Neometals (ASX: NMT) has welcomed a new project agreement for additional funding support for the company's wholly owned, patent-pending vanadium recovery process (VRP).

Under the deal, Germany’s EIT RawMaterials will inject approximately $2.7 million into Finnish company Novana and a proposed VRP plant in Finland.

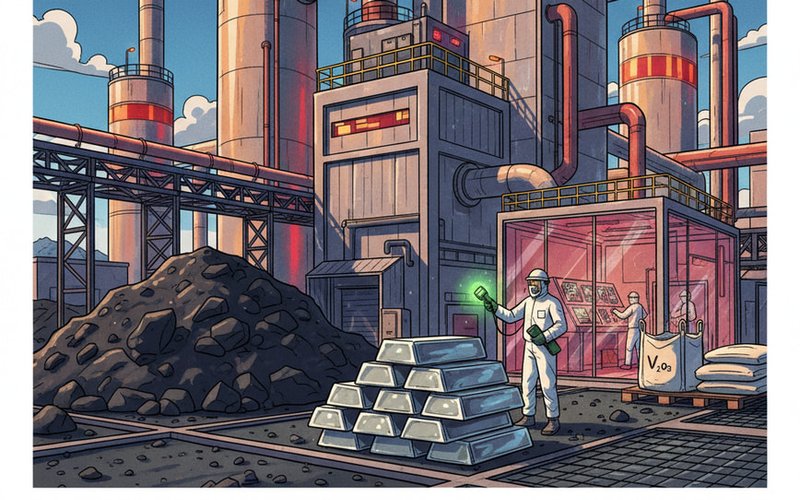

Novana is commercialising Neometals’ unique VRP technology, a sustainable hydrometallurgical process able to produce high-purity vanadium pentoxide (V2O5) from vanadium-bearing steel slag.

Royalty agreement

The Finnish company holds the exclusive licence to the VRP technology in the Nordics and a non-exclusive licence for areas outside that region and is required to pay Neometals a 2.5% gross revenue royalty on all products and sales.

The EIT RawMaterials agreement comes after Novana recently received $86.2 million in conditional funding support for the VRP project. It is currently undertaking a project financing selection process with leading Nordic bank SEB with assistance from EIT RawMaterials.

Neometals managing director, Christopher Reed, said a recent VRP project feasibility study confirmed the potential for V2O5 production at the lowest-quartile operating costs, with a low-to-negative carbon footprint.

"We hope to capitalise on the significant support from the Finnish state and EU to deliver Europe’s first domestic producer of high-purity vanadium, a critical material for the production of high-strength steel, aerospace titanium alloys and stationary energy storage batteries.”

Ironclad gold deal

The latest VRP developments come hot on the heels of a Neometals’ successful progression of the Iron Clad gold development in Western Australia.

Under a non-binding Letter of Intent (LOI), the company’s wholly owned subsidiary Avanti Exploration and BML Ventures are investigating future open-cut mining of the Ironclad deposit

Under a completed arrangement, BML Ventures would provide funding and manage mining and haulage operations and receive 50% of the profit under a toll-milling operation.

Ironclad hosts an inferred mineral resource of 13,000 ounces with recent and historical drilling confirming multiple significant intercepts, including high-grade intervals, highlighting its potential to support early commercial production scenarios.