Invictus Energy (ASX: IVZ) has terminated its subscription agreement with Al Mansour Holdings after concluding the parties were unable to agree acceptable terms for a revised strategic transaction.

The decision follows extended negotiations that included multiple deferrals of the original settlement date as the parties attempted to restructure the proposed investment and broader partnership framework.

Invictus said the terms ultimately sought by Al Mansour were unacceptable, non-commercial, and – in some cases – inconsistent with Australian regulatory and listing rule requirements.

The company has now ceased all discussions with Al Mansour, and no further negotiations or transactions are being progressed between the parties.

Proposed Transaction Background

Under the original subscription agreement announced in August 2025, Al Mansour agreed to acquire a 19.9 per cent equity interest in Invictus for A$37.8 million before costs.

In parallel, the parties established joint venture company Al Mansour Oil & Gas to pursue producing and near-term development oil and gas assets across Africa.

Al Mansour also agreed to provide Invictus with up to US$500m of conditional future funding intended to support the development of the Cabora Bassa project, subject to separate binding agreements and development milestones.

The parties have since deferred settlement of the subscription agreement on several occasions to allow to align strategic objectives and finalise documentation.

This was to include discussions around a revised transaction structure that could have resulted in Al Mansour and associated parties becoming major shareholders.

Repudiation of the Agreement

Invictus said it became apparent that Al Mansour did not intend to satisfy its contractual obligations under the subscription agreement.

On that basis, the company determined that Al Mansour’s conduct constituted a repudiation of the agreement and elected to terminate the agreement with immediate effect.

Invictus said this course of action was necessary to protect the company’s assets, governance framework, and shareholder interests, as well as ensure ongoing compliance with Australian regulatory requirements.

The board acknowledged disappointment that the strategic investment could not be concluded but said the outcome was in the best interests of shareholders.

Company Focus Intact

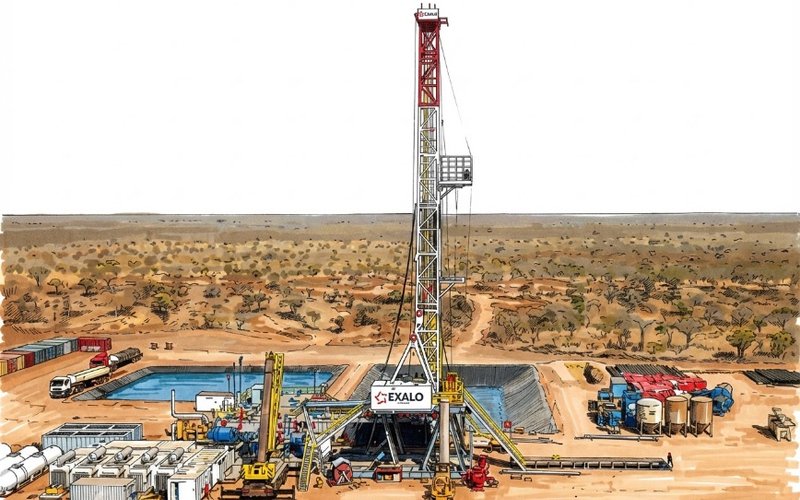

Invictus said it remains focused on advancing its core asset portfolio in the Cabora Bassa Basin in Zimbabwe, including ongoing development work at the Mukuyu gas field.

The company continues to actively engage with a number of alternative strategic and funding counterparties, as well as potential industry partners.

Invictus said the level of interest received to date is encouraging and positions the company to pursue value-accretive transactions and partnerships aligned with its forward work program.

The board remains committed to progressing the project in a manner that maintains governance standards and delivers long-term value for shareholders.