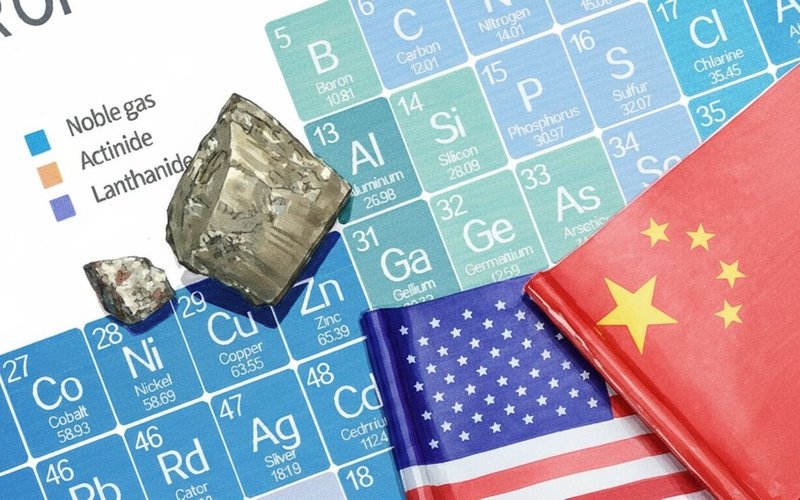

China has dramatically expanded its export controls on rare earth elements, adding five new materials and a raft of refining technologies to its restricted list in a move that tightens Beijing’s grip on global supply chains for critical minerals.

The latest measures, announced Thursday by China’s Ministry of Commerce, introduce new licensing requirements for the export of holmium, erbium, thulium, europium, and ytterbium , elements essential to manufacturing EVs, wind turbines, semiconductors, aircraft engines, and defence technologies.

The announcement also extends to certain refining technologies, and for the first time, imposes restrictions on foreign producers that use Chinese rare earth materials or equipment, even when no Chinese entities are directly involved in the transaction.

Global and US Reaction

The move, which comes ahead of a scheduled meeting between Presidents Donald Trump and Xi Jinping later this month in South Korea, is widely viewed as a strategic escalation , a reminder of China’s dominance in a sector where it processes more than 90% of the world’s rare earths.

The restrictions follow calls from US lawmakers earlier this week to broaden bans on the export of chipmaking equipment to China, escalating the technology standoff between the two powers.

The White House said it is “closely assessing any impact from the new rules,” describing the sudden expansion as an attempt by Beijing to “exert control over the world’s technology supply chains.”

US-listed rare earth and critical minerals stocks rallied on the news , Critical Metals Corp jumped 17%, Energy Fuels rose 11%, and both MP Materials and USA Rare Earth climbed more than 6% in New York trading.

What It Means for Australia

For Australia, which is rapidly positioning itself as a non-Chinese supplier of critical minerals, the latest development could accelerate investment interest in ASX-listed companies with rare earth exposure in North America , where the US is now actively funding domestic supply chain projects.

Among the likely beneficiaries are:

- Arafura Rare Earths (ASX: ARU) — developer of the Nolans Project in the Northern Territory and a strategic supplier to global EV manufacturers, already aligned with US and European decarbonisation efforts.

- Vital Metals (ASX: VML) — operator of the Nechalacho Project in Canada’s Northwest Territories, one of the few rare earth mines outside China already in production, with processing ties in North America.

- Iluka Resources (ASX: ILU) — through its planned Eneabba rare earth refinery, positioned to become a key Western alternative in refining capacity.

- American Rare Earths (ASX: ARR) — with significant projects in Wyoming and Arizona, directly aligned with Washington’s strategic goal of securing critical mineral supply from US soil.

- Hastings Technology Metals (ASX: HAS) — advancing the Yangibana Project in WA, with established partnerships in Europe and growing interest from US buyers seeking diversification.

These companies stand to benefit not only from higher rare earth prices but also from potential strategic investment flows out of the United States, which continues to fund domestic and allied sources of critical minerals.

A Structural Realignment

Industry analysts describe the move as the latest step in a “structural bifurcation” of global supply chains.

China appears intent on localising its rare earth and semiconductor value chains, while the US, Europe, and allied partners , including Australia and Canada , are racing to build alternative refining and processing capacity.

“The world is effectively splitting into two parallel ecosystems for critical materials,” said Neha Mukherjee, a rare earths analyst with Benchmark Mineral Intelligence.

“China is securing its own downstream integration, while the US and its partners are accelerating investment in non-Chinese supply chains.”

China’s new restrictions will take effect on 8 November, with additional compliance measures for foreign companies to follow on 1 December, adding a new layer of complexity to an already fragile supply chain.

For ASX investors, the message is clear: rare earth and critical mineral projects in North America and allied jurisdictions just became even more strategically valuable.