It has been something of a horror end to the economic year for Australia with the share market plunging in line with a crunching Wall Street and our growth figures coming in well under expectations at just 0.3 per cent in the September quarter.

Annualised the September quarter figure suggests economic growth of just 1.2 per cent, which in the Australian context is perilously close to recession levels.

Not that many young people even know what a recession is, given Australia’s record 26 years of uninterrupted economic growth.

Trend not positive

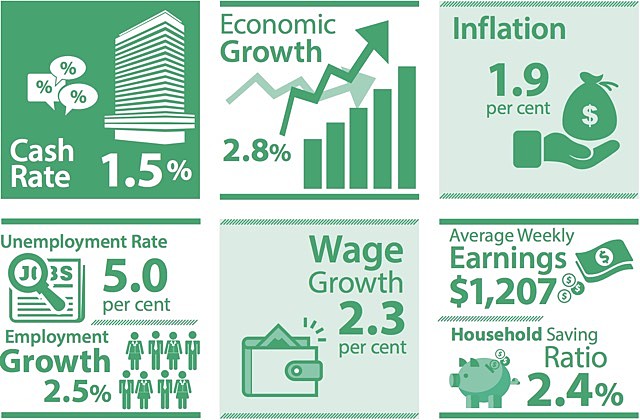

Given that quarterly figures can be misleading, the figures look a bit better if you look at the year to the September quarter which was 2.8 per cent.

However, the trend is not great – if you combine the June and September figures together that rate falls to 2.4 per cent, which is OK but still well short of the Reserve Bank’s forecast of 3.5 per cent for the current calendar year and even the milder forecast of 3.25 per cent for 2019.

While it is always dangerous putting too much emphasis on a single quarter’s growth numbers, it is still difficult to look around and spot too many economic stimulus measures on the horizon.

Employment remains crucial

Employment will be crucial and is still holding up at this stage but at the household level things continue to look fairly bleak, despite a reasonable 0.3 per cent rise in retail sales in October.

The Federal Government (and the broader Liberal Party) seems to be more focussed on patching up its internal cohesion than any form of economic leadership and the four big banks are still caught in the headlight glare of the Royal Commission and seem to have significantly tightened up loan access for businesses small and large and also property investors.

Budget going well but where is the stimulus?

The Federal Government coffers are filling nicely as the Budget comes back into balance but that needs to be deployed in the form of tax cuts or more government spending to make a mark on the economy.

State Governments are still spending on infrastructure which is great as far as it goes but the household sector is by far the biggest game in town and there are plenty of stretch marks appearing.

Household debt and repayments are high which acts as a brake on further spending and wage rises are still modest to non-existent.

The outcome of all of this is that consumers are struggling to save, meaning there is not a big backstop for consumers to draw on to pick up any slack.

Welcome to 2019

All of which presents an intriguing welcome to 2019, with a wide range of economic growth possible depending on your point of view.

You could take the RBA forecasts as gospel and see just a minor slowing in the New Year but that seems to be inconsistent with the actual numbers that have now come through.

You could have a view that the September numbers were a bit of an aberration and that growth is due to pick up some steam in early 2019, leading to a less rosy outcome than the RBA forecast but still resulting in a positive year.

Then there is a muddle through option, with growth moderating to somewhere around the 2.8 per cent level suggested by the past two quarters – less than the RBA forecast but probably enough to keep the growth engine from stalling.

Of course the fourth option – which can’t be dismissed at this stage – is that the September number is a harbinger of more disappointment to come and that growth is in the process of stalling and more quarterly numbers around the 0.3 per cent mark or even lower or negative could be in prospect.

Possibility that R-word could spring into view

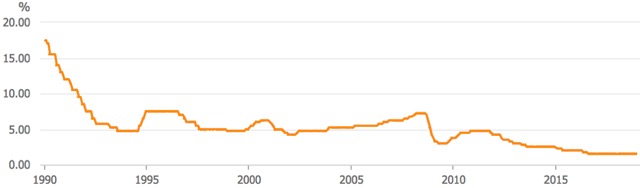

Such a result brings a few very nasty possibilities to the forefront such as the RBA having to move away from its “interest rate rise at some time in the future’’ rhetoric to signalling that the next interest rate move could be a cut.

And then that R- word – recession – would start to haul into view, even though it may be a novel and theoretical concept for anyone aged under 30.

Indeed, younger Australians should consult their elders to hear some of the horror stories of recessions long past, given that they can be a scarring and literally life-changing event.

Of course the future is inherently unknowable, particularly in a world in which the two big trading countries – China and the US – are in the midst of a time of peace but could at any time resume their trade war.

We are in for an interesting ride in 2019 with the likely prospect of a change of Government at the Federal level and an economy that is poised on a knife edge and could literally head in either direction.