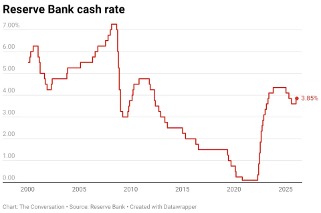

The RBA’s February rate hike marked a decisive shift for Australian markets, with the cash rate lifted to 3.85% and the risk of further tightening back in focus for 2026.

In our latest research article, we explain what this hawkish pivot means for equity valuations and why higher rates are increasing pressure on banks, retailers and growth stocks. More importantly, we outline where we see opportunity re-emerging as capital rotates toward hard assets and global earners.

The report takes a close look at resource leaders including, BHP (ASX: BHP), Northern Star (ASX: NST), Evolution Mining (ASX: EVN), Genesis Minerals (ASX: GMD), Sandfire Resources (ASX: SFR), and Silver Mines (ASX: SVL), and why gold, copper and silver are retain strategic relevance.

As we moved into 2026, it became clear that Australia’s monetary narrative had shifted decisively. What many investors had expected to be a gentle extension of 2025’s easing cycle has instead given way to a renewed tightening bias.

On 3 February, the Reserve Bank of Australia lifted the cash rate by 25 basis points to 3.85%, abruptly restoring a restrictive stance and suggesting that inflation risks now outweigh concerns about slowing growth.

Source: RBA (2026)

We believe, this decision marks more than a routine policy adjustment. It reflects the RBA’s conclusion that the economy is running hotter than its productive capacity allows. For equity investors, particularly those focused on the ASX, this demands a rethink of where sustainable returns are likely to come from in a higher-for-longer rate environment.

We Offer Wealth Management Services via our Australian growth, Australian Balanced and Australian Income Portfolios, designed to stay ahead of evolving market trends. To learn more about our HIN-Direct Wealth Management Portfolios and their Performances, please contact me at ++mark.elzayed@investorpulse.com.au++

Why the RBA Turned Hawkish Again

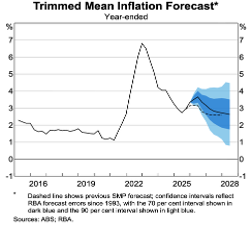

The immediate trigger for the February hike was the resurgence in underlying inflation through the second half of 2025.

Trimmed mean inflation accelerated to 3.4%, materially above the Bank’s previous forecasts.

While some of the lift can be traced to temporary factors such as the expiry of electricity rebates, we agree with the RBA’s assessment that the broader inflation pulse is now demand-driven.

Services inflation, construction costs and retail prices are all telling the same story. Australia’s economy is operating beyond its speed limit, and price pressures are becoming embedded rather than transitory.

Private Demand Is Doing the Heavy Lifting

What surprised us most in late 2025 was the strength of private demand. Household spending rebounded more forcefully than expected, supported by earlier rate cuts, rising real incomes and the lagged effects of tax reductions. Business investment also picked up, particularly in areas tied to infrastructure and energy.

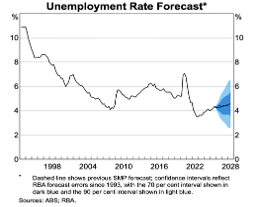

The labour market has reinforced this imbalance. Unemployment has drifted only marginally higher to around 4.3%, still low by historical standards. Firms continue to report difficulty hiring, and unit labour costs remain elevated. From a policy standpoint, this combination is uncomfortable. Without tighter financial conditions, inflation risks becoming entrenched above the 2 to 3% target band.

Higher Rate Path Now Embedded in Forecasts

The February Statement on Monetary Policy makes it clear that the RBA is no longer confident inflation will fall back into target without further restraint. Market pricing, which the Bank uses as a technical assumption, implies at least two additional 25 basis point hikes by the end of 2026.

Inflation forecasts have been revised higher across the board. For equity markets, this matters because higher policy rates feed directly into higher discount rates. The effect is mechanical. Future earnings are worth less today, particularly for sectors where cash flows are weighted toward the distant future.

How the ASX Is Responding

The ASX 200 initially sold off on the surprise element of the February hike. What has been more instructive since then is the divergence beneath the surface. We are seeing a clear preference for hard assets and globally exposed earnings, while domestically focused cyclicals are losing favour.

Financials remain the largest weight in the index, but they are also among the most vulnerable to a shift in rate expectations. While higher rates can support net interest margins, valuations were already stretched. Commonwealth Bank’s (ASX: CBA) forward P/E of around 19.3x sits well above its long-term average of 12.7x.

Source: ASX 200, daily chart (2026)

With rate cuts now off the table, we expect the focus to turn to deposit competition and credit quality. Households are more rate-sensitive, and banks may need to offer higher deposit rates to retain funding. In our view, the risk-reward balance for the sector has deteriorated.

The Consumer Is Feeling the Squeeze

The consumer discretionary sector is where the impact of tighter policy is felt most directly.

Mortgage repayments have risen again, by roughly $150 per month on a $1 million loan following the February move. That pressure flows quickly into discretionary spending.

