Weekly review: Australian share market shooting out the lights near 6000 points as dollar hits US70c

WEEKLY MARKET REPORT

The Australian market got a full flush of excellent readings on the last day of trading before the long weekend.

After flirting around the 6000 mark, the ASX 200 index finished agonisingly short of that mark with an 0.12% rise to 5998.7 points – marking the fifth straight day of gains and the highest daily close since March 6.

At the same time as the index had added an impressive 4.5% for the week and its sixth straight week of gains, the Australian dollar rose above US70c for the first time since January.

The currency hit a high of US70.04c at 4pm on Friday as traders saw a positive read on US futures and no trade on Monday as a great opportunity to get a jump and buy.

Recovering big banks turbocharging the market

Once again formerly battered financial stocks provided a big push to the ASX 200, adding a lazy 7.1% for the week as investors who had been worried about COVID-19 being particularly toxic for banks changed their minds on the basis that the financial damage looks like being far lower than previously expected.

That followed on from an impressive 11.1% rise for the week before.

The milder forecast for banks and broker upgrades saw some hefty rises for the heavyweights with Commonwealth (ASX: CBA) adding 1.58% or $1.07 a share to $68.73 and Westpac (ASX: WBC) 3.36% or 61c to $18.79.

Their smaller rivals were also impressive with Australia and New Zealand Banking Grp (ASX: ANZ) jumping 2.92% or 56c to $19.77 and National Australia Bank (ASX: NAB) up 2.96% or 56c a share to $19.48.

ANZ and NAB are both now close to breaking through the $20 a share mark, which is a long way away from their March lows of $13.88 for NAB and $14.40 for ANZ.

Never mind the dividends, feel the capital growth

Investors may need to wait longer for smaller dividends but with capital gains like those, canny traders won’t be complaining.

Macquarie (ASX: MQG) did not fall as hard as the retail banks but even it added 0.42% or 49c higher at $118.

As you might expect the more defensive health sector was down 2.75% as blood products giant CSL (ASX: CSL) gave back some of this week’s gains, falling 3% or $8.90 to $285.33.

It was a similar situation for other big players in the sector which also weakened including ResMed (ASX: RMD), Fisher and Paykel (ASX: FPH), Ramsay Health Care (ASX: RHC), Sonic (ASX: SHL) and Cochlear (ASX: COH).

Travel stocks are going places

Risk was back and so the really big winners were the travel stocks which had a fantastic session.

Qantas (ASX: QAN) was up an impressive 7% as the airline prepared to ramp up domestic and regional capacity this month.

The big airline has now more than doubled its share price since the March lows but still has lost 36% this year.

Other big travel winners included Flight Centre (ASX: FLT) and Corporate Travel (ASX: CTD) which both put on more than 8% on Friday.

Small cap stock action

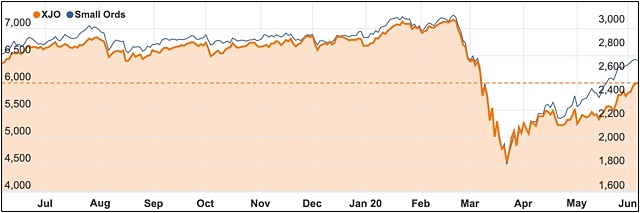

The Small Ords index rose 1.73% this week to close on 2704.2 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Novonix (ASX: NVX)

North American-based Novonix’s share price has surged this week amid rumours there may be a collaboration with electric vehicle manufacturer Tesla, along with the imminent commercialisation of an existing supply agreement with Samsung and news of a technology breakthrough.

Novonix was spun out of renowned lithium-ion battery innovator Jeff Dahn and his Dalhousie University team in Nova Scotia.

Mr Dahn’s team has been working with Tesla since 2016 on advancing lithium-ion battery chemistries.

Novonix has two main business divisions: Novonix BTS, which is focused on battery technology innovations and PUREgraphite, which develops high performing, lower cost battery materials.

The company has raised $58.28 million and will use funds to fulfil its supply contract of shipping 500t of its proprietary synthetic graphite material to Samsung.

Novonix co-founder and Novonix BTS chief executive officer Dr Chris Burns said the funds would also be used to commercialise the company’s patented dry particle microgranulation (DPMG) manufacturing breakthrough.

He said the method had 100% yield, reduced waste and could be used to generate cathode and anode material for lithium-ion batteries.

FBR (ASX: FBR)

Robotic brick laying developer FBR reported its Hadrian X construction robot could lay more than 200 blocks per hour – essentially achieving the threshold where it can compete commercially with traditional manual methods.

The robot can lay more than 200 blocks an hour for the duration of the build, with the building also meeting professional standards.

“We’ve achieved so many amazing technical milestones over the last two years, but this is the first time that we have been able to prove the real commercial case of the Hadrian X in practice,” FBR’s managing director and chief executive officer Mike Pivac said.

Mr Pivac said the company was still continuing to increase the lay speed and enhance the Hadrian X robot.

