China’s dominance over global midstream processing of critical minerals—controlling between 50% and 98% of refining and smelting across key metals—poses a strategic threat to Western industrial resilience, according to Australian investor Craig Tindale.

Speaking on ++Episode #516++ of the MacroVoices podcast, Tindale said the West has unintentionally ceded control of its industrial and national‑security future by offshoring these essential metallurgical capabilities.

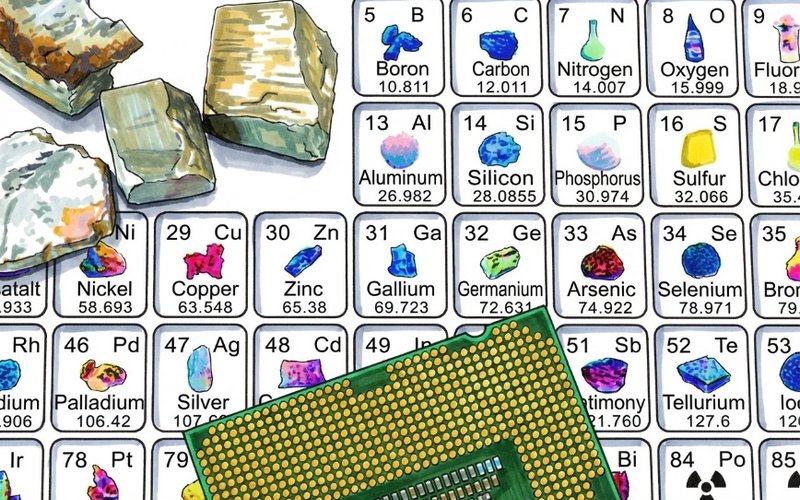

Tindale describes a system in which China has captured the “middle of the supply chain”—not necessarily the mining itself, but the chemical and metallurgical conversion steps that turn ore into usable industrial inputs.

These capabilities underpin everything from EVs to data centres to defence technologies. Without them, Western economies cannot fully industrialise, electrify or sustain advanced manufacturing.

He argues this is not simply an economic imbalance, but a structural vulnerability that leaves the West exposed to supply disruptions, geopolitical leverage, and technological stagnation.

China’s approach, rooted in state‑capitalist investment across smelting, separation and alloying, stands in contrast to decades of Western offshoring driven by a belief in market efficiency.

Silver is one of the most concerning metals in Tindale’s view—strategic for electrification, AI hardware and industrial energy systems, yet poorly understood and vulnerable to future scarcity if China restricts midstream output.

ASX Companies Positioned for a New Critical Minerals Order

While Tindale does not name ASX‑listed companies in the interview, Australia’s critical‑minerals sector is already responding to the very dynamics he warns of.

Recent government‑backed investment, new refining initiatives and a surge in investor capital demonstrate that Australia is emerging as a key non‑Chinese source of critical metals.

Rare Earths: Australia’s Strategic Leverage

ASX rare‑earth stocks have rallied sharply as geopolitical pressure intensifies. Beneficiaries include:

- Lynas Rare Earths (ASX: LYC), Australia’s largest rare‑earths producer, which surged during the announcement of the US‑Australia minerals deal before later easing

- Arafura Rare Earths (ASX: ARU), whose Nolans Project has been formally identified as a priority under the US‑Australia Critical Minerals Framework, with major government backing

- Iluka Resources (ASX: ILU), a mineral‑sands producer with rare‑earth by‑product exposure. - Northern Minerals (ASX: NTU), a heavy‑rare‑earth developer supported by strong investor interest

- VHM (ASX: VHM), a smaller rare‑earth aspirant that rallied over 20%

These companies reflect the exact supply‑chain vulnerabilities identified by Tindale—particularly the lack of non‑Chinese separation plants and metallurgical refinement.

Gallium: A new frontier for Australia

Gallium—used in semiconductors, defence electronics and LEDs—is one of the metals China dominates almost entirely. Australia is now moving to break that monopoly.

A major new gallium refinery is planned for Wagerup, Western Australia, co‑funded by the US and Australia under a US$13B critical‑minerals partnership.

The project will be co‑located with Alcoa’s alumina refinery and aims to supply up to 10% of global gallium demand.

Although Alcoa is not ASX‑listed, the project has catalysed broader interest in associated metals.

This should benefit Latrobe Magnesium (ASX: LMG), which rallied strongly as investors sought exposure to strategic battery‑metal producers.

Silver, Copper & Critical Metals Producers

Tindale highlights silver and derivative metals as future chokepoints due to their midstream vulnerability. Among ASX names:

- Australian Critical Minerals (ASX: ACM) holds silver, gold and copper projects across Peru and Western Australia, positioning it well within the metals Tindale identifies as strategically vital

- Australia’s broader battery‑metal sector—including Pilbara Minerals (ASX: PLS) and others—also saw capital inflows on the back of the US‑Australia strategic‑minerals deal

Why This Matters for Australia

The ASX is becoming a strategic platform for reshaping global supply chains. Tindale’s warning is clear: mining alone is not enough. Nations that control refining will control the economic and technological future.

Australia’s increasing government‑backed investment, new critical‑mineral refineries, and rapid capital rotation into non‑Chinese supply chains suggest the country is moving to close the midstream gap Tindale emphasises.

The West’s industrial and national‑security future may depend on it.