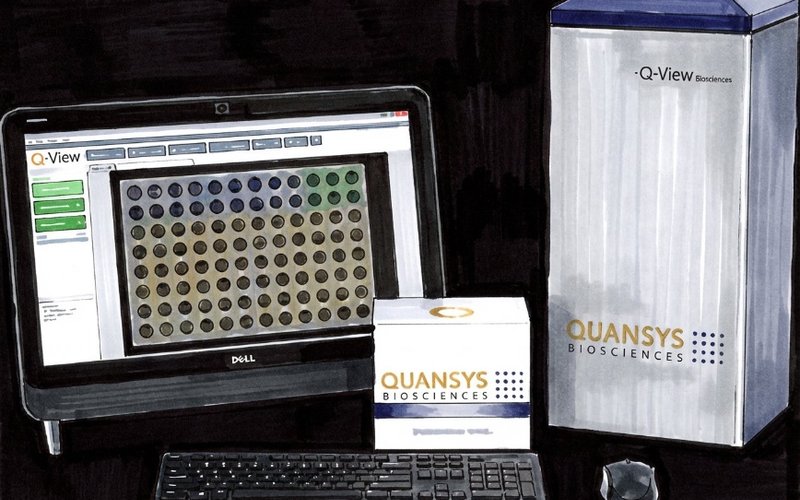

Rhythm Biosciences (ASX: RHY) has secured a multi-year manufacturing agreement with Quansys Biosciences for its ColoSTAT reagent kits, ensuring scalable production with fixed pricing for two years.

This critical step supports the upcoming ColoSTAT Access Program and broader commercialisation efforts.

Manufacturing will be ISO13485-certified, ensuring quality and scalability for commercial launch.

Fixed pricing for the initial two years provides cost visibility and budgeting certainty.

The agreement is funded by existing budgets and establishes global logistics and distribution.

ColoSTAT Commercialisation Path

ColoSTAT commercialisation commenced following an updated ISO15189:2022 accreditation.

The test will be offered as a blood-based diagnostic via Rhythm's Melbourne laboratory.

A ColoSTAT Access Program will engage clinical leaders for data collection and market penetration.

A NATA variation assessment on 23 January 2026 aims to formalise accreditation.

Manufacturing Readiness and Validation

Final clinical validation for ColoSTAT was completed in Q1 FY26.

Manufacturing validation for the second-generation ColoSTAT and production line readiness were achieved with Quansys.

The path to commercialisation is supported by regulatory progress including pending NATA accreditation.

Funding and Financial Position

The manufacturing agreement is funded by Rhythm's existing budgets.

Q1 FY26 saw an oversubscribed capital raise of $3.75 million to fund commercialisation.

A RDTI refund of $1.6 million is expected in Q2 FY26 to improve liquidity.

Cash reserves were $2.746 million at 30 September 2025, with an estimated runway of approximately 1.51 quarters.

Manufacturing Deal De-risks ColoSTAT Launch

The manufacturing agreement with Quansys Biosciences is a significant operational milestone that de-risks the commercialisation of Rhythm's ColoSTAT test by securing scalable, quality-controlled supply.

This, combined with ongoing regulatory steps and previous funding, strengthens the company's position for market entry, although execution risks regarding adoption and financial management remain.