Anyone who knows me know I only sing when I’m winning, and my North Sydney Sun Bears put on a clinic over the weekend with a 10–0 win. Clean, disciplined, no nonsense. I chipped in with an RBI, a run, a hit and a walk — which is baseball shorthand for doing your job and letting the game come to you. Markets, as usual, would benefit from the same mindset.

Now, on with the show.

Two podcasts, one message

We recorded two podcasts on Friday, both circling the same uncomfortable truth: markets aren’t broken, but positioning matters more than ever.

My own podcast The Theory of Thing with Patrick Walta – reopening trades, commodities, and where capital rotates after the headlines fade.

Listen here: ++https://podcasts.apple.com/au/podcast/tot-s12-e5-patrick-walta-discusses-the-reopening/id1516050081?i=1000747268198++

Our Investor Pulse CIO and I recorded a monthly wrap and outlook.

ASX 200 into 2026, gold, hard assets, and rate reality with Mark Elzayed. Fewer fairy tales, more nuance.

Listen here: ++https://podcasts.apple.com/au/podcast/asx-200-2026-gold-rally-hard-assets-rate-hikes/id1490977815?i=1000747467174++

Weekly Feature: Chart That Made Me Stop Scrolling

This week it wasn’t a chart so much as a moment.

A trading bot ‘Clawdbot’ appearing to joke about becoming self‑aware. No, the machines aren’t sentient (yet), but markets are increasingly reflexive.

Narratives feed price, price feeds narrative, and suddenly fundamentals are chasing momentum instead of the other way around.

See the thread here: ++https://x.com/AlexFinn/status/2017305997212323887?s=20++

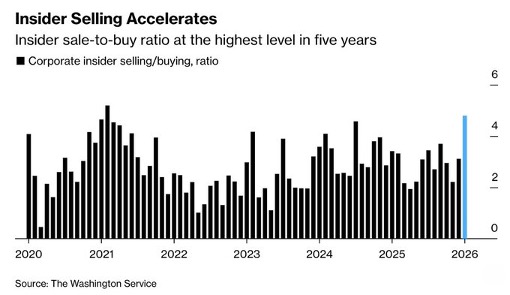

Insider Selling: Yellow Light, Not Red

Insider selling is picking up, and yes, it’s worth watching. But insiders sell for many reasons and usually after good performance.

At this stage it’s a warning against complacency, not a reason to hit the eject button. Awareness beats panic every time.

Source: ++https://x.com/Barchart/status/2017438510597419236?s=20++

Hard Assets Get Political Backing

One story that matters more than it first appears: the US moving to establish a US$12bn strategic minerals stockpile to counter China. This is policy admitting that supply chains are now national security. Hard assets aren’t just inflation hedges anymore, they’re strategic assets.

Reuters link: ++https://www.reuters.com/world/china/trump-launches-12-billion-minerals-stockpile-counter-china-bloomberg-news-2026-02-02/++

Silver Doing Silver Things

Silver sold off over the weekend and reminded everyone why it’s not gold. More volatile, more emotional, and often wrong‑footing traders.

Unless the broader hard‑asset thesis breaks (which it hasn’t) silver’s wobble is noise, not signal.

If you want a prediction, I’ll say that silver puts it all back on in a fairly short amount of time.

My preferred method is to not bother with the physical or spot and simply buy a producer that’s undervalued. For example, Broken Hill Mines (ASX: BHM).

Closing Thought

Like baseball, markets reward patience.

Know when to swing, know when to take the walk, and don’t try to win the game in the first inning. The season’s long.

All the best and stay safe,

Jimmy James