Retailers such as Wesfarmers (ASX: WES), JB Hi-Fi (ASX: JBH), and Harvey Norman (ASX: HVN) now face a more challenging operating backdrop.

Elevated valuations leave little room for disappointment, and the upcoming reporting season will be critical in assessing how resilient margins really are as volumes soften.

Growth Stocks Under Pressure from Higher Discount Rates

Technology stocks have also struggled as investors recalibrate required returns. Companies such as Xero (ASX: XRO) and WiseTech Global (ASX: WTC) remain high-quality businesses, but higher terminal rate assumptions compress growth multiples. Added to this are broader concerns about the capital intensity of AI infrastructure and the risk of overinvestment across the sector.

Source: AUD/USD, weekly chart (2026)

Looking ahead, we see the first half of 2026 as distinctly bifurcated. Globally, the US Federal Reserve is edging closer to easing. Domestically, the RBA is moving in the opposite direction. That policy gap is likely to support a firmer Australian dollar and reinforce the case for companies with offshore earnings.

Q1 Earnings Season and the Mining-Led Narrative

We expect the ASX 200 to trade largely sideways in the first quarter, roughly between 8,600 and 8,900. Earnings season will matter, but not all earnings are equal. In our view, the resources sector is carrying the bulk of the earnings growth story in 2026.

We also expect mining to deliver the strongest upgrades, supported by firm commodity prices and improving global industrial demand. Cost discipline and production reliability will be key differentiators.

By the second quarter, attention will turn squarely to March CPI data. Several economists see a real risk of a further 25 basis point increase in May, taking the cash rate to 4.10%. Such a move would reinforce the RBA’s inflation-fighting credentials and prolong pressure on domestic cyclicals.

Why Metals Remain Central to Our Strategy

Against this tightening backdrop, we see a compelling case for precious and industrial metals. They offer inflation protection, currency hedging and exposure to long-term structural demand tied to electrification and AI.

Gold remains the anchor. Prices have pushed toward US$5,000 per ounce, supported by sustained central bank buying as countries diversify reserves. While higher real rates can weigh on gold in theory, geopolitical risk and fiscal imbalances continue to undermine traditional correlations.

Silver has gone a step further. Persistent supply deficits, combined with rising industrial demand from solar, data centres and electric vehicles, have created a tight market with asymmetric upside.

Source: Gold, weekly chart (2026)

Copper, meanwhile, has emerged as the defining commodity of 2026. Prices above US$14,000 per tonne reflect a collision between surging demand and constrained supply. For us, this underpins a strong case for established producers with scale and growth options.

Where We See the Opportunity on the ASX

We continue to see relative value in resource pure plays. Gold producers such as Northern Star, Evolution, and Genesis are generating strong cash flows at current prices.

In copper, Sandfire offers direct exposure to structural shortages. In silver, Silver Mines provides development leverage, while BHP offers diversified exposure with a growing copper contribution.

Northern Star Resources: High-quality gold exposure as margins expand into record pricing

Source: NST, weekly chart (2026)

We continue to see Northern Star as one of the cleanest and most resilient ways to gain exposure to gold, particularly while the metal remains a preferred hedge against the RBA’s battle with sticky inflation. What underpins our confidence is balance sheet strength. Northern Star holds net cash of $293m and total liquidity of $1.18bn in cash and bullion, giving it ample flexibility as funding conditions tighten domestically.

While FY26 production guidance has been modestly revised to 1.6–1.7m ounces, we think the market may be underestimating the margin uplift ahead. As the hedge book rolls off, Northern Star is increasingly exposed to spot prices that remain near record levels. The key medium-term catalyst remains the KCGM mill expansion, which we see as a material step-change event from FY27 onward. Q2 FY26 results reinforced the underlying earnings power, with more than $1bn in cash earnings generated in the first half alone, supporting both balance sheet protection and a dividend payout ratio of 20 to 30% of cash earnings.

From a technical perspective, we note consistent buying interest on pullbacks toward long-term moving averages. While there has been some operational noise at assets such as Pogo and KCGM, the broader uptrend remains intact. The post-guidance consolidation suggests the market is looking through short-term execution risks and remains focused on the longer-term production uplift and valuation upside.

Evolution Mining: Balance sheet repair meets full exposure to rising gold prices

Source: EVN, weekly chart (2026)

We see Evolution Mining as one of the most improved names in the large-cap gold space. The latest Q2 FY26 update showed operating cash flow surging 57% to more than $1bn, a result that materially reshapes the investment case. This cash generation allowed Evolution to cut gearing from 11% to just 6%, a meaningful advantage as interest rates remain elevated.

Crucially, Evolution’s largely unhedged position is now working decisively in its favour. With gold prices back above $4,900 per ounce, the company is capturing the full upside. Operationally, we are encouraged by higher throughput at Cowal and Mungari following recent expansions. While adverse weather impacted copper output at Ernest Henry, the asset remains a low-cost and strategically important part of the portfolio. Guidance of up to 780,000 ounces for the year remains intact, with AISC still competitive despite persistent cost inflation.

