The ASX 200 lost 14 points, or 0.2% on Friday but still managed to record a weekly rise of 0.5% and closed off a successful 4.5% rise for November, which was the strongest monthly gain since January.

The main culprits dragging down the index on Friday were technology stocks which fell 1.1% but still managed a strong week in which they gained 2.3% for the week.

Consumer stocks were also weaker, although Premier Investments (ASX: PMV) swam against the trend with shares in the owner of Smiggle and Peter Alexander gaining 2.8% to $25.11, after the retailer said it expected earnings before tax in its first half to come in better than analysts had tipped at around $200 million.

Financial services platform, Iress (ASX: IRE), continued a very strong weekly performance, gaining another 4.7% on Friday to be up more than 25% since Monday.

The strong market reaction followed on an upgrade to the company’s earnings guidance for 2023 to between $123 million and $128 million, well up from the previous levels of $118 million to $122 million.

Fall follows first strike

The news wasn’t quite so good for Sayona Mining (ASX: SYA) with shares down 6.1% to a year low of 6.2c after the lithium developer received its first remuneration strike at its AGM on Thursday.

Volatility also continued among uranium stocks with Paladin Energy (ASX: PDN) shares a good example, up 6.2% to $1.04 after falling around 5.5% on Thursday, as traders pushed uranium stocks in both directions.

Shares in supermarket giant Coles (ASX: COL) fell 1 % to $15.17 after the ACCC decided not to stand in the way of plans by the supermarket owner to buy two milk facilities from Saputo.

Analysts at Citi downgraded Core Lithium (ASX: CXO) shares to a sell which led to a 3.6% fall in the share price to 27¢.

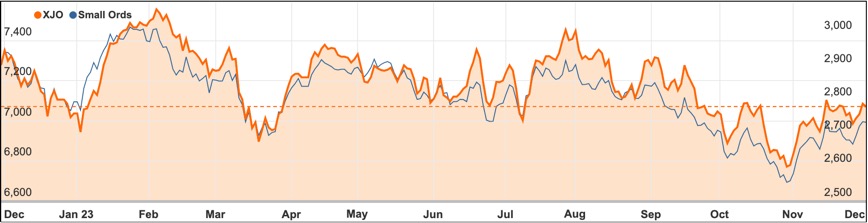

By the end of trade the ASX 200 index had recovered to be down 0.2% to 7073.2 points after hitting an intraday low of 7041.4 points which followed on from a 0.7% rise on Thursday.

Small cap stock action

The Small Ords index rose 1.98% for the week to close at 2737 points.

Small cap companies making headlines this week were:

Mitre Mining (ASX: MMC)

Mitre Mining announced it will acquire the Cerro Bayo silver-gold project in Chile for $5 million.

The project has been on care and maintenance since October 2022 after being in production for over 15 years and producing more than 45 million ounces of silver and 650,000oz of gold.

The project includes over $150 million worth of existing infrastructure, with Mitre planning to capitalise on this by starting a drilling program early in the new year.

Their immediate strategy involves a 6,000m drilling program to expand and infill the mineralization, aiming for two resource upgrades in 2024.

To fund this acquisition and development, Mitre is raising $8.3 million and has recruited experienced geologist Damien Koerber, who previously operated at Cerro Bayo and multiple locations in South America.

Australian Pacific Coal (ASX: AQC)

Australian Pacific Coal and its joint venture partner Tetra Resources have secured a $90 million debt facility from Vitol Asia to restart the Dartbrook coal mine in NSW’s Hunter Valley.

This funding will cover all remaining restart capital expenditures and the acquisition of additional mining systems.

Dartbrook, a 6 million tonnes per annum underground mine, was operational from the mid-1990s to 2006 and has been on care and maintenance since 2007.

The funding agreement assigns coal marketing rights to Vitol, with Australian Pacific Coal’s interim chief executive officer Ayten Saridas highlighting the importance of this partnership for the project’s success.

The revised schedule targets the first coal production in Q1 of 2024, with the company now focused on finalising a working capital facility to support commercial operations.

Wide Open Agriculture (ASX: WOA)

Wide Open Agriculture has secured an investment and distribution deal with UK-based Ingå Group for its lupin-based proteins, facilitated through its subsidiaries.

Ingå will invest approximately $825,000 in Wide Open Agriculture GmbH for a 15% stake, with the funds earmarked for working capital and scaling operations in Germany.

The companies will establish a four-member advisory board for strategic guidance and aim to finalise an exclusive European distribution agreement for Wide Open’s lupin-based protein products by year-end.

Wide Open chief executive officer Jay Albany views this partnership as a milestone in sustainable food production, leveraging Ingå’s network and expertise.

Ingå chief executive officer Adrian Short highlights the alignment in sustainability visions, seeing the investment as a step towards building a sustainable food ecosystem in Europe.

Euro Manganese (ASX: EMN)

Euro Manganese has secured a pivotal $150 million funding package for its Chvaletice manganese project in the Czech Republic, primarily from Orion Resource Partners Group-managed OMRF LLC.

The funding is divided into a $75 million loan, convertible into a small royalty on project revenues, and a $50 million exchange for a slightly larger royalty post-Final Investment Decision.

Euro Manganese’s chief executive officer, Dr. Matthew James, highlights that this strategically structured funding minimises future project financing requirements and underlines the project’s robustness.

The Chvaletice project, located near major EV manufacturers, recently achieved a milestone by producing high-purity manganese sulphate monohydrate (HPMSM) at its demonstration plant, confirming its potential as a critical supplier for the EV and energy storage sectors.

This funding and technical progress reinforce Euro Manganese’s position as a leader in high-purity manganese processing in the West.

Aurumin (ASX: AUN)

Aurumin has expanded its Sandstone project in Western Australia with three new tenements, increasing the total gold resource to 946,000 ounces.

These tenements add significant potential to the project, which already includes the central Sandstone gold project and the Birrigrin and Johnson Range projects.

The newly added tenements have been lightly explored, offering opportunities for further discovery and expansion.

Managing director Brad Valiukas emphasises the company’s focus on the Sandstone region, consolidating its presence with these acquisitions.

Additionally, Aurumin is streamlining its portfolio by selling its iron ore rights at Mt Dimer and executing a sale agreement for the Mt Dimer mining leases, allowing a stronger focus on Sandstone’s gold prospects.

The week ahead

There is plenty of pre-Christmas action on the economic side in the coming week with the main thing to watch out for the Reserve Bank interest rate decision on Tuesday.

That decision is likely to see rates remain on hold at 4.35% but the language of the announcement will be checked for any confirmation that the RBA could have finished hiking rates for this cycle after 13 fairly rapid rises.

The other big news to keep an eye on will be the economic growth statistics for the September quarter, released on Wednesday, which are likely to show that the current trend of the economy slowing and inflation softening are continuing.

There are plenty of US releases to watch out for with job market data to be examined to look at separate factors such as job growth, the jobless rate and hourly wages for clues about how the world’s biggest economy is responding to higher interest rates.

Purchasing manager surveys in China and the US should also give an indication on how quickly both economies are weakening while Chinese inflation figures will be a useful check on whether deflationary fears are justified or not.

Australian earnings results are expected from Metcash (ASX: MTS), Metals X (ASX: MLX) and Novonix (ASX: NVX).

Also, one to watch as iron ore prices continue to climb will be Rio Tinto (ASX: RIO), which is hosting an Investor Day on Wednesday.