Australia’s property slump a distant memory as prices boom again

Australia’s national property index has increases for the 5th monthly running and jumped the highest in a single month in over 16 years..

Remember Australia’s property slump?

Well, it got a lot of attention at the time but after a couple of years in which the major markets of Sydney and Melbourne fell by 14.9% and 11.1%, respectively, the slump is now well and truly over and happy times are here again.

Corelogic’s latest figures show that Sydney and Melbourne have bounced back with the biggest monthly lift in national house prices in 16 years as a shortage of available stock and falling interest rates combine to once again send real estate prices soaring.

Sydney and Melbourne driving growth

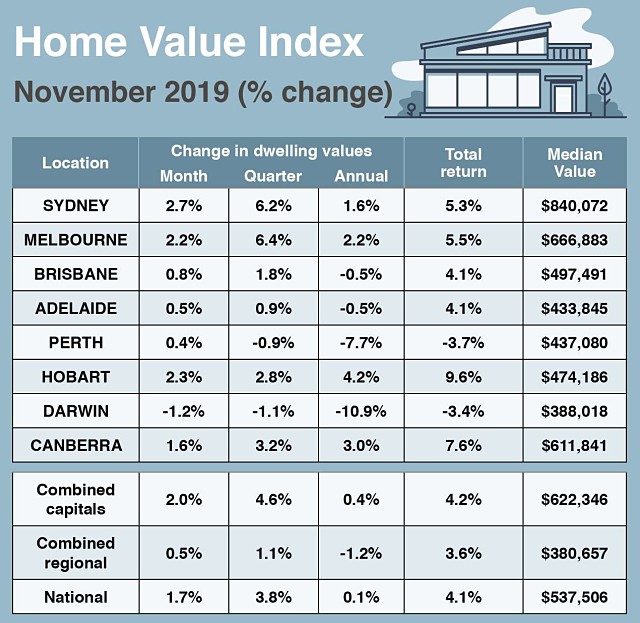

CoreLogic’s monthly measure of values showed dwelling values across the nation’s capitals jumped by 1.7% in November – the largest monthly lift since 2003.

Just as the big markets of Sydney and Melbourne drove the market down, they have driven this increase as prices snap back and reluctant buyers are now worried about missing out rather than overpaying.

Sydney was the star of the show with house values up by 3.1%, taking the median house value to $956,249. That represents a $37,900 increase through the month, with values now up by 4% this year.

Overall dwelling values in Sydney were up by 2.7%, with both monthly rises the biggest since 1988.

Corelogic property data as of 30th November 2019.

Melbourne was far from disgraced, with house values jumping by 2.4%, taking the median value to $774,023. Melbourne house values increased by almost $23,000 during November, taking the annual rise to 2.9% so far this year.

That is the biggest monthly lift in Melbourne house values since May 2015.

Other than falling interest rates which have dropped by 75 basis points and looser lending standards, the end of uncertainty over tax policy after the Coalition’s May election victory also marked a major turning point for the property market.

Hobart remains a giant killer

The property market outside the big capitals was fairly healthy too with Hobart continuing its giant killing performance with house values up by 2.2% for the month to 4.2% since the start of the year.

Darwin still disappointing but Perth back to growth

Darwin was the only disappointment, dipping 1.8% for the month to be down 10.9% so far this year but with Brisbane (0.9%), Adelaide (0.5%), Canberra (1.8%) and even the previously struggling Perth (0.4%) all showing positive results.

Drilling a bit further, the premium end of the market was seeing the biggest rises, with Melbourne’s inner east enjoying an 8% boost so far this year and inner Melbourne up by 5% for the year.

Sydney’s Baulkham Hills (4.3%) and the inner west (up by 4.2%) were also strong performers.