Markets have stabilised after a sharp repricing triggered by the RBA’s renewed hawkish stance. This is not a liquidity-driven bounce. It is a selective recovery, where capital is flowing back with intent, favouring balance sheet strength, pricing power and businesses able to operate under sustained restrictive policy settings. Models reliant on cheap funding or distant cash flows remain under pressure.

In our latest Investor Pulse Update, we explain why leadership has re-emerged in materials, financials and defensives, and where conviction is being rewarded. We outline high-conviction positions including Transmetro Corporation (ASX: TCO), Orica (ASX: ORI), GenusPlus Group (ASX: GNP), Perenti (ASX: PRN), IVE Group (ASX: IGL), Korvest (ASX: KOV), Newmont Corporation CDI (ASX: NEM), and Emerald Resources (ASX: EMR).

Markets are finding their footing after a sharp correction triggered by the RBA’s renewed hawkish stance. The repricing was swift and uncomfortable, particularly for duration-heavy assets, but it has served a purpose. Rather than undermining confidence, it has restored discipline. What we are now seeing is not a liquidity-fuelled rebound, but a more grounded recovery built on earnings quality, balance sheet strength and pricing power.

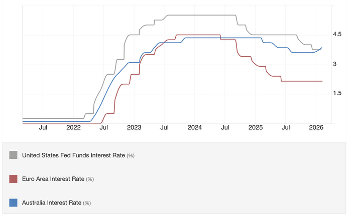

Source: Trading Economics, RBA, EU, Fed, Interest Rates (2026)

This phase is about conviction rather than sentiment. The market has become far less forgiving. Capital is returning, but it is doing so with intent, gravitating towards businesses that can operate under sustained restrictive policy settings. Models reliant on cheap funding or distant cash flows remain under pressure.

Our positioning reflects this reality. We are treating the rebound as a reallocation of capital rather than a cyclical bounce, shaped by monetary discipline and real economic constraints rather than expectations of near-term easing.

Monetary Discipline Brings Valuation Reality Back to the Foreground

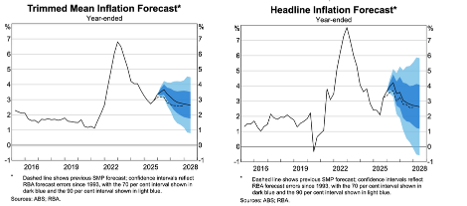

The RBA has been clear in its message. Inflation control remains the priority, even if that means tolerating near-term discomfort in asset prices. For investors, this has reintroduced a higher hurdle rate across the market.

We see this as constructive rather than punitive. Markets function better when capital is priced properly. Businesses with pricing power, conservative leverage and internally funded growth are now being rewarded. Those that depended on benign financial conditions are being forced to adjust. Importantly, this environment favours tangible earnings over narratives. The rebound is being earned, not granted.

Global Exposure Provides Ballast as Domestic Conditions Tighten

One of the clearer lessons from the correction is the value of globally exposed revenue streams. Companies selling into offshore markets are benefiting from demand dynamics that are not tied to local consumption or household balance sheets.

We continue to favour sectors where pricing is set globally and costs are managed locally. This creates a natural hedge against domestic policy restraint and supports earnings visibility. As a result, leadership in the rebound has come from areas aligned with external demand rather than purely domestic cycles.

Materials Regain Leadership as Fundamentals Reassert Themselves

The materials sector remains central to our strategy. The correction did little to alter the underlying forces supporting precious metals and base metals. Gold and silver continue to benefit from monetary uncertainty and concerns around fiscal sustainability. Copper remains supported by electrification, grid investment and data infrastructure. These are not cyclical impulses. They are structural. For producers, this translates into margin resilience and cash flow strength, particularly for those with disciplined capital allocation. We remain focused on operators with scale, cost control and balance sheet flexibility.

Within precious metals, the market is clearly differentiating. We are seeing a preference for execution over optionality. Gold is increasingly treated as monetary infrastructure rather than a tactical hedge. That has sharpened the focus on operating performance and free cash flow rather than reserve size alone. Silver adds an industrial layer through its role in energy transition technologies. That dual identity continues to support long-term demand, even through periods of volatility.

Copper Highlights Leverage to the Physical Economy

Copper stands apart in this cycle. Demand is being driven by physical investment rather than financial conditions. Electrification, renewable energy and data infrastructure all require substantial copper intensity. Supply remains constrained, and new projects are capital-intensive. In this environment, we prefer established producers with existing infrastructure and conservative balance sheets. Execution matters more than ambition.

Financials Re-Emerge as Anchors of Income and Stability

The banking sector has regained relevance following the rate-driven repricing. Higher rates create pressure on borrowers, but they also restore margin discipline and support earnings visibility.

