Weekly review: Aussie market continues to rally on hopes of US recovery

WEEKLY MARKET REPORT

It was another great week for investors who will have enjoyed seeing the ASX 200 hit a record close on rises virtually across the board.

A post-pandemic unemployment low in the United States of below 400,000 people set the scene for a positive day with only the big miners sitting out for the rally, which briefly touched above 7300 points.

By the close the ASX 200 had finished up 35.3 points on Friday to hit an all-time closing peak of 7295.4 points, up 1.6% for the week with the rise worth about an extra $46 billion in investor’s pockets.

Big names push higher

A bad day for the miners didn’t really matter too much with the big banks that are writing new mortgages as fast as they can continuing to do well.

Commonwealth (ASX: CBA) continued to impress, up 1.3% to a new record price of $102.52.

Not to be left out of the action, Westpac (ASX: WBC) and NAB (ASX: NAB) both hit highs since the pandemic crunch in March of last year, both up 1.4%.

ANZ (ASX: ANZ) jumped 1.5% and Macquarie Group (ASX: MQG) was up 1%.

The search for dividend income wasn’t just limited to the banks with telco Telstra (ASX: TLS) enjoying a solid 1.7% rise to $3.58.

The renaissance for supermarkets continued with Woolworths (ASX: WOW) adding 3.4% for the week and 1% on Friday to $43.35, closing in on an all-time record.

The strength in the car market continued to be reflected in the performance of after-market car part supplier ARB Corp (ASX: ARB), with its shares up 6.3%.

Market strength

Other than the bullish US news, other drivers for the market included the strength of underlying profits and the need to outperform almost zero interest rates being offered by the Reserve Bank well into the foreseeable future.

Perhaps even the agreement between the Commonwealth and Victorian governments to build and staff a new Melbourne quarantine facility and the bringing forward of Pfizer vaccinations nationally to 40-to-49-year-olds from June 8 had a positive impact.

The continuing economic damage from the Melbourne COVID-19 lockdown has seemingly already been built into forecasts and been overcome by hopes of a faster vaccination drive and perhaps a lot more supermarket shopping.

There is a growing consensus among some analysts that the pandemic has actually been a mild positive for many companies, boosting their bottom lines as Australians are forced to spend their money locally.

Tech stocks remain out of favour on inflation worries

The only real sign of weakness in the market was in technology companies, where worries about inflation due to the strong US economic data caused weakness in a mirror of falls in the share prices of growth stocks in the US.

It was not really a bad week for the big iron ore miners as they and the iron ore price recovered from the worst of the China sabre rattling but they had to sit out the rally on Friday with BHP (ASX: BHP) down 1.7% to $48.75, Rio Tinto (ASX: RIO) down 1.9% to $124.62, and Fortescue Metals (ASX: FMG) down 2% to $22.62.

CEO share sales send Appen down

There was some market moving company news with Appen shares (ASX: APX) down 6.3%.

Chief executive Mark Brayan has now sold 109,430 shares at $13.08 a share to satisfy tax obligations after he was vested 173,153 performance rights in March this year.

Mr Brayan still holds 482,032 Appen shares.

Sezzle sizzles but Reject shop not so hot

Sezzle (ASX: SZL) shares fell back 4.4% after they rocketed 23% on Thursday after a deal with Target in the US which allows shoppers to use its buy-now-pay-later platform in-store and online.

It wasn’t such good news for discount retailer, the Reject Shop (ASX: TRS) which fell 6.3% after reporting challenging trading trends since the release of its first half results in February.

Like-for-like sales are down 1.4% and supply chain costs remain high.

Small cap stock action

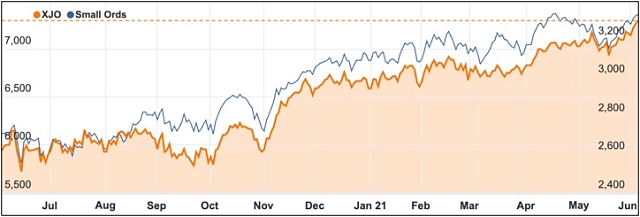

The Small Ords index rose 1.07% to close the week at 3328.7 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

CFoam (ASX: CFO)

CFoam revealed its 10.24%-owned investee Innovaero Group had secured a memorandum of understanding with Boeing subsidiary Insitu Pacific.

Insitu will provide its common architecture software and ground control solutions to Innovaero – enabling Innovaero to accelerate development of its Fox vertical take-off and landing drone.

The agreement also allows for the companies to explore ways in which their technologies can be used in the Australian Defence Force as well as Asia Pacific forces.

