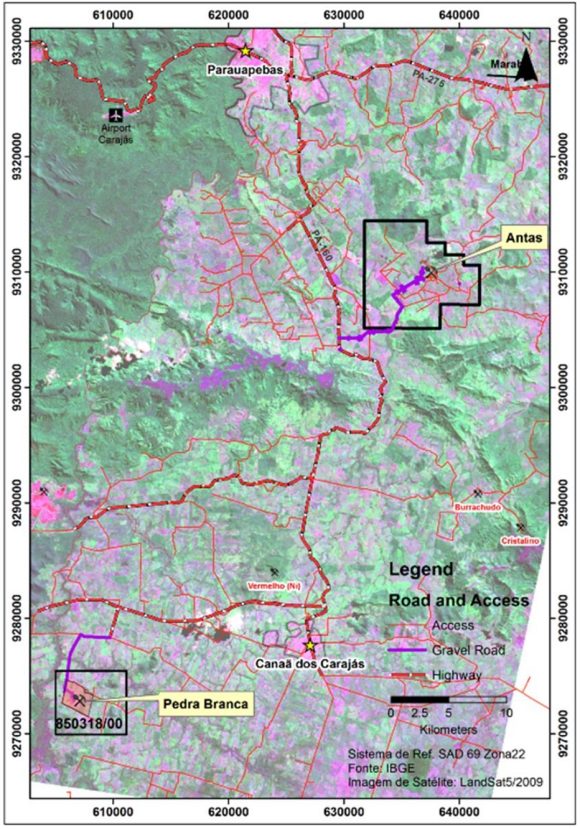

Pedra Branca is Avanco’s second and much larger project, located ~50km (straight line) southwest of the producing Antas Mine.

Pedra Branca comprises two adjacent high grade, steeply dipping copper-gold deposits, East and West (PBE and PBW). PBE is the subject of the current study and the results are considered very positive.

Key outputs from financial modelling of the full-scale development at PBE are:

- 1.2Mtpa production for 24,000t Cu (19,200t Cu to 28,800t Cu) and 16,000oz Au (12,800oz Au to 19,200oz Au) per annum

- NPV ~US$200M (~US$160M to ~US$240M) and IRR 34% (28% to 41%)

- ~US$368 million LOM net cash flow (~US$309M to ~US$463M)

- Pre-production CAPEX US$158M

- C1 cost ~US$1.30/lb

The PBE Pre-Feasibility Study was completed to an overall ±20% level of accuracy.

ASX Chapter 5 Compliance and Cautionary Statement

The information and production target presented herein is based on a pre-feasibility study where reserves have not been declared, thus there is no assurance of economic development and for the findings of this study to be realised.

The production target referred to is based on mineral resources which are classified 19% measured, 55% indicated, and 26% inferred. There is a low level of geological confidence associated with inferred resources, and there is no certainty that further exploration work will result in the determination of indicated resources, or that the production target itself will be realised.

All JORC modifying factors have been sufficiently considered, including: mining studies, underground designs, processing studies, laboratory scale metallurgical testwork, conceptual engineering and infrastructure assessments. Capital and operating costs, where applicable, are based on actual costs from Avanco’s nearby Antas Mine.

Third party accredited consultants have been used to complete or have contributed to the majority of technical aspects of the study and independent peer reviews, with the remainder of the work completed by company technical staff. These studies support the assumptions that have been made in the pre-feasibility study.

Avanco has concluded it has a reasonable basis for providing the forward-looking statements included in today’s ASX release.

Avanco also believes it has a reasonable basis to expect to be able to fund a definitive feasibility and any early decline development from existing cash reserves. Subject to additional financing it is also reasonable to expect that the full scale Pedra Branca East Project will be developed in the future.

All material assumptions on which the forecast financial information is based are set out in the announcement.

Avanco’s Pedra Branca East – Pre-Feasibility Study

In 2016, Avanco announced the results of the PBE scoping study. This exercise studied development of a 1.2Mtpa standalone operation in the East producing 24,000tpa of copper in concentrates. The Study included the option of an initial small scale “Development Stage” scenario wherein the Hanging Wall High Grade Zone12 would be exploited and trucked to Antas.

In late 2016 the early development stage option became redundant since capacity at Antas to treat other ores no longer exists following the upgrade in production guidance at the Antas mine. Consequently, management removed the early development option from the pre-feasibility study. The final PFS therefore focused on achieving full-scale production from a standalone mine at Pedra Branca East as soon as practicable.

Financial modelling in the more detailed PFS demonstrates an NPV within approximately 6% of the NPV previously published in the scoping study. The lower IRR is attributed to the absence of development stage cash flows.

Upsides and savings realised in the PFS have largely offset the impact of a softening long term copper price and strengthening Brazilian Real since publication of the Scoping Study. The current PFS study uses April 2017 pricing and related modelling indices.

Analysis illustrates that if the Scoping Study indices are applied to the PFS, an increment of approximately 10% is achieved on the NPV, serving to demonstrate that the project has improved even without the benefit of the early cashflows.

PBE is most sensitive to copper price, with a 10% increase improving NPV by approximately 40%. In terms of costs, a 10% reduction in operational costs improves NPV by 16% whereas a 10% reduction in capital costs improves NPV by 11%.

In terms of opportunities identified by the PFS to extend/expand and/or improve flexibility at the PBE project, these included:

- Extending the mineral resources available at PBE, including conversion of Inferred Resources to higher classifications.

- Open pit and/or underground potential at the PBW deposit, which is at an earlier stage of development.

- Exploration potential in the surrounding tenements.

- Improvement in commodity prices, depreciation of the Brazilian Real and/or realisation of available tax relief.

The successful completion of the PFS at PBE and the commencement of a definitive feasibility study and associated infill reserve drilling are important strategic milestones for the future growth of Avanco as it aspires to be the next mid-tier copper producer.

Avanco has already commenced the definitive feasibility study. It is envisaged that this will be completed, and announced to shareholders within 12 months, i.e. before the end of May 2018.