A gloomy take on the Australian economy by the Reserve Bank and some mixed company profit results was all it took to overcome a strong lead from Wall Street and send the ASX200 index 37.4 points lower to 6004.8 points on Friday.

In a sign that it sees Victoria’s continuing stage four lockdown as particularly bad news for the Australian economy, the RBA released three much bleaker forecasts for the Australian economy.

For the baseline scenario, the Australian economy was expected to contract by about 6% over 2020, before growing by around 5% over 2021 and 4% over 2022.

Unemployment set to hit 10%

The unemployment rate is expected to peak at around 10 per cent by the end of this year and Victorian job losses and slower JobKeeper payments would more than offset the jobs recovery in other states.

For an upside scenario, which assumes good control of the virus soon, there would be a faster unwinding of activity restrictions and greater confidence leading to a faster recovery in consumption, investment and employment.

The unemployment rate would peak at a lower level and decline faster than in the baseline scenario.

Downside scenario realistic but bleak

The RBA’s downside scenario predicts the world experiencing a widespread resurgence in infections in the near term, with Australia facing further outbreaks and lockdowns.

In this scenario, activity restrictions would reduce household consumption and business investment, despite continued policy stimulus and income support.

Domestic activity would take much longer to recover, resulting in the unemployment rate remaining close to its peak throughout 2021.

All of this overrode the strong US lead which was built on optimism that Congress would reach a new stimulus deal, sending US stocks higher.

Despite the poor ending, the ASX 200 still managed to finish ahead for the week, adding 1.3% over the five sessions.

Higher metal prices don’t buoy miners

Shares in the big miners weighed down the index despite most metal prices remaining high.

Gold was particularly strong, holding around US$2,070 an ounce while iron ore hit a 12-month high.

Despite that news BHP (ASX: BHP) was down 1.3% while Rio Tinto (ASX: RIO) shed a larger 2.9%.

Shares in Fortescue Metals (ASX: FMG) also fell a disappointing 2.4%.

Gold miners also failed to shine and ride the higher prices with shares in Northern Star (ASX: NST) down 2.4% and Silver Lake (ASX: SLR) down 3.1%.

The big four banks ended mixed, with National Bank (ASX: NAB) the worst with a 0.4% fall while ANZ Bank (ASX: ANZ) was up 0.25%.

Results drive diverse movement

Insurance Australia Group (ASX: IAG) was down 0.8% after the insurer released its FY20 profit.

Insurance premiums rose slightly to $12.1 billion but that couldn’t prevent net profit after tax (NPAT) slumping 59.6% to $435 million, with natural disaster and Covid-19 claim costs leaving a big dent.

Due to low expectations, poor results didn’t always lead to share declines with REA Group (ASX: REA) and News Corp (ASX: NWS), which owns 60% stake of REA, both up despite weak results.

Shares in News were up 5.7% on a fourth quarter net loss of US$401 million while REA shares were up 1.9% despite property listings – particularly those in Victoria – being hit hard by Covid-19 restrictions.

Health stocks were down with ResMed (ASX: RMD) shares down 3.2%, and blood products group CSL (ASX: CSL) down 1.3% to $274.19.

Small cap stock action

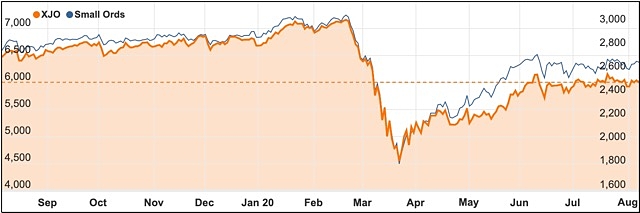

The Small Ords index rose 2.01% this week to close on 2686.6 points.

Small cap companies making headlines this week were:

Esports Mogul (ASX: ESH)

eSports media and software business Esports Mogul has announced the appointment of former Google, YouTube and Spotify managing director Kate Vale as director.

The news follows positive interim results from the company including “exceptionally strong” interest in the Mogul platform with COVID-19 increasing the appeal of eSports.

According to Mogul managing director Gernot Abl, Ms Vale’s digital sales and marketing expertise will be of great value to the company as it expands its market footprint in eSports.