Matador Mining (ASX: MZZ)

It was a big news week for Canada-focused gold explorer Matador Mining which has generated “excellent” gold recoveries during a second round of testing on samples taken from its flagship Cape Ray project in Newfoundland.

During laboratory test work on ore from the Central Zone and Window Glass Hill deposits, average gold recoveries of 96% were achieved using gravity and cyanide leaching processes.

Matador followed up the positive metallurgical test work results with news it had boosted its landholding in the region by 37% to 750sq km.

Global Energy Ventures (ASX: GEV)

Global Energy Ventures has appointed executive director Martin Carolan as managing and director and chief executive officer, with Mr Carolan to steer the company’s expansion plans in Europe and Australia.

To facilitate penetration in the European market, Global Energy Ventures has executed a memorandum of understanding with German-based ILF Beratend Ingenieure to identify and develop green hydrogen projects in the region and Australia.

Mr Carolan noted Europe’s renewable energy sector was “growing at a rapid rate” and presented a “highly suitable” market for the company’s compressed green hydrogen shipping and supply chain technology.

Vintage Energy (ASX: VEN)

Another company with big news this week was Vintage Energy which revealed extensive gas pay had been found at the Odin-1 well in Queensland’s Cooper Basin, paving the way for the well to be cased for future production.

Over in South Australia’s onshore Otway Basin, production testing of the Nangwarry-1 carbon dioxide well has confirmed the gas flows at a higher rate than previous commercial rates in the region.

The company is now working on an updated resource for the well, which current gross recoverable estimates totalling 7.8Bcf (low), 25.1Bcf (best), and 82.1Bcf (high).

Kingston Resources (ASX: KSN)

Resource drilling at Kingston Resources’ flagship Misima project in Papua New Guinea has produced more gold and silver intercepts at the Kulumalia target.

These intercepts were unearthed outside of the current proposed reserve pit shell.

Notable assays were 3m at 8.3g/t gold and 87.2g/t silver from 1.5m, and 21.3m at 1.69g/t gold and 30.5g/t silver from 218m.

Kingston has completed 19 diamond drill holes for 3,820m at Kulumalia, with these results to be incorporated in a resource and reserve update, which is scheduled for the September quarter.

3D Metalforge (ASX: 3MF)

Additive manufacturing company 3D Metalforge will supply it range of pump impellers and parts to Flowserve’s network of quick response centres (QRCs) in the Asia Pacific.

US-based Flowserve is a pump, valve and seal manufacturer and has QRCs strategically located in most industry locations to enable reduced lead-time and rapid part deliveries.

Under the deal, 3D Metalforge will be added to Flowserve’s qualified vendor list giving customers the option to purchase its impeller replacements rather than parts made using traditional processes.

Meteoric Resources (ASX: MEI)

Meteoric Resources has published a maiden resource for its Palm Springs gold project, with the resource coming “well ahead” of schedule and made possible from a “treasure trove” of historic drill data and last year’s successful exploration season.

The resource is based on the Butchers Creek and Golden Crown targets and stands at 5.6Mt at 2g/t gold for 357,000oz.

Of this resource, 40% is in the indicated category which totals 139,000oz at 2.24g/t gold.

Meteoric managing director Dr Andrew Tunks said the resource marked the “single-most significant event” for the company during his tenure.

Barton Gold (ASX: BGD)

Investors won’t have much longer to secure a slice in IPO Barton Gold, with the offer officially now scheduled to close on Monday 7 June 2021 instead of the original date of 11 June 2021.

Within five days of the IPO’s open, Barton had raised its maximum $15 million target.

The upcoming ASX debutant owns two large-scale gold projects (Tarcoola and Tunkillia) plus the mothballed former Challenger mine and mill in South Australia.

Barton has been exploring the projects since it acquired them in 2019. Tunkillia hosts a resource of 26.1Mt at 1.15g/t gold for 965,000oz. At Tarcoola, the company has firmed up a number of high priority drill targets, with the project home to numerous historic high-grade workings.

The week ahead

After last week’s deluge of new and mainly positive economic data, this week promises to be much quieter.

However, with the COVID-19 lockdown continuing in Melbourne and mystery clusters of new variants, there is sure to plenty of information about the progress of vaccinations and infections to focus on.

There are local consumer and business sentiment surveys, some jobs data following the end of the JobKeeper wage subsidy which should give us some useful information on what appears to be developing skill shortages.

The Melbourne Institute’s consumer inflation expectations survey for June may be of interest given the market’s fixation with inflation, along with hard inflation and trade data out of the United States and China.

The US figures out on Thursday promise to be the most interesting after consumer prices lifted by 0.8% in April to be up 4.2% on a year ago.

The measure might be a bit more settled this time but any sign that consumer prices are stuck in an upwards trend could be a big negative for the share market.