Red Mountain Mining (ASX: RMX) has identified new antimony veins in an expanded exploration program at the Oaky Creek prospect within its Armidale antimony-gold project in New South Wales.

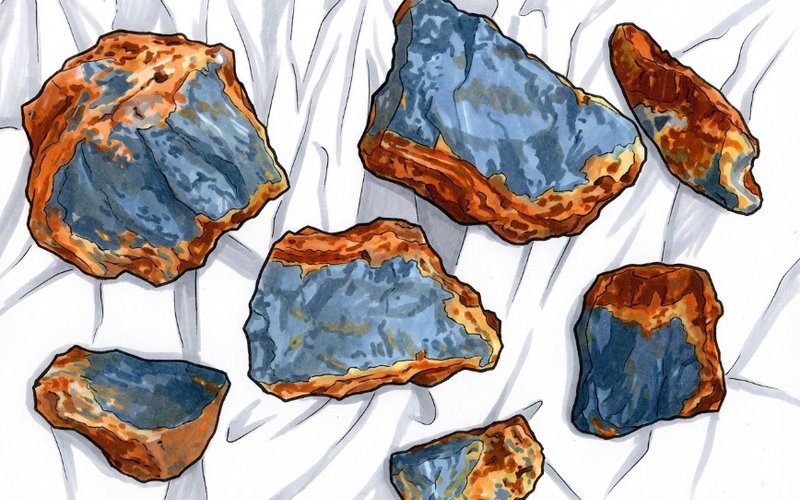

The company visually estimated mineralisation returned in the first two days of auger sampling to contain up to 60% stibnite and 5% oxide stibiconite close to the southern end of the Oaky Creek North anomaly, where the company is targeting a 1.2-kilometre strike featuring antimony-in-soils.

Red Mountain is expecting to collect up to 900 samples from the Oaky Creek area to define orogenic mineralisation targets for drill testing in the new year.

At Oaky Creek South, the company’s upcoming sampling program will expand the existing coverage to include the remainder of the coherent antimony soil anomaly.

High-Priority Prospect

The Armidale project covers nearly 400 square kilometres of prospective ground in the New England Oregon, considered to be Australia’s premier antimony district.

Oaky Creek is one of the high-priority prospects at Armidale and one of several known orogenic antimony-gold occurrences with strong structural, lithological and mineralogical similarities to Larvotto Resources’ (ASX: LRV) Hillgrove deposit towards the east.

The prospect has been targeted by two groups of shallow historical pits and shafts at Oaky Creek North and Oaky Creek South, which are thought to date back to the late 19th century and have been subject to limited exploration.

Extensive Sampling Conducted

Since acquiring Armidale 12 months ago, Red Mountain has completed two sampling campaigns at Oaky Creek centred on a major splay of the Namoi Fault that defined a 1.5km-long soil anomaly grading more than 2 parts per million antimony and extending past the historical workings at Oaky Creek North.

A similar soil anomaly extending north from Oaky Creek South indicated a significant orogenic antimony-gold mineral system with a strike extent of 3km.

The first sampling program returned values of up to 28.3% antimony and 0.54 grams per tonne gold and showed a spatial correlation to the antimony-soil anomaly and high-grade mineralisation found to be outcropping in a creek exposure 500m north-northwest of Oaky Creek North.

The second program returned stronger results of up to 39.3% antimony and 1.09g/t gold, approximately 500m northwest of Oaky Creek South.

Placement Finalised

To help fund the program, Red Mountain has received firm commitments for a placement raising $1.35 million.

The company will issue approximately 51.9m at a price of $0.026—a 13% discount to the last trade of $0.03 and a 20% discount to the 15-day volume-weighted average price.

Subject to shareholder approval at an upcoming General Meeting, placement participants will receive 1-for-2 attaching unlisted options at an exercise price of $0.05 expiring on 31 December 2028.