The global copper market is entering a new era of structural tightness. Supply constraints, surging demand from electrification and renewables, and a repricing cycle that could redefine returns are creating what we see as one of the most compelling medium-to-long-term investment windows in years.

Australia, with its stable regulatory environment and high-quality ASX-listed producers, is emerging as a prime destination for investors seeking secure exposure. From BHP’s diversified anchor positions to high-growth names like Aeris Resources, the sector offers opportunities for both stability and upside.

In our latest analysis, we cover:

· Why supply constraints will persist for years, not quarters

· How electrification, renewable energy, and AI-driven infrastructure are driving demand

· The ASX-listed copper stocks best positioned to benefit from this structural shift

· Practical insights on pricing, market sentiment, and entry points

A New Era of Global Tightness

As we survey the landscape, we see a copper market evolving beyond the usual boom-and-bust cycles. The forces now redefining the industry are structural, powerful and mutually reinforcing. Supply is tightening, demand is accelerating and the world is depending on copper to facilitate a profound industrial shift. From our perspective, this environment is setting up one of the most attractive medium to long-term investment windows we have encountered in the resources sector. For investors looking ahead, particularly on the ASX, the timing is favourable.

We continue to observe a supply side struggling with issues that will take years, not quarters, to resolve. Production growth remains muted, with expectations of 1.2% in 2025 and 2.2% in 2026, which falls well short of what the global economy increasingly requires. Ore grades are declining across major regions, development timelines stretch beyond 20 years, and capital availability remains far below what is needed to rebuild the pipeline.

The deficit outlook underlines the challenge: around 230,000 tonnes of shortfall in 2025, rising above 400,000 tonnes in 2026. Operational setbacks and geopolitical pressures in core producing countries reinforce a system that is both fragile and slow to respond. In our view, this structural constraint is one of copper’s strongest investment pillars.

Accelerating Demand Cycle

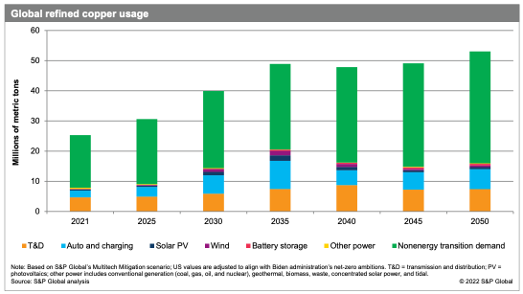

On the demand side, momentum continues to build across multiple pillars of the global economy. We see electrification, grid renewal, renewable energy expansion and the rapid scale-up of data-centre infrastructure all pulling in the same direction. EVs, which require several times more copper than traditional vehicles, are gaining further market share, while transmission networks worldwide are undergoing sustained reinforcement.

Source: S&P Global, Global refined copper usage (2022) [1]

With demand set to expand by 2.8% in both 2025 and 2026, and with upside risks from AI-driven power infrastructure and faster EV adoption, the consumption profile appears increasingly robust. From our vantage point, this is one of the most durable and multi-layered demand cycles copper has ever experienced.

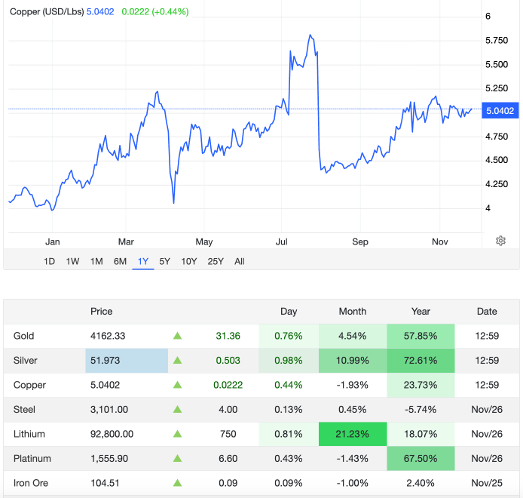

The price trajectory reflects a market struggling to find balance. Forecasts pointing to copper reaching about $13,000 per tonne by late 2026 appear consistent with the fundamentals we observe daily. Inventories remain thin, and the market reacts sharply to even minor disruptions. The IEA’s projection of a 30% supply shortfall by 2035 captures the scale of what lies ahead.

