Melbourne-based crypto investment fund Apollo Capital is on course to become Australia’s best performing crypto fund and effectively the country’s leading crypto asset investment firm sometime next month from a field of over 9,000 funds.

The fund prides itself on investing in “crypto assets that are powering the next generation of computing infrastructure”, money transfers and smart contracts, based solely on open-source software and independence from third-party company or organisations.

When Morningstar’s managed fund performance numbers for the past 12 months to April are published in mid-July, market analysts are tipping Apollo will post record figures – serving as a resounding silencer for crypto critics.

Next month’s figures are expected to show that between April 2020 and April 2021, the fund was up 699% while its two-year annual rate of return was 924%.

If confirmed, it would mean that since inception, Apollo has recorded an average return of 363% per annum.

The only other contender for the Aussie crypto crown is Digital Asset Capital Management led by Richard Galvin.

Galvin’s Digital Asset Fund, a fund not included in Morningstar’s rankings, has delivered a return of 2,747%. The fund has attributed its outperformance to some of the best performers in the DeFi sub-sector, including Matic, Solana and Maker.

Apollo the pack leader

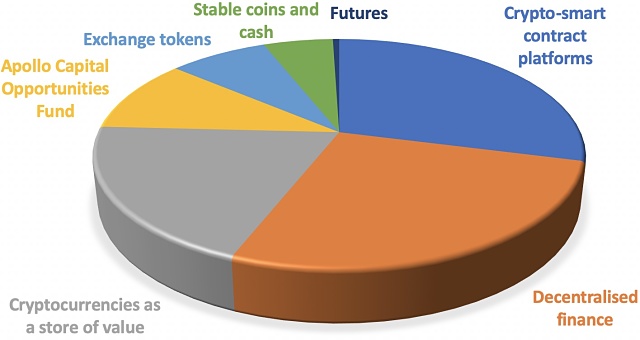

Currently, Apollo holds close to 29% in crypto-smart contract platforms, 27% in decentralised finance, 19.8% in cryptocurrencies as a store of value, 10.4% in “market-neutral” strategies via its parallel Apollo Capital Opportunities Fund, 7.8% in exchange tokens, 5.5% in stable coins and cash, and 0.5% in futures.

Apollo’s total assets under management including both its Capital and Capital Opportunities Funds amounts to $100 million.

For a fund focused on investments in various crypto assets, the results would prove the concept that investors are able to extract above average returns from the crypto space while sending out a clear message to all Australian investors: the crypto boom is not just a storm in a teacup, or a bubble that must inevitably burst.

Quite the contrary, Apollo’s numbers, and those of other top funds such as DigitalX Bitcoin Fund and Terra Capital Natural Resource Fund, suggest that cryptocurrencies (and the technology that underpins them) have matured into fully-fledged investment products that are here to stay.

Unique offering

According to Apollo, it offers a unique blend of financial services experience and considers its early adoption of crypto assets as a means of making the fund “ideally placed” to manage crypto asset portfolios.

For Henrik Andersson, chief investment officer of Apollo, the success of its flagship fund is because of an investment strategy focused on crypto’s disruption of financial services.

More specifically, Apollo is focused not only on harnessing strong crypto-price appreciation in recent years but generating value through what is known as “decentralised finance”.

“We have bitcoin in the portfolio, and we’re strong believers in bitcoin, but the main value creation is happening in what we call decentralised finance, using blockchain technology to automate financial services,” Mr Andersson said.

“We made two assumptions when we launched the fund more than three years ago: one was that you need to be actively managed in the crypto space because it’s a very inefficient space. The second one is a strong focus on an area within crypto called decentralised finance.”

“So those are two strong convictions we had, and they have played out when we compare our returns to a passive index like the Crypto 20 index. We have vastly outperformed that index since inception,” Mr Andersson noted.

Apollo Capital co-founder and chairman Domenic Carosa stated “We started the fund with Henrik our CIO and Tim our MD three years ago with the sole purpose of giving Australian investors an safe and convenient way to access the burgeoning digital asset market. We feel like our journey is just beginning and we believe the future of finance is a decentralised one.”

Mr Carosa is also the founder and chairman of Toronto Stock Exchange listed Banxa Holdings Inc (TSX-V: BNXA) a leading Payment Service Provider for the digital asset industry that has seen its share price rise by almost 400% since listing in January 2021.

High profile billionaire, Alex Waislitz of Thorney fame is a notable investor in both Apollo Capital and Banxa.

The dawn of decentralised finance

Apollo’s investment value proposition is further bolstered by the concept of decentralised finance.

Traditional banking, including regulated institutions with strict capital requirements typically receive deposits and lend money. However, decentralised loan platforms are threatening to cut out the middleman by not requiring borrowers or lenders to identify themselves.

In practice, this means all users can access a decentralised platform to borrow money or earning interest by providing liquidity to form liquidity “pools”.

Concept pioneers such as Crypto.com, BlockFi and Binance (among many others) are offering returns on crypto deposits with interest rates in the region of 5-10% per year.

Aside from consumers and savers, investors are also taking notice. Despite crypto market embodying high price volatility, top performing funds have managed to deliver triple-digit returns. The likes of Apollo can generate triple-digit annual returns – a significant blow to crypto naysayers.

The case for investing in crypto is further bolstered by an economic environment where interest rates are artificially suppressed, while other assets such as stocks and bonds, are trading at close to all-time highs.

Ultra-thin yields in traditional assets are enticing investors into crypto and the idea of being able to earn passive income at higher rates has boosted crypto investment.

Several firms have launched and rapidly expanded operations seeking to capitalise on not only crypto price appreciation, but also the underlying technology that’s tipped to streamline the financial services sector. With such rapid growth, however, it is important to look beyond the appealing rates of return being offered and understand some of the other factors that should inform investor’ decision making process.

When it comes to decentralised finance, there is a greater understanding now that that’s really where the value is captured outside bitcoin,” Mr Andersson said.