Strong capital positions and diversified income streams continue to underpin confidence. In a market that has become more selective, reliable income has regained appeal. We see this as a rational rotation rather than a defensive retreat.

Defensives Attract Capital Quietly as Risk Is Repriced

Beyond materials and financials, capital continues to flow into areas with predictable demand. Consumer staples, infrastructure-linked industrials and energy have all benefited from this reassessment. These sectors lack excitement, but they offer stability. In a higher-rate environment, resilience is being repriced. Energy remains supported by supply discipline and structural constraints, while infrastructure assets provide regulated or indexed cash flows that help stabilise portfolios.

Technology Remains Challenged by Funding and Execution Risk

**We continue to avoid technology at this stage of the cycle. **The issue is not innovation, but economics. Elevated capital expenditure, integration risk and higher financing costs are compressing returns. Many businesses are discovering that scale does not guarantee profitability when funding costs rise. Artificial intelligence will drive long-term productivity, but the near-term reality involves construction delays, energy costs and uneven monetisation. The market is no longer willing to underwrite those risks indiscriminately.

A Rebound Defined by Discipline Rather than Enthusiasm

This recovery looks very different from previous cycles. It is not driven by falling rates or abundant liquidity. It is driven by discrimination. Capital is favouring hard assets, balance sheet strength and tangible earnings. Materials, financials and selected defensives continue to define leadership.

Where We Remain Positioned

Volatility is likely to persist. Clarity on inflation and policy will take time. What is already clear is that markets have re-embraced fundamentals. In this environment, selectivity is the primary source of return. We remain aligned with sectors where demand is structural, pricing is global and capital discipline is enforced. That is where we see the most durable opportunities as the rebound unfolds.

We see the following companies as high-conviction positions within our portfolios. They are unified by three themes we continue to prioritise in the current environment: resilience to higher domestic interest rates as the RBA remains restrictive, leverage to global commodity upcycles, and valuation support that provides downside protection even if macro conditions deteriorate.

Our Direct HIN WM portfolios are:

- Held directly on your own HIN - you retain full ownership and control

- Invested in direct Australian equities (no pooled vehicles)

- Fully transparent at all times and Reports available to download through the Portal

- Actively managed and executed by me as CIO

- Top up or sell down anytime, no lock in or exit fees.

The goal isn’t to trade headlines or chase short-term noise. It’s to stay invested through volatility, rotate portfolios when conditions change, and apply disciplined risk management so clients aren’t constantly reacting after the move has already occurred.

For investors who don’t have the time to monitor markets daily - or who are tired of being caught in downtrends after missing the upside - professional portfolio management makes a material difference.

To find out more about our Direct HIN wealth portfolios, please email me your interest at mark.elzayed@investorpulse.com.au for an information pack.

Transmetro Corporation (ASX: TCO)

Source: TCO, daily chart (2026)

We view Transmetro as a particularly defensive opportunity within consumer services. Its balance sheet is exceptionally robust, with cash exceeding debt, a rare advantage at a time when higher interest rates are compressing returns across capital-intensive industries. This financial flexibility gives the group strategic optionality and a clear competitive moat.

Operationally, its focus on hotels and hospitality aligns well with the resilience we are seeing in discretionary services demand. Earnings momentum reinforces this view, with full-year EPS rising to $0.22 from $0.15 and revenue from ordinary activities climbing to $24.64 million. Despite this improvement, the company continues to trade on a materially lower earnings multiple than the broader consumer cyclical sector, a disconnect we believe remains underappreciated.

While near-term technical indicators suggest stretched momentum, the longer-term trend remains firmly constructive. We see it as a “Strong Buy” supported by a high earnings yield and a fair value assessment comfortably above prevailing levels.

Source: ORI, daily chart (2026)

Orica remains a cornerstone of our materials exposure. Its role as a critical supplier to the global mining industry, particularly through cyanide used in gold processing, provides direct leverage to elevated gold prices and sustained mining activity.

Revenue strength has been evident, with the latest reporting period delivering $8.14 billion in sales. The recent equity raising strengthens the balance sheet and funds strategic acquisitions and technology upgrades, particularly in areas linked to decarbonisation and efficiency. Analysts have responded by lifting EPS expectations, reflecting confidence in integration and execution.

From a technical and risk perspective, Orica stands out for its relatively low volatility and supportive moving-average structure. Combined with a significant discount to intrinsic value estimates, we see the stock as a defensive way to maintain exposure to the commodity cycle.

Source: GNP, daily chart (2026)

GenusPlus is one of our preferred infrastructure growth exposures, directly aligned with Australia’s energy transition. Its positioning across power and communications infrastructure places it at the centre of renewable energy zone development and grid upgrades.

Momentum accelerated following an earnings upgrade in January 2026, with management pointing to roughly 35% growth in normalised EBITDA. This is underpinned by major contract wins, including the Western Renewables Link project, and strong revenue growth across its energy and engineering divisions.

