Electric vehicles (EVs) have duly arrived for the benefit of consumers and air-quality-conscious legislators — but there’s a catch.

Out of all the countries currently pushing forward with EV adoption, there’s only one that currently buys more electric cars than combustion-powered incumbents each year.

If you’re wondering who — it’s not the United States, Japan, or even China.

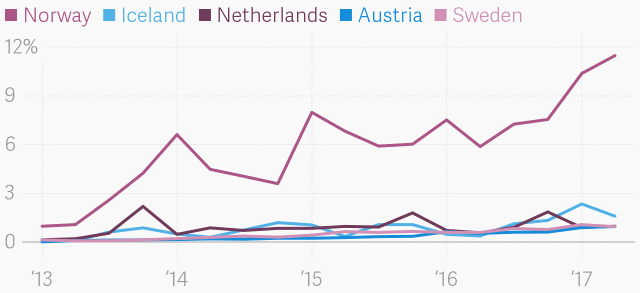

To the surprise of most market analysts, the country that has taken to electric cars like a duck to water has been Norway. According to the International Energy Agency, Norway isn’t just leading the pack — it has left the entire peloton of EV hopefuls disappearing in its rear-view mirror.

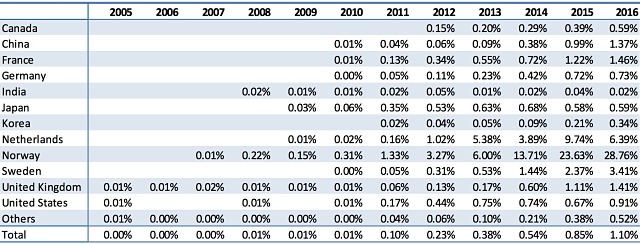

Traditional combustion engine car makers have seen their share of car sales eroded by electric cars which are finally starting to attract significant numbers of new car buyers, but the rate of change is highly variable from country to country.

As it stands, almost 30% of all cars in Norway are now electric or a hybrid. To highlight how far ahead Norway is (or how far behind the rest of the world is), consider that despite “aggressive” domestic championing of the EV by Chinese policymakers, China is only “hoping” for EV’s to reach 11% of new car sales by 2020.

Offering bundles of improvements upon existing combustion cars, electric cars are being adopted, but not as quickly as hoped.

If judging by plans being hatched by the likes of Volkswagen, BMW, Chevrolet and Tesla, electric cars is where all manufacturers are looking to end up over the next decade.

The electric future of automobiles

Electric cars are growing in popularity because they offer a compelling alternative.

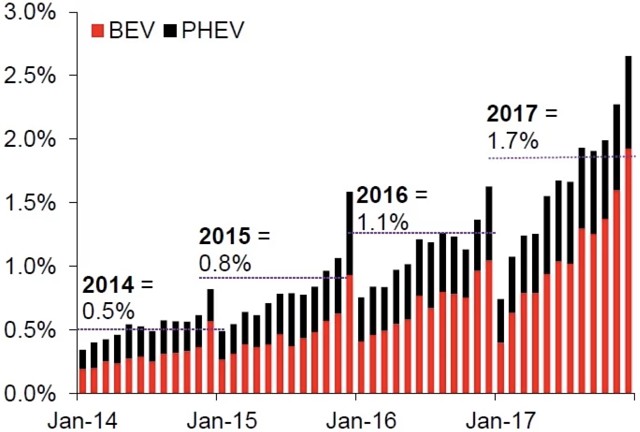

However, despite grandiose marketing campaigns and a huge rush by mining companies into battery metals (cobalt, lithium, zinc) exploration, EVs have only penetrated less than 2% of the global market.

When looking at specific EV technologies, the most commonly known variants leading the sales charts are battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

BEVs are purely electric cars such as those made by Tesla whereas PHEVs go halfway towards delivering an electric experience whilst retaining a petrol or diesel engine.

There is also another type called fuel cell electric passenger light-duty vehicles (PLDVs). Fuel cell electric vehicles power an electric motor and battery by converting hydrogen gas into electricity.

Fuel-cell vehicles are currently the least adopted variation of EVs and are far less common than BEVs or PHEVs, but they do offer significant potential as a low-carbon “clean” technology.

Volkswagen stance

According to Volkswagen CEO Matthias Mueller, for VW to improve upon its currently meagre proportion of electric cars sold, the automaker must redirect increasing amounts of resources towards EVs.

Only 0.1% of Volkswagen’s cars are of the “e-vehicle” variety, and given the spearheading trends being set by Tesla, Germany’s largest automaker has embarked on a billion-dollar catch-up mission.

In a market statement last week, Mr Mueller confirmed that VW will spend €20 billion (A$25 million) over the coming 3 years to compete for world EV market share with the likes of Tesla but admits that an electric future in EVs will have to be paid for with present combustion-sourced earnings.

“Naturally, we are looking to continue our operating business success in 2018 because we must generate the revenue we will need for our enormous future investments,” said Mr Mueller.

Judging by the current starting positions, the likes of Tesla are arguably in the lead due to their exclusive focus on EVs.

VW is the world’s largest car manufacturer so although it may take longer to raise its EV production line from scratch when it finally does, it will mean VW will produce a new EV “virtually every month” of the year according to Mr Mueller.

VW plans to start its roll-out of EV’s as of next year with intentions of creating the “largest fleet of electric vehicles in the world.”

Chinese barriers to entry

China and US are the world’s two largest EV markets, selling a combined 45 million cars per year. China accounted for 45% of all EV sales last year and indications are China will retain its market dominance in EVs for several years to come, given its national economic prowess and far higher level of spare capacity than the US.

Whereas Americans have been avid car buyers for decades, with many households already owning 2 or more cars; China has a much higher population and is starting further back on the grid, so to speak.

China’s rapidly enriched populace is gradually assuming the role of the global consumer — a role traditionally occupied by US consumers for decades.

If looking at Europe, several countries have vowed to reduce pollutive combustion cars through legislation incentivising EVs and discouraging combustion engines.

The typical parade of sales taxes and carbon emissions caps means it is becoming ever more expensive to own a combustion car in Europe.

In the meantime, many European countries such as France, Norway, Sweden, the Netherlands and Germany have opted to subsidise their EV industries to help with the changeover.

There is, however, one slight little problem — consumers have been slow to jump on board the EV bandwagon in any great numbers. The only exception is Norway where 60% of all new cars sold are electric and the current market share occupied by EVs stands at 29%. Contrasting this with the rest of the world makes for grim reading.

China has assumed the number one position for global plug-in vehicles, with volumes increasing by 73% last year. Globally, China represents almost 50% of all EVs sold and thereby can claim to be the leading adopter of EVs from a political perspective.

Japan and South Korea are currently working hard to catch up to the pace set by the Chinese, but the deeper question is that of consumer demand.

It seems that Norwegian consumers are more likely to substitute their petrol-powered cars for EVs and far more likely to buy a new one from the showroom.

There are more electric cars sold in the US and China than anywhere else (around 45 million per year). But as a proportion of its population, only 1-3% of all car sales in the US, China and Japan are electric, in real terms.

Clearly, the larger G20 countries that constitute the vast majority of the world’s wealth and disposable income have some catching up to do. So much so, that it’s likely to be a long and winding road to global electric car ubiquity.