Technically, the share price has staged a sharp V-shaped recovery from its recent correction, returning to levels near multi-year highs. We interpret this as evidence of renewed institutional accumulation. The stock is now testing resistance last seen in late January, and a sustained break higher would likely confirm a new trading range as the market rewards the rapid deleveraging and earnings momentum.

Genesis Minerals: From developer to debt-free growth platform in Leonora

Source: GMD, weekly chart (2026)

We continue to view Genesis Minerals as the standout growth story in the Leonora district. The company is rapidly transitioning into a high-quality mid-tier producer with a credible pathway to more than 400,000 ounces per annum. The latest quarterly update was particularly impressive, with a record underlying cash increase of $216m and the full repayment of $100m in corporate debt just seven months after the Focus acquisition.

With more than $400m in cash and no bank debt, Genesis is exceptionally well insulated from the RBA’s hawkish stance. The near-term focus is the Tower Hill project, which is progressing ahead of schedule. Management’s decision to bring forward growth capital reinforces our view that project economics are compelling at current gold prices. We also see the forthcoming five-year strategic plan, due in the June half, as a potential catalyst, particularly if it outlines mill expansions or further consolidation across the Western Australian goldfields.

From a chart perspective, Genesis trades as a high-beta gold equity. The pattern of higher lows reflects a persistent buy-the-dip mentality among investors. The stock is currently consolidating within a bullish flag formation, supported by stronger volume on up-days, which historically indicates continuation of the primary uptrend.

Sandfire Resources: A global copper producer leveraged to structural supply tightness

Source: SFR, weekly chart (2026)

We see Sandfire as a differentiated way to gain exposure to copper, a metal facing structural supply shortages as electrification accelerates. In H1 FY26, Sandfire delivered copper-equivalent production of 72,100 tonnes and remains on track to meet full-year guidance. More importantly, the balance sheet has been transformed, with the company now reporting net cash of $13m following the previously debt-heavy MATSA acquisition.

This improved financial position is particularly valuable in an environment where a stronger Australian dollar and higher interest rates can pressure margins. The ramp-up at Motheo in Botswana remains the key operational driver, with ongoing drilling aimed at extending mine life toward 15 years. The addition of the Kalkaroo project further enhances long-term optionality. With EBITDA margins near 50%, Sandfire retains a meaningful buffer against cost inflation.

Technically, the stock has materially outperformed the ASX 200 over the past year and continues to trade above key short-term moving averages. While resistance has emerged near historical highs, the broader trend remains constructive. Although valuation appears full on near-term metrics, we agree with the view that Sandfire remains undervalued when assessed against forward cash flows in a sustained high copper price environment.

Silver Mines: Australia’s Largest Undeveloped Silver Project

Source: SVL weekly chart (2026)

We view Silver Mines as a high-quality, pure-play option on silver, offering development leverage that is increasingly scarce on the ASX. While regulatory timing remains the primary risk, the company is progressing updated ecological surveys at its Bowdens project, with resubmission targeted for mid-2026.

With more than $40 million in cash, Bowdens hosts 71.7 million ounces of silver in reserves and 164 million ounces in the higher-confidence Measured and Indicated resource categories, positioning it as one of the largest undeveloped silver deposits globally.

The NSW Government has since amended planning laws, providing a clearer approval pathway for Bowdens. Silver Mines is well advanced in refreshing its development application and expects to return to the Independent Planning Commission in 2026, with the objective of securing new development consent by year-end.

In a market where silver continues to outperform many commodities, Silver Mines offers high-torque exposure to both industrial demand and silver’s role as a monetary safe haven. From a technical perspective, the stock trades like an option - exhibiting elevated volatility and sensitivity to project-specific news - and is currently consolidating within a long-term accumulation zone.

BHP Group

Source: BHP weekly chart (2026)

BHP remains the anchor of the resources sector. The company recently upgraded FY26 copper guidance to nearly 2m tonnes, driven by record throughput at Escondida. Its ability to keep unit costs at the lower end of guidance, despite ongoing domestic cost pressures, reinforces BHP’s operational edge. Diversification across iron ore, copper and potash adds resilience that few peers can match.

BHP continues to behave as a value and quality proxy for the broader commodity complex, with strong technical support at levels that have historically attracted institutional buying.

Our Bottom Line

The RBA’s February decision confirms that inflation control is back at the centre of policy, even at the cost of slower growth. For investors, this is not an environment to hide in the index.

We see elevated risk in richly valued domestic cyclicals and a more attractive balance of risk and reward in globally leveraged resource stocks. As long as monetary policy remains restrictive, capital discipline and exposure to structural scarcity themes are, in our view, the clearest path to outperformance in the Australian market through the first half of 2026.

If you enjoyed reading my article, you can reach out to me at ++mark.elzayed@investorpulse.com.au,++ add me on LinkedIn and subscribe to my research. I look forward to connecting with you.