Although the stock has recently consolidated after a strong run, we view this as a healthy reset rather than a deterioration in fundamentals. We continue to see GNP as a solid long-term “buy”, supported by a strong order book and a balance sheet capable of funding further growth.

Source: PRN, daily chart (2026)

Perenti represents a clear deep-value opportunity within mining services. Over the past year, management has made tangible progress in improving cash flow and reducing leverage, materially strengthening the company’s financial position.

Revenue reached $3.49 billion, while earnings rose more than 26% year on year. Share buybacks signal management’s confidence in intrinsic value, and consensus forecasts point to double-digit earnings growth over the medium term.

Recent weakness has pushed momentum indicators into oversold territory. While this has weighed on short-term sentiment, we see little change in the underlying investment case, with valuation metrics continuing to point to meaningful upside relative to long-term fundamentals.

** **

Source: IGL, daily chart (2026)

IVE remains one of our highest-conviction income names. Its diversified marketing and printing operations provide a stable, recurring revenue base, and its shareholder returns profile remains compelling in a higher-rate world.

The company currently offers a dividend yield near 6%, supported by consistent cash generation. Recent director buying has further reinforced confidence, even as first-half revenue modestly undershot more optimistic expectations.

From a valuation perspective, IVE continues to trade on a low earnings multiple relative to its growth outlook. Technical indicators suggest neutral positioning rather than excess, and its strong relative performance over the past year highlights its defensive characteristics.

Source: KOV, daily chart (2026)

Korvest continues to benefit from sustained infrastructure and industrial activity. Its EzyStrut segment has secured a record pipeline of projects, while disciplined cost management has protected margins in an inflationary environment.

First-half FY26 results were notably strong, with double-digit revenue growth and a sharp increase in profit before tax. The fully franked interim dividend reflects management’s confidence in cash flow durability, and the order book suggests momentum is likely to carry into the second half. Across valuation, yield and trend indicators, Korvest remains attractively positioned relative to its growth profile.

Source: CAA, daily chart (2026)

Capral is a cyclical deep-value exposure to the domestic aluminium market. The company trades below book value, offering leverage to any recovery in construction and industrial demand.

Valuation metrics remain compelling, with a low earnings multiple and ongoing capital returns through buybacks and dividends. While near-term momentum has softened, we view this as cyclical noise rather than a structural issue. Current fair value estimates imply substantial upside, making Capral a higher-risk but potentially high-reward position.

Bisalloy Steel Group (ASX: BIS)

Source: BIS, daily chart (2026)

Bisalloy provides differentiated exposure to defence and mining through its speciality steel products. Demand for wear-resistant and high-strength steel continues to benefit from elevated industrial and defence spending.

The balance sheet remains conservatively structured, and earnings growth has been strong. Despite recent technical softness, valuation remains well below broader market averages, supporting the long-term investment case.

Newmont Corporation CDI (ASX: NEM)

Source: NEM, daily chart (2026)

Newmont offers global-scale exposure to the precious metals bull market, complemented by by-product silver and copper revenues. It remains our preferred large-cap vehicle for sustained exposure to gold.

The stock has delivered exceptional returns over the past year, reflecting both rising gold prices and improved sentiment toward producers. Valuation remains reasonable relative to history, and technical support levels remain intact. We continue to see to further upside should gold prices continue to grind higher amid fiscal and geopolitical uncertainty.

Source: EMR, daily chart (2026)

Emerald remains one of our highest-conviction small to mid-cap gold names. Its execution track record in Cambodia, combined with high insider ownership, underpins confidence in management alignment.

Earnings growth forecasts materially outpace the broader market, supported by strong cash generation at the Okvau mine and recent resource upgrades in Western Australia. Although the stock has consolidated recently alongside the broader materials sector, we expect EMR to continue to move higher. We also see Emerald as offering a rare combination of growth, cash flow and valuation support within the gold space.

Discipline Defines the Next Phase of the Rebound

The market is sending a clearer signal. This is no longer an environment that rewards hope or duration. It is rewarding execution, balance sheet strength and earnings that can absorb a higher cost of capital. The rebound is real, but it is narrow and selective, with capital flowing back to businesses that can operate under sustained restrictive policy settings rather than those reliant on easing expectations.

From our perspective, this is a healthier market. Monetary discipline has brought fundamentals back to the centre, restoring a focus on tangible cash flows, structural demand and capital restraint. Volatility is likely to persist as the RBA maintains its stance, but the direction is clear. Selectivity has re-emerged as the primary source of returns, and durability matters more than speed as this rebound continues to unfold.

To find out more about our Direct HIN wealth portfolios, please email me your interest at mark.elzayed@investorpulse.com.au for an information pack.

**Mark Elzayed **

CIO, Investor Pulse