For much of the past year, broad exposure to metals delivered strong returns. As 2026 progresses, that approach is starting to look blunt. Gold is holding firm for structural reasons, silver is behaving more like a strategic metal, and copper is increasingly defined by scarcity rather than cyclicality.

What matters now is execution. On the ASX, a gap is opening between companies merely benefiting from higher prices and those converting them into cash flow, stronger balance sheets and longer asset lives. Some of the best performers have yet to be fully re-rated, as the market is only beginning to trust the operational progress underneath.

*We maintain a selectively positioned portfolio designed to stay ahead of evolving market trends. To learn more about our HIN-Direct wealth management services, please contact me at ++mark.elzayed@investorpulse.com.au*++

We analyse five stocks across gold, silver and copper that reflect this shift. Each offers a different way to gain exposure as the cycle evolves and capital becomes more discerning.

We are at a point in the commodity cycle where the conversation needs to change. For much of the past year, simply being exposed to metals was enough. Prices rose, sentiment improved and capital followed. As we move deeper into 2026, that approach is starting to look blunt. Gold is holding firm for reasons that go beyond fear, silver is behaving less like a niche trade and more like a strategic metal, and copper is increasingly defined by scarcity rather than cyclicality. These metals are running off structural drivers, with an upside trend not losing any steam. This is when stock selection starts to matter far more than sector exposure.

What we are seeing on the ASX is a growing divide between companies that are merely riding higher prices and those that are genuinely converting them into cash flow, balance sheet strength and longer asset lives. Some of the strongest performers of the past year still have not been fully re-rated because the market is only beginning to trust the operational progress underneath. The five stocks below capture that shift in real time, each offering a different way to express a constructive view on metals. What follows is a closer look at where the earnings are coming from, why the market is paying attention, and why these names still matter as the cycle evolves.

Gold: Kingsgate Consolidated - From turnaround narrative to cash-generative producer

Source: KCN, weekly chart (2026)

Kingsgate Consolidated (ASX: KCN) has quietly become one of the defining mid-cap gold stories on the ASX. A 346% share price gain over the past 12 months places it firmly among the market’s standout performers, yet the underlying story is less about speculation and more about execution. The successful restart and ramp-up of the Chatree Gold Mine in Thailand has transformed what was once a distressed asset into a consistently producing operation.

In its December 2025 quarterly update, Kingsgate confirmed production of close to 21,000 ounces of gold and 157,000 ounces of silver, landing squarely at the midpoint of FY26 guidance despite the December quarter historically being the weakest seasonally. That detail matters. It suggests the mine is now operating with a degree of stability that the market had not previously priced in.

The balance sheet tells the same story. Cash and bullion rose 56% quarter-on-quarter to $179 million, reflecting a combination of higher output and a gold price that remains near record levels in Australian dollar terms. Importantly, this has been achieved without shareholder dilution. Management is funding plant optimisation and balance sheet de-risking organically, which is a meaningful shift from the company’s past.

From a market perspective, KCN now sits in an awkward but potentially lucrative phase. It is no longer a turnaround, but it has not yet been fully re-rated as a long-life, high-margin producer. The stock has paused after its rapid ascent following the latest update, yet it continues to materially outperform the All-Ordinaries Gold Index. We think the enterprise value still understates the life-of-mine potential at Chatree, particularly once silver by-products are properly factored into costs.

Gold: Resolute Mining - Operational discipline meets institutional re-rating

Source: RSG, weekly chart (2026)

Resolute Mining’s (ASX: RSG) 231% rise over the past 12-month period marks one of the most dramatic sentiment reversals in the sector. Its inclusion in the S&P/ASX 200 in December 2025 was more than symbolic. It signalled a return to institutional relevance after years defined by balance sheet stress and operational inconsistency.

The company’s core assets at Syama in Mali and Mako in Senegal are now delivering steady output, while costs have moved decisively lower. Recent results point to a meaningful improvement in all-in sustaining costs, allowing Resolute to capture the upside of a gold price that remains well above long-term averages.

The release of the Doropo definitive feasibility study late last year added a further layer of credibility. The study outlined improved economics and a clear development pathway for what could become Resolute’s next major production centre in Cote d’Ivoire. This is not growth for growth’s sake, but a measured extension of a portfolio that is finally generating cash.

