The chill of autumn is upon us and the days are getting that little bit shorter.

Soon enough football season will roll in, and with it the winter of discontent—the perfect backdrop for markets that can’t decide whether they’re topping, correcting, or just messing with us for sport.

(Speaking of sport, the North Sydney Sun Bears went close to getting a much needed away win on a dark Sunday arvo. I feel that my worst all-time batting performance failed to help. 4 Plate Appearances: 1 ground out, 1 SO, 1 reached on error, 1 Fielders Choice, 1 run scored. Abysmal. As always I’ll take the lesson and work hard to amend for next week. This sets us up massively for a end of season decider at home. BBQ and beers will be provided.)

Note: The SmallCaps team will be in Fremantle for the RIU Explorers Conference this week.

I hope to see you at the Esplanade Hotel for a catch up.

Let’s get after it.

The SaaS Sell‑Off: A Theory of Thing Special

Heath and I dug into this on the latest Theory of Thing episode—the SaaS wobble that turned into a proper stumble.

When the market decides to take a chunk out of high‑multiple software, it rarely does it politely. This time was no different.

Link here and it’s really worth a listen.

The takeaway:

- The selling wasn’t indiscriminate - the weakest balance sheets wore it first.

- The market is finally remembering that “recurring revenue” doesn’t mean “immune to gravity.”

- And as always, when SaaS sneezes, the Nasdaq catches a cold.

There’s opportunity here, but only if you’re willing to separate the real businesses from the ones that were built for the multiple, not the customer.

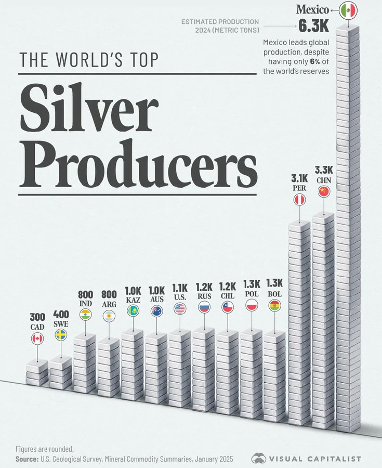

Silver Supply Tightens

(Credit: @ekwufinance)

The silver market is doing that thing it does every few years - quietly tightening while no one pays attention.

The chart shared by @ekwufinance this week showed the structural deficit widening again.

Miners aren’t bringing on new supply, industrial demand keeps grinding higher, and investment flows are asleep at the wheel.

“Despite leading production, Mexico holds only ~6% of global silver reserves. In other words, current supply relies on a narrow group of producers with limited reserves.”

This is how silver bottoms form:

- No hype

- No headlines

- Just a slow, grinding imbalance

When the crowd finally notices, it’s usually too late. I still love Broken Hill Mines (ASX: BHM) as the best local play to gain from another silver run.

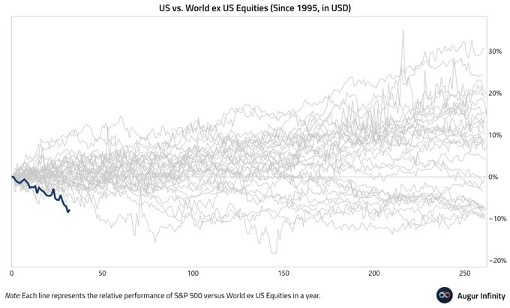

US vs Rest of World: The Gap Widens

(Credit: @mikezaccardi)

Mike Zaccardi posted the chart that should make every global allocator wince.

Going back to 1995 the US had NEVER performed worse compared to international stocks.

We’re now at the point where the US/ROW divergence is so stretched that even the permabulls are starting to look uncomfortable.

Continuation or a return to the mean?

History says these gaps close. Experience says they close violently.

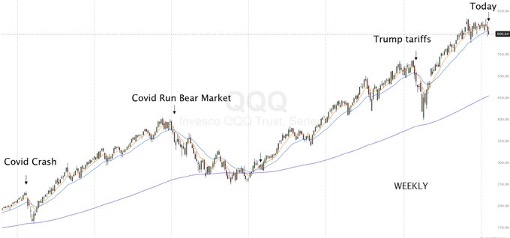

The 8/21 Cross: A Red Flag Worth Respecting

(Credit: @realjgbanks)

The 8/21 moving‑average cross flashed red this week - and while no single indicator is gospel, this one has a habit of showing up before things get wobbly.

It doesn’t mean “sell everything.” It means “stop pretending nothing can go wrong.”

Momentum is slowing.

Breadth is thinning.

And the market is starting to feel like a party where the music hasn’t stopped yet, but the DJ is definitely looking at his watch.

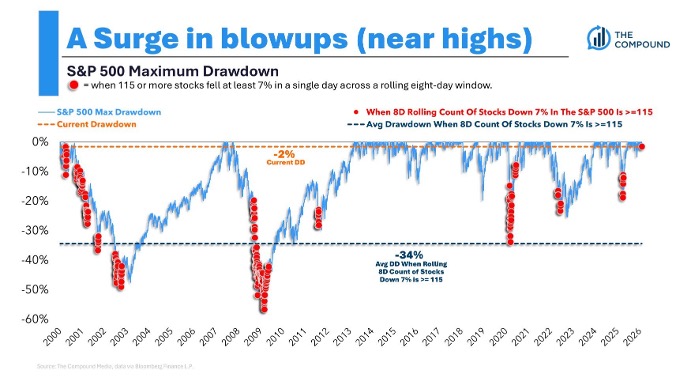

The Chart Everyone Is Talking About

(Credit: The Compound)

Pour a drink because this one takes some explaining.

Each red dot is a time when deep breath 115 or more stocks on the S&P 500 fell at least 7% in a single day across a rolling 8 day window.

Now deep breath when that happens the average drawdown on the index is 34%.

We just issued the first “red dot” in a while.

It’s the perfect encapsulation of 2026 so far:

- The index looks fine

- Everything underneath is on fire

This is what late‑cycle feels like.

Not doom. Not panic. Just a slow, creeping fragility that eventually becomes obvious in hindsight.

The Finger’s Take

- This week wasn’t about one big theme - it was about a dozen small cracks forming at the same time:

SaaS stumbling

- Silver tightening

- The US stretching away from the world

- Momentum indicators flashing

- Breadth deteriorating

- Blowups accelerating beneath the surface

None of these alone are fatal. Together, they tell you to keep your head up.

Autumn is here. Winter is coming. Act accordingly.

Stay safe and all the best,

James