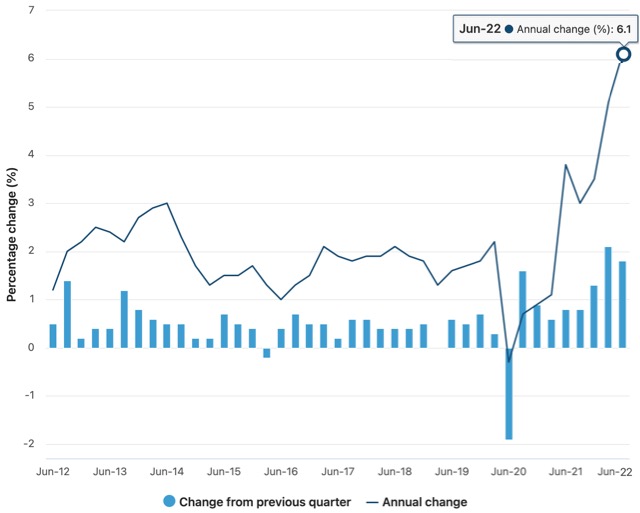

The Australian Bureau of Statistics (ABS) revealed this morning that Australia’s annual inflation reached 6.1% in the June quarter – its fastest increase in over 20 years and the situation is only predicted to worsen.

Data released by the ABS on Wednesday showed the consumer price index (CPI), also known as inflation, rose by 1.8% in the June quarter, bringing the annual rate to 6.1%.

ABS Prices Statistics head Michelle Marquardt said the quarterly increase “was the second-highest since the introduction of the GST”, which was rolled-out back in 2000.

Australian Treasurer Dr Jim Chalmers said the increase will place more pressure on families already struggling with the cost of living.

“We face economic headwinds. We face rising inflation. We face rising interest rates,” he said.

“There are real challenges there, but I’m comfortable that my government has a plan to deal with those challenges.”

Some analysts have suggested the rapid pace of inflation could prompt the Reserve Bank of Australia (RBA) to raise interest rates by as much as 75 basis points at its upcoming meeting on Tuesday.

If the RBA does hike interest rates by this much, it will be the largest monthly increase since December 1994.

Despite this, the annual 6.1% CPI figure was slightly less than the 6.3% that analysts were tipping.

Cost of living crisis

Treasurer Chalmers said today’s announced inflation rate probably comes as no surprise to Australians, who are already struggling with the cost of living every time they buy food and petrol.

In the June quarter, ABS data shows new dwelling prices rose by 5.6% and petrol prices continued their upward ride, up 4.2% – driving the broader significant CPI spike.

Ms Marquardt said the CPI’s automotive fuel series hit new levels that were not seen before.

“The CPI’s automotive fuel series reached a record level for the fourth consecutive quarter,” she said.

“Fuel prices rose strongly over May and June, following a fall in April due to the fuel excise cut.”

The price of goods also increased throughout the quarter, at a much faster rate than services, rising 2.6% and 0.6% respectively.

Supply chain disruptions caused by floods, labour shortages, and rising freight costs saw fruit and vegetable prices surge 7.3%, with meat, seafood and bread 6.3% higher.

Non-discretionary items were up 7%, as were furniture prices, with issues such as increased transport, material costs and shortages across stock underpinning the price hikes.

Inflation rises globally

Living costs continue to rocket not only in Australia, but across the globe, with New Zealand also experiencing new 32-year heights, reaching 7.3% CPI in the June quarter.

As for the UK and the US, these countries posted inflation rates exceeding 9% in June and the Eurozone saw its annual rate rise to 8.6%.

Inflation rates will continue to soar

Treasurer Chalmers has urged Australians that the rising cost of living and mounting pressures will continue and worsen.

“Inflation is high and rising. It will get tougher before it gets easier,” he said.

“The reality is the quarterly outcome does not yet include the electricity price spike that came in July.”

However, the treasurer added the government was doing its best to address the “domestic factors” to inflation.

“I think Australians understand when they’re at the supermarket, when prices are going through the roof, that this challenge is partly global and there are domestic components of this challenge as well,” he said.

“I wanted to reassure them that the government is very focused on those domestic factors.”