As former country manager for Google Australia and New Zealand, Ms Vale reportedly grew revenues from zero to US$500 million (A$691 million) over six years.

Her appointment follows other high-profile recruitments to Mogul’s board including Canva co-founder Cameron Adams and founder of political movement MiVote, Adam Jacoby.

These high-profile appointments were rounded out with former Electronic Arts, Midway and Disney executive Michael Rubinelli joining the board as chief executive officer on Thursday.

Mogul noted Mr Rubinelli had more than 20 years’ experience and had achieved success across large gaming corporations and start-ups alike.

Alterity Therapeutics (ASX: ATH)

Dual-listed biotech Alterity Therapeutics has confirmed the efficacy of its lead drug candidate ATH434 for the treatment of multiple system atrophy (MSA), according to new clinical data.

The company reported new animal data from the Medical University of Innsbruck in Austria showing the drug can reduce alpha-synuclein pathology, preserve neurons and improve motor performance in patients afflicted with the rare and rapidly-progressive neurological disorder.

The data has been selected for presentation at the 2020 International Congress of Parkinson’s Disease and Movement Disorders and the American Neurological Association’s 2020 annual meeting.

For the first time, Alterity will also present cardiac safety data from its phase 1 study of ATH434, which indicates there is no evidence of cardiac liability at clinically-tested doses.

There is currently no adequate treatment for MSA, with most symptoms unable to be properly addressed by available drugs intended for patients with Parkinson’s disease, a similar disorder.

Danakali (ASX: DNK)

Advanced sulphate of potash (SOP) explorer Danakali is targeting maiden production from its Colluli project during 2022.

Danakali owns 50% of the project with the Eritrean National Mining Corporation holding the other 50%.

In a recent presentation, Danakali described the Eritrea-based project as “ready for take-off”, shored up by a recent mine development approval from the country’s government.

The Eritrean Ministry of Energy and Mines has given the joint venture up to mid-December 2022 to begin commercial production as well as approving the duo’s financing plan.

Switzerland-based EuroChem has already agreed to take 87-100% of the project’s first stage SOP production, while the Africa Finance Corporation plans to provide US$150 million in development funding.

Colluli has a 1.1 billion reserve and 200-year mine life generating SOP.

Caprice Resources (ASX: CRS)

The latest company to reveal a gold acquisition was Caprice Resources, which reported it was purchasing the Island project in the Cue goldfields.

Island covers 21sq km of tenements close to the Lake Austin gold mining district and 20km south of the town of Cue.

The project includes two granted mining leases and an exploration licence with multiple drill ready targets.

Limited previous exploration at the project returned 11m at 14.9g/t gold from 77m; 24m at 6.8g/t gold from 24m; 15m at 10.5g/t gold from 75m; 4m at 17.3g/t gold from 8m; and 3m at 24.3g/t gold from 27m.

Under the deal, Caprice will issue the vendors 16.6 million shares and make a $100,000 cash payment. Additionally, Caprice will cover $800,000 in unpaid invoices and incurred expenses.

Caprice plans to begin a 3,000m maiden drilling program once the acquisition has been completed.

Crowd Media (ASX: CM8)

Through an initial six-month deal, Crowd Media has the rights to distribute US-based Teadora Inc’s natural beauty products across the European Union.

The beauty products are fair trade sourced, sustainably harvested, recyclable and biodegradable with a focus on reducing the carbon footprint.

Additionally, the brand claims to be 100% vegan, toxin-free, cruelty-free, gluten-free and synthetic fragrance-free.

The deal gives Crowd exclusive digital distribution rights in the region and has already begun selling them via the Amazon EU online marketplace.

Under the agreement, Crowd will leverage its digital social media and influencer marketing capabilities to promote sales of the Teadora products.

Actual agreement terms have not been disclosed but is believed to be consistent with standard distribution and reseller margins of 75%.

Kalamazoo Resources (ASX: KZR)

Gold explorer Kalamazoo Resources has built what it calls a “top flight” team to advance its recently acquired Ashburton gold project in WA.

