Once again, an Australian encore followed a Wall Street sell-off as investors grew increasingly nervous about the prospect for rate falls, with bond yields rising and shares in interest rate sensitive areas falling.

Weakness in commodity prices didn’t help the Australian market, with falling prices for iron ore and gold helping to broaden the decline across mining stocks as well.

By the close of Friday trade the Australian market was down just under 1%, with the ASX 200 dropping 77.50 points to 7,734.30 points following on from falls on all three US benchmarks.

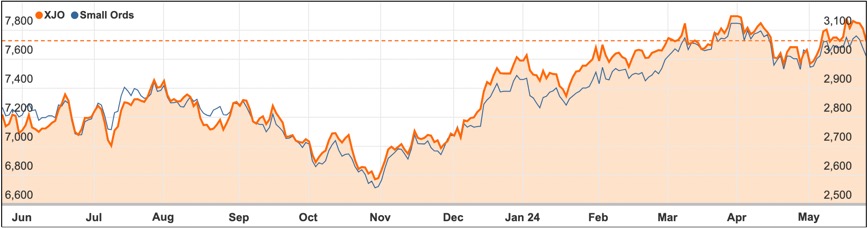

That represents a 1.03% fall on the ASX 200 over the last five days, but is far from a tragedy, with the market still only 2.23% below its 52-week high.

Higher US business activity sets up falls

Firmer than expected business activity in the US in both services and manufacturing this month helped to cause the global unwinding of bullish bets on an imminent rate cut and led to higher bond yields.

Here in Australia the yield on 10-year Australian government bonds added 8 basis points to 4.35%, sending down share prices in interest rate-sensitive sectors such as technology, retail and banking.

Banking leader Commonwealth Bank (ASX: CBA) saw its shares drop 2% to $118.53 while shares in National Australia Bank (ASX: NAB) were down 1.8%.

Miners weaken on lower metal prices

It was a similar story for the big miners as they reacted to lower commodity prices with BHP (ASX: BHP) down 0.5% to $44.75, helped along by fears the Anglo-American takeover is now looking more likely.

Rio Tinto (ASX: RIO) shares were down 0.75% to $132.50 and Mineral Resources (ASX: MIN) shares were down 1.9% to $75.30.

It wasn’t all bad news with shares in online labour hire and data entry business Appen (ASX: APX) adding 2.5% to 60c after telling shareholders at its annual meeting that it expects to break even at an operating level in the coming financial year.

With the US dollar and Treasury yields spiking, that put pressure on the struggling Australian dollar, which traded around US$0.66.

Small cap stock action

The Small Ords index slipped 1.08% for the week to close at 3010.8 points.

Small cap companies making headlines this week were:

Strategic Energy Resources (ASX: SER)

Strategic Energy Resources has secured $2 million from institutional and sophisticated investors for exploration at the Achilles 1 polymetallic prospect in New South Wales’ South Cobar Basin.

The funds, raised through a two-tranche placement, will primarily be used to explore the copper-gold prospect with promising initial results.

Datt Capital, a major shareholder, and Lowell Resources Fund are significant contributors, with Tony Gu of Datt Capital joining the board as a non-executive director.

The strong investor demand highlights the potential of the Achilles 1 prospect, encouraging the company to fast-track its exploration plans.

In addition, Strategic was awarded a $120,000 grant for exploration but faced delays due to severe weather conditions.

Keypath Education (ASX: KED)

Keypath Education will be acquired by an affiliate of Sterling Partners for $0.87 per share, valuing the company at approximately $186.8 million.

This offer represents an 88.3% premium to Keypath’s six-month volume-weighted average price.

Upon completion, Keypath will delist from the ASX and deregister from the US Securities and Exchange Commission.

The acquisition is recommended by a special committee and is subject to shareholder approval, with a special meeting expected around September 2024.

The merger announcement coincides with Keypath’s strong Q3 FY24 revenue growth of 8.6%, reflecting the company’s strategic focus and success in the US and APAC regions.

RareX (ASX: REE)

RareX has agreed to acquire the Khaleesi niobium project in Western Australia from two private vendors.

The acquisition includes one granted tenement and five pending applications, covering 966 square kilometers, for a payment of $100,000 plus 9.8 million shares valued at approximately $157,000.

The project is located near significant mineral deposits and has shown potential for niobium and rare earth elements through historic exploration.

RareX plans to fund the acquisition from its existing working capital and will focus on rapid, targeted exploration of the project.

The acquisition aligns with RareX’s goal of becoming a leading rare earths company, complementing their development of the Cummins Range project.

Charger Metals (ASX: CHR)

Charger Metals has identified additional lithium anomalies at the Mt Gordon prospect within the Lake Johnston project in Western Australia through an infill soil sampling program.

The sampling included 864 samples taken at closer spacings, which helped better define the large lithium soil anomalies.

Managing director Aidan Platel noted that this phase increased the resolution of the anomalies, providing more accurate targets for upcoming drilling.

The program also identified a significant niobium anomaly, measuring 1.8 km by 1.7 km, requiring further investigation.

The work is being conducted under a farm-in agreement with Rio Tinto Exploration, following Charger’s acquisition of full ownership of Lake Johnston from Lithium Australia.

Adherium (ASX: ADR)

Adherium has secured a $1.1 million contract with AstraZeneca to use its Hailie Smartinhaler platform in a clinical trial.

The three-year trial will involve recording and transferring medication usage data using Adherium’s Hailie Smartinhalers, app, and platform.

Adherium’s technology, which helps manage asthma and COPD, underscores its commitment to enhancing patient care through advanced technology.

The agreement marks a significant phase in Adherium’s commercial development as it raises funds to support its growth and expands its presence in the US market.

Adherium’s sensors, cleared by the US FDA, cover the top 20 branded inhaler medications.

The week ahead

Inflation has been the driving force behind market moves as investors try to second guess when central banks will begin the rate cutting cycle so the Australian monthly inflation measure for April will be pivotal.

Too high and the markets will turn bearish while a low result will be a sign that the stickiness of inflation is finally succumbing to gravity and function as a buy signal.

It is a very similar story in the United States, with the Fed’s preferred measure of inflation – effectively the price component of consumer spending (core PCE price deflator) – being released.

At the moment that measure is running at an annual rate of 2.8%, so any fall could spark a rally, while a rise would be bad news for markets.

Also out in the US is a preliminary reading on economic growth on Thursday.

With just a month to go until the end of the financial year, there are early but still tentative signs that inflation is on the way down in other parts of the world with countries like Sweden cutting interest rates and others such as the UK and Canada moving closer to a cut.

The rest of Europe might also follow but here in Australia it looks more likely that the Reserve Bank would move down late in the calendar year or perhaps next year, depending on progress on inflation numbers and any signs of further weakness in the economy.