Source: Trading Economics, Copper price (2025) [2]

We see the current environment not as a temporary spike, but as the early stages of a longer repricing cycle. In our view, copper will require structurally higher prices to incentivise the capital commitments necessary to rebuild global supply. This is a market that needs investment, and higher prices are the mechanism through which it will be drawn in.

Premier Copper Investment Destination

When we compare global jurisdictions, Australia stands out as a clear beneficiary of the structural shift underway. The country offers regulatory stability, transparent permitting processes and a mining ecosystem that is consistently dependable. A 3-to-5-year approval timeline provides visibility that many other regions simply cannot match.

While some countries offer larger geological endowments, they also carry far greater political, regulatory or operational risks. Australia’s jurisdictional advantages are becoming increasingly valuable as investors seek secure exposure to copper during a decade of structural scarcity. We see these advantages translating directly into a more attractive risk-reward profile for ASX-listed producers and developers.

Within the ASX copper universe, we have identified companies that combine balance sheet resilience, strong operating leverage and credible near-term catalysts. These names stand to benefit not only from rising copper prices but also from growing investor attention to supply-secure jurisdictions. As the structural narrative accelerates, we expect the market to reward operations with clarity, reliability and scale.

Five ASX Copper Stocks

The following five ASX-listed stocks are proposed for portfolio allocation, based on our assessment of recent strong price action and solid fundamental catalysts, providing diversified exposure across the copper sector.

BHP Group (ASX: BHP) - The Global Anchor and Diversification Play

Source: BHP, weekly chart (2025)

BHP sits at the centre of the global copper market, and we see it as the anchor position for investors building long-term exposure to the metal. BHP remains the world’s largest copper miner, and that scale continues to matter. Its diversification across iron ore, nickel and metallurgical coal provides a level of stability that few peers can offer, giving investors participation in the structural copper story while maintaining the financial strength to weather short-term swings in prices and supply chains.

We think its fundamentals have been reinforced by the consolidation strategy in Australia, most notably the acquisition of OZ Minerals. Folding Prominent Hill and Carrapateena into the portfolio has deepened BHP’s South Australian presence at a time when the industry is grappling with tightening ore grades. Chile is still central through Escondida, yet structural pressures are visible. Management expects a 6% decline in FY26 volumes and an 18% rise in unit cash costs as grades ease. The contrast with the Australian Copper SA division is striking. Olympic Dam continues to deliver competitive unit cost guidance of US$1.00–$1.50 per pound, offering insulation from the broader rise in global All-in Sustaining Costs driven by declining average ore grades.

The strategic rationale remains clear to us - dependable long-term exposure to copper supported by BHP’s scale, balance sheet strength and disciplined asset acquisition. The group’s focus on high-quality, established operations in stable jurisdictions gives investors a liquid and lower-risk route into the copper thematic, without the development or geopolitical risks more common among smaller producers.

Current price action and sentiment argue for patience. We would want to see a firm consolidation above $40 per share, followed by a decisive break through the $43.6 level, before considering a potential entry.

Sandfire Resources (ASX: SFR) - Operational Strength in Strategic Geographies

Source: SFR, weekly chart (2025)

Sandfire Resources sits firmly in the mid-to-large-cap bracket of global copper producers, carrying a market value of roughly $7.52 billion. Its presence in the sector is not marginal: the group delivered more than 24,000 tonnes of copper in the third quarter of 2025, placing it 24th worldwide. We see this scale and consistency as central to its appeal, offering pure copper exposure at a moment when the market remains acutely tight and the price recently traded at $10,777.50 per tonne. In an environment shaped by deepening supply deficits projected into 2026 and beyond, the company is positioned to capture elevated margins as the cycle matures.

Our view on Sandfire is reinforced by the strength of its operations, which continue to generate dependable cash flow. This gives the group scope to reinvest for expansion while retaining the capacity to return capital where appropriate. Its focused portfolio enhances its sensitivity to copper’s upward trajectory, in contrast to diversified miners where the commodity’s contribution may be diluted. The ASX listing adds an additional layer of reassurance through the Australian regulatory backdrop, which remains among the more stable and predictable jurisdictions for resource investment.

We regard the investment case as a clean expression of tightening market fundamentals. The company’s ability to deliver high volumes consistently positions it well as the supply imbalance intensifies, allowing it to convert favourable pricing directly into stronger operating performance. For investors seeking close correlation with copper’s structural reset, underpinned by established scale and disciplined execution, Sandfire stands out as a compelling presence in the producer space.