He added this will continue as the cost of laying decreases, while the market for its robots grows.

The company also noted it had received “significant inbound interest” for its technology from the US, Europe and Asia.

Perseus Mining (ASX: PRU) and Exore Resources (ASX: ERX)

The latest duo to merge in the gold space is Perseus Mining and Exore Resources with both companies endorsing the tie-up, which will give the combined entity a substantial footing in northern Cote d’Ivoire.

Under the takeover, Perseus will issue Exore shareholders one Perseus share for every 12.79 Exore securities held.

This would effectively give Exore shareholders 4% ownership of Perseus and the combined assets.

The deal gives Exore a fully diluted equity value of $64 million based on Perseus’ closing price of $0.105 per share on 2 June prior to the announcement.

This values Exore’s shares at 69% premium to its closing price of $0.062 on 2 June.

Exore managing director Justin Tremain said the board unanimously endorsed the takeover in the absence of a superior proposal, claiming it offers shareholders “compelling value”.

Perseus managing director and chief executive officer Jeff Quartermaine said the tie-up would create a company with a strong enterprise value of almost $1.6 billion.

He added that Exore brings more than 2,000sq km of prospective land in a region where Perseus is already experienced and operating.

Impression Healthcare (ASX: IHL)

Impression Healthcare revealed it would focus exclusively on cannabinoid sales and drug development, which the company’s chief executive officer Joel Latham claims is the part of the business that drives value for shareholders.

“The opportunities in the medicinal cannabis sector are significant and [Impression] has assembled a world-class team in this space, with four clinical assets undergoing assessment,” he said.

To reflect this focus, Impression plans to change its industry classification code from Health Care Equipment and Services to Pharmaceuticals, Biotechnology and Life Sciences.

Additionally, Impression proposes to change its name to its medicinal cannabis brand Incannex Healthcare Ltd.

The new focus follows Impression kicking-off trials to assess the impact of its cannabidiol (CBD) drug IHL-675A against COVID-19 induced associated acute respiratory distress syndrome (SAARDS), which is the primary cause of death in severe COVID-19 patients.

Under the first stage of the trial, the drug will be used on rodents with induced sepsis. Results from stage one will then underpin the next stage which will investigate the “optimal inflammation dampening response” of the drug.

If the studies prove successful, then Impression will apply to the US FDA for Emergency Use Authorisation, which will enable testing in human COVID-19 patients.

Blackstone Minerals (ASX: BSX)

Nickel explorer Blackstone Minerals has hit massive sulphide nickel within the first two drill holes of its Ban Chang prospect within the Ta Khoa nickel-platinum group element project in Vietnam.

The company pointed out the two holes were drilled 200m apart and along strike within a 1.2km-long anomaly that had been identified via electromagnetic (EM) surveys.

Blackstone managing director Scott Williamson said many explorers play it safe when drilling and often step out as little as 25m to avoid missing mineralisation.

He said intersecting massive sulphide nickel mineralisation provided proof of concept that EM surveys were an important tool in unlocking the mineralisation in the region.

Blackstone continues to drill the King Cobra discovery, while a second rig will test EM targets at King Snake, Ban Khoa, Ban Khang in addition to continuing drilling at Ban Chang.

“With the advantage of an in-house geophysics team, we are extremely well positioned to unlock this world-class geology and understand the full potential of our flagship asset,” Mr Williamson said.

Mr Williamson dropped by to chat with Small Caps this week on the podcast about the company’s drill results, plans going forward and the nickel market.

Freehill Mining (ASX: FHS)

Chile-focused Freehill Mining started the week with news it had upgraded its Yerbas Buenas magnetite resource fourfold.

The upgrade firmed up the company’s confidence in creating a low-cost, near term magnetite operation at the project.

Global resources for the project now total 67 million tonnes at 19.1% iron, and contributing to that figure is the new estimate for YB6 which is 49Mt at 20.4% iron.

Professional and sophisticated investor Gavin Ross followed up the positive mineral resource news, with a $700,000 investment in Freehill. The placement is subsequent to an earlier one in February this year where he scooped up $750,000-worth of Freehill shares at $0.018 each.

Speaking with Small Caps, Mr Ross said he was “very impressed” with Freehill’s board and asset after visiting the project earlier in the year.

The week ahead

There is a dearth of fresh economic indicators in Australia this week after a busy week last week, with the share market also taking a day off for the Queen’s Birthday holiday on Monday.

Some of the indicators such ANZ’s job advertisements and NAB’s business survey for May will give some indication of how deep the economic slump has been.

That picture will be filled out with other measures including credit card spending, consumer sentiment, consumer confidence, new home lending and consumer inflation expectations.

There is a welter of offshore news including China’s export and import figures for May and inflation numbers which will be a bit of a guide to how the pandemic recovery is progressing.

In the US there is no shortage of news including inflation expectations, business optimism, job openings, inventories, consumer prices, jobless claims, consumer sentiment, producer prices and export and import prices.

All of which will be an interesting overlay to the US Federal Reserve meeting.