There are, inevitably, jurisdictional risks associated with West African operations, and these remain part of any serious investment discussion. Yet at current gold prices, the quality of Resolute’s cash flows is difficult to ignore. Following the index inclusion, the market now frames recent share price weakness as consolidation rather than exhaustion, with consensus targets around $1.45 implying double-digit upside from current levels.

Copper: Sandfire Resources - A direct beneficiary of the electrification trade

Source: SFR, weekly chart (2026)

For investors seeking copper exposure beyond the mega-caps, Sandfire Resources (ASX: SFR) has emerged as a compelling alternative. The stock is up about 100% over the past 12-month period, driven by the successful commissioning of the Motheo Copper Mine in Botswana alongside solid contributions from the MATSA operations in Spain.

This operational progress has coincided with a powerful move in the copper price. As of January 2026, copper is trading near record highs at around US$13,000 per tonne, underpinned by structural supply constraints and accelerating demand linked to electrification and energy transition infrastructure.

Sandfire’s financial profile is now reflecting the heavy capital investment of recent years. Quarterly data shows record concentrator throughput, setting the stage for a sharp lift in EBITDA in the first half of calendar 2026. Notably, unit costs have remained relatively contained despite global inflationary pressures, allowing margins to expand as prices rise. Year-on-year, copper prices are up roughly 40%, and Sandfire is capturing that leverage almost in full. The market has taken notice. The stock is trading at or near 52-week highs, supported by sustained institutional buying.

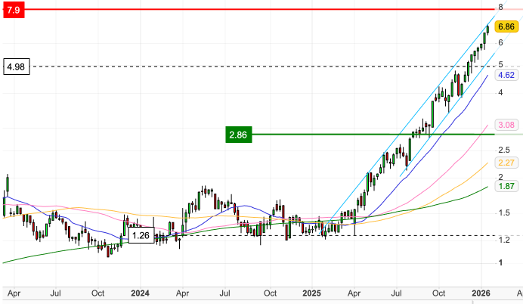

Silver: Silver Mines - A high-conviction lever to the silver price

Source: SVL, weekly chart (2026)

Silver Mines (ASX: SVL) remains the closest thing to a pure-play silver exposure on the ASX, and its relevance has increased as silver prices push back toward US$93.5 per ounce. The company’s Bowdens project in New South Wales continues to stand out as the largest undeveloped silver deposit in the country.

Momentum returned to the stock in late 2025 following the release of what management described as its strongest drilling results to date, including a 116-metre intersection grading 245 g/t silver. These results reinforced the scale and quality of the resource, which currently stands at 71.7 million ounces in proven reserves.

The key overhang has been permitting. After legal setbacks in 2024, the company has been working through a redetermination process with the NSW Department of Planning. Recent updates confirm that all requested information has been submitted, shifting investor perception from prolonged uncertainty to a more defined approval timeline.

SVL is not a low-risk investment. It is volatile and tends to amplify moves in the underlying silver price. That said, with silver bullish and demand driven by both safe-haven flows and solar photovoltaic manufacturing, the stock offers significant leverage. Compared with North American peers, valuations remain modest, particularly given Bowdens’ advanced stage.

Diversified Metals: South32 - A large-cap behaving like a mid-cap

Source: S32, weekly chart (2026)

South32 (ASX: S32) sits slightly apart from the rest of the group, but its inclusion is deliberate. While technically a large-cap, it increasingly trades like a portfolio of focused, high-quality mid-cap assets. The stock rose +12% in the first two weeks of January 2026 alone, reflecting renewed investor interest in its exposure to silver and copper.

Cannington remains one of the world’s largest silver producers, providing direct earnings leverage as silver outperforms most other commodities. At the same time, South32’s stake in the Sierra Gorda copper mine positions it well for sustained strength in base metals.

Strategically, the company has been redefining its portfolio, divesting thermal coal assets and emphasising what it describes as green metals. This has supported a re-rating of its earnings multiple, as investors place greater value on commodities aligned with decarbonisation and electrification.

Technically, the stock is breaking out of a prolonged consolidation range and is trading near 52-week highs. With a strong balance sheet, disciplined capital allocation and a clear commitment to shareholder returns, South32 is increasingly viewed as a lower-risk way to participate in the silver and copper cycle without the single-asset exposure that characterises smaller miners.