Aeris Resources (ASX: AIS) - The High-Growth Mid-Tier Catalyst

Source: AIS, weekly chart (2025)

Aeris Resources has delivered an exceptional run this year. We see this as a clear signal of market confidence in its assertive, near-term growth agenda. The momentum is not speculative; it is tied to concrete development milestones and a defined expansion pathway. Management is moving decisively to fund this next phase, including an $80m equity raising designed to secure the capital needed to advance its projects at pace. In a copper market marked by tightening supply, this commitment to rapid execution places the company in a favourable position.

The core of Aeris’s fundamental story rests on the accelerating progress at the Constellation project. The recent maiden ore reserve declaration provides a 5-7 year mine life, offering a crucial anchor for forward planning. This underpins the company’s FY26 ambitions, with targeted copper output of 24-29 kt, representing a 37% uplift on current levels. The production pathway is clear, measurable and under active development, giving us confidence that further re-rating potential remains as the group progressively de-risks its timeline.

We view Aeris as a solid growth name aligned with the near-term widening of the structural copper deficit. Its combination of strong price momentum, explicit operational targets and a tangible reserve base offer meaningful leverage to the copper cycle. As the business steps into a materially larger production phase, the scope for valuation expansion looks significant, making it a compelling option for investors seeking high-growth exposure within the copper developer segment.

Develop Global (ASX: DVP) - Value Uplift Through Project De-Risking

Source: DVP, weekly chart (2025)

Develop Global presents a compelling case, anchored by the standout economics from its updated Definitive Feasibility Study for the Sulphur Springs zinc and copper project in Western Australia. The revised study points to free cash flow rising to about A$1.5bn, almost double previous forecasts. It also lifted project value by 76% to $921 million while reaffirming a strong pre-tax IRR of 59%. These figures speak to the strength of the unchanged 8.8Mt ore reserve and reflect a project with genuine financial depth.

We see the development strategy as equally important. The decision to employ a bottom-up underground mining approach provides the flexibility needed for an efficient ramp up to a steady-state rate of 1.5m tonnes a year. It offers a more controlled build-out and supports a smoother operational transition. With Western Australia providing a highly stable regulatory setting and all major approvals already secured, the project enjoys a level of certainty that many global peers lack. This clarity supports the credibility of the A$329m pre-production capital estimate and reduces the risk of cost slippage tied to permitting delays or political uncertainty.

In our view, Develop stands out as a leveraged development name with valuation supported by well-defined and de-risked economics. The strong DFS outcomes and the focus on accelerating the build place the company in a position to capture the benefit of rising commodity prices and growing demand. For investors looking for exposure to a project with clear financial strength, low jurisdictional risk and significant value uplift potential as it moves toward a final investment decision, Develop offers a compelling proposition.

Hot Chili (ASX: HCH) - The Chilean Development Opportunity

Source: HCH, weekly chart (2025)

Hot Chili is focused on advancing the Costa Fuego copper-gold project in Chile, where it is actively consolidating resources to establish a major production hub. Operating in South America, the company has built a robust fundamental profile by addressing the region’s inherent risks. A key strategic advantage is its location just 30 miles from the ocean, coupled with a secured 10-year water permit, an invaluable asset in water-scarce Chile that many other regional projects do not have.

We see the company’s operational fundamentals strengthened further by logistical achievements. The Memorandum of Understanding for Las Losas port ensures secured export capacity, reducing production costs and streamlining future operations. This proactive de-risking enhances operational certainty and supports investor confidence. Hot Chili is also exploring the spin-off of its water rights into a standalone water supply company, creating the potential for an additional revenue stream outside the copper operation. At the same time, it is expanding its resource base through regional consolidation, including the acquisition of the Domeyko land package.

While the fundamentals remain strong, we remain cautious regarding the current price action and broader market sentiment. We are looking for consolidation above the $0.70 per share range, with a clear break above the $1 mark potentially triggering a substantial rally. In our view, Hot Chili’s strategic advantages, combined with these technical conditions, position it well for upside once market confidence aligns with its operational progress.

Taking the full picture into account, we see copper transitioning from a cyclical commodity to a long-duration strategic asset. Supply remains structurally constrained, demand is intensifying and the global economy is leaning heavily on copper to enable a far-reaching energy and digital transformation. For investors willing to position early in this shift, we believe the coming years will present a meaningful opportunity to capture the rewards of a market entering a new and lasting phase of tightness.