The company has appointed Matthew Rolfe as senior exploration geologist with his most recent appointment with Northern Star Resources where he was also a senior exploration geologist in the Pilbara region.

Kalamazoo noted Mr Rolfe has a “deep understanding” of Ashburton and, as such, will play an “important part” in expediting exploration.

Mr Rolfe has been joined by Dr Margaret Hawke as fellow senior exploration geologist for the project.

Dr Hawke was previously jointly credited for Sandfire Resources’ DeGrussa copper-gold deposit which is now a mine.

Investigator Resources (ASX: IVR)

Investigator Resources is looking to advance its Paris silver project in South Australia to take advantage of the precious metal’s recent price surge.

The company has just raised $8 million through a share placement with its largest shareholder, London’s Merian Gold and Silver Fund, snapping up half.

The funds have been allocated for resource drilling, development studies and further exploration around the Paris project, where it now aims to proceed to pre-feasibility studies.

Drilling is anticipated to start in early September.

Investigator describes Paris as “Australia’s highest grade undeveloped primary silver project” with a JORC resource of 9.3Mt at 139g/t silver and 0.6% lead for 42Moz of silver and 55,000t of contained lead.

Upcoming listings

Making their way onto the ASX bourse this week were:

Dynamic Drill and Blast Holdings (ASX: DDB)

After servicing WA’s civil and mining sectors for nearly a decade, Dynamic Drill and Blast Holdings listed under the code DDB.

The company had a $5 million IPO via the issue of 25 million shares at $0.20 each, with funds raised to steer the company through the next stage of growth.

This will include the purchase of $2.83 million in new plant and equipment to service fresh contracts.

Since incorporation, Dynamic Drill has completed over 30 contracts and developed a client base of established names including Rio Tinto (ASX: RIO), Fortescue Metals Group (ASX: FMG), Galaxy Resources (ASX: GXY), Metals X (ASX: MLX), Alcan, Water Corporation, Atlas Iron, Mount Gibson Iron (ASX: MGX) and Newmont Corporation.

The company currently operates at three WA sites including Galaxy’s Mt Cattlin spodumene mine, Fortescue’s Eliwana rail project and Rio’s Western Turner Northern Access road project.

4DMedical (ASX: 4DX)

Lung imaging technology company 4DMedical plans to take advantage of the COVID-19 pandemic in the US with its IPO, which will fund the company’s technology roll-out in the region.

Via its IPO, 4DMedical raised $55.8 million through the issue of 76.43 million shares priced at $0.73 each, giving it an estimated market capitalisation of $193 million on listing.

4DMedical’s technology is “non-invasive” and enables physicians to better understand regional lung motion and air flow and to identify deficiencies “earlier and more sensitively”.

The XV Technology cloud-based platform has FDA clearance to be used with its ventilation analysis software.

4DMedical anticipates COVID-19 will “substantially and permanently increase the demand for lung health assessments and in turn, grow the respiratory diagnostics market”.

The company began trading under stock ticker 4DX.

The week ahead

While the macro factors around the US/China tensions and the progress of the Covid-19 virus will still predominate, a flood of Australian company results will start to draw a picture of how badly the corporate sector has been hit.

Some of the bellwether stocks to report results in the coming week include the Commonwealth Bank (ASX: CBA), QBE Insurance Group (ASX: QBE), SEEK (ASX: SEK), Transurban (ASX: TCL), AGL Energy (ASX: AGL), AMP (ASX: AMP), Telstra (ASX: TLS) and Woodside Petroleum (ASX: WPL).

Together, these stocks should give a broad reading across some of the major industries of how consumers and customers have been reacting to recession, lockdowns, uncertainty and stimulus payments.

There will also be some much-needed guidance on dividend payments and perhaps some brave attempts to forecast what the future holds.

Investment bank Citi has predicted Australian corporate earnings will have fallen by around 20% over the past financial year.

Citi also predicts dividends will be down by 37% (from $72 billion last year, to $45 billion this year), with banks being hit the hardest.

Another question around the results is how many companies will need to go back to shareholders for more cash to bolster their balance sheets through the recession.

Other economic indicators to look out for this week include the July jobs data, business and consumer confidence and a variety of readings on the health of the US and Chinese economies.