I’m calling it early. Seahawks 28, Patriots 10.

Is that happening today? Probably not. Is that the point? Absolutely.

Predictions are easy. Discipline is harder. Markets tend to reward the latter, eventually.

Now, on with the show.

Over the weekend, reports circulated that more than 100 US Air Force C-17 aircraft were repositioning toward the Middle East, numbers that invite comparisons to Desert Storm era logistics.

This does not mean war is imminent. It does mean optionality is being prepared.

Markets are very good at ignoring geopolitics right up until they aren’t. Early signals rarely show up in equity indices. They show up in logistics, energy pricing, freight, insurance, and volatility elsewhere.

Force movement isn’t a headline. It’s friction.

That being said I’ll hazard a guess and say the US goes over the top on the 11th Feb since that’s Revolution Day in Iran. Funnily enough the 47th anniversary of it. 47 is Trump’s “president number” and the man, as we know, is like 92% drama.

Courtesy @osint613

Charts for Days

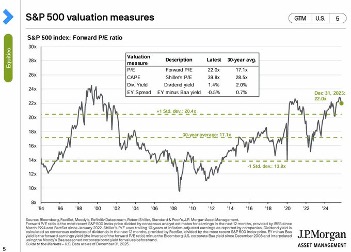

Two charts doing the rounds caught my eye. One shows risk assets behaving as if nothing is happening at all. The other highlights how often that calm has preceded less calm outcomes.

This isn’t a call to panic. It’s a reminder that markets can stay serene while risk migrates under the surface. When positioning is crowded, the move isn’t announced. It’s discovered.

Just a note that 40% declines in some tech stocks isn’t necessarily a sign that the bargain bin is open for picking. Hold the line.

Markets don’t break because of surprises. They break because of ignored information.

No one is calling war, but a few things are harder to ignore. Energy staying bid on dips. Gold refusing to behave like a risk-off relic. Volatility compressing where it probably shouldn’t.

If tensions escalate, and this is a tail risk not a base case, Iran is the obvious fulcrum. Markets don’t need conflict to reprice. They just need uncertainty to stop fading.

Optionality has a cost. Someone is paying it.

This is not about war trades or hero bets. It’s about resilience.

Uranium

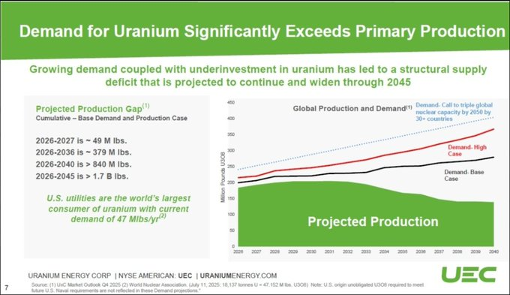

Courtesy @ekwufinance and I’ll use his words which seem about right regarding what’s ahead in uranium:

“- India plans to 10x nuclear generation capacity by 2047, reaching 100 GW

- This would add 50 mlbs of annual uranium demand

- Equivalent to roughly 30% of current global uranium production At the same time, uranium supply is expected to decline over this period. This creates a projected cumulative deficit of 1.7B lbs... nearly 10x current annual uranium production.”

How to Be Involved for Now?

Energy producers with cash flow. Gold exposure without leverage. Logistics and infrastructure names that get paid when things move. Select defence-adjacent services selling shovels, not stories.

When markets shrug at geopolitics, it’s usually because positioning is comfortable. Comfortable positioning and external shocks don’t mix.

You don’t need to sell everything. You do need to avoid pretending nothing can happen.

I might be wrong about the Seahawks. I’m often wrong about plenty of things.

But acknowledging uncertainty without panicking tends to age better than bold predictions.

Markets don’t reward certainty. They reward preparation.

More next week and keep an eye on the 11th.

Stay Safe and All the Best,

Jimmy James