Adveritas in fight against digital fraud swiping billions from advertisers

Software solutions company Adveritas is taking aim at mobile app installation fraud, which is estimated to cost digital advertisers $42 billion in 2019.

Following a recent string of contract wins and upgrades, software solutions company Adveritas (ASX: AV1) is looking to scale its TrafficGuard technology globally to combat a problem forecast to cost digital advertisers US$100 billion by 2023.

In just eight months since launching its flagship anti-fraud software, the Perth-based company has attracted the attention of major international “super-apps” looking to take down mobile app installation fraud, one click at a time.

But in order to gain recognition at a global scale, advertisers must first understand the severity of the problem and how machine learning technology works to outsmart so-called “human click fraud farms” and more sophisticated fraud rings that exist.

These fraud rings, like 3VE (a company that reportedly made US$29 million from ad fraud) act like real businesses, investing in research and development to try and outsmart existing fraud solutions and earn money.

TrafficGuard takes a proactive, rather than reactive, approach to fraud by using machine learning to identify patterns of fraud beyond the ability of traditional human analysis.

Every click, conversion and event is received by TrafficGuard along with hundreds of data points that characterise that transaction, like source IP, device, operating system, time of day, among other things.

The transaction’s record is saved in the appropriate location and enriched by all of the other trillions of data points in TrafficGuard – all the other times a device has been seen, other transactions on the same campaign and across campaigns by the same supply source.

With the context of that specific transaction and the trillions of data points TrafficGuard has been built on, it can confidently say whether a transaction is valid or invalid.

Tackling click fraud

According to digital market research specialist Juniper Research, digital advertising fraud is estimated to cost advertisers around the world a total of A$42 billion this year, with the figure projected to grow to US$100 billion (A$147 billion) by 2023.

This fraudulent activity is the result of automated bots as well as “human click fraud farms” and other fraud rings, which pay individuals to continuously download apps and engage with ads when they have no intention of becoming genuine customers.

As a result, this increases the amount advertisers pay for ad engagements because they are charged according to the amount of times users view, click and convert on ads. These organised fraudulent groups make their money by receiving a portion of the advertiser’s payment per download.

This scam was highlighted when ride-sharing giant Uber filed a multi-million-dollar lawsuit against advertising agency Fetch in 2017, accusing the latter of knowingly using click-fraud operations to inflate user traffic statistics.

However, Fetch argued that both it and Uber were aware of the click fraud problem when they made their ad deal and Fetch said it even suggested tools that Uber could use to combat the issue.

Uber later withdrew its claim, and in June this year, it was revealed the pair are jointly suing five mobile ad tech companies and about 100 unnamed third parties they worked with.

According to court documents, Fetch passed the media-buying duties onto these five companies who allegedly took credit for potentially millions of fake click or app installations. This shows that fraud happens further down the funnel, which makes it harder to control.

Superior fraud protection

Basic anti-fraud software generally works by blocking particular websites and blogs completely. However, this approach also risks blocking genuine downloads, which would be detrimental to the advertiser.

Adveritas’ TrafficGuard product is an advanced system that uses machine learning to constantly analyse user download behaviour to identify patterns of fraud.

The technology was developed by the company’s internal team of data scientists and software engineers using data gathered over years of advertising campaigns.

It involves detecting suspicious activity such as changes in device or location details at different journey stages, click-through rates, click-to-install times and post-conversion activity.

According to Adveritas, the product offers three layers of protection and “ensures that digital advertising results in real engagement”.

Educating the sector

Adveritas recently released a presentation outlining its company strategy, stating its goal to globally scale TrafficGuard now that it has engaged its marquee clients.

The company also listed three segments that would benefit from its software product – brands, media agencies and ad networks.

Adveritas’ first strategy for growth involves educating the digital marketing sector on the global ad fraud problem.

It has published various white papers and journal articles on the subject, including profiling the issue in North America and South East Asia, and explaining why machine learning is a superior anti-fraud solution.

It has also showcased its technology and industry research at events such as the Mobile Growth Summit in New York in July.

Its marquee client Rappi was a big advocate of TrafficGuard at this event, demonstrating through its participation in a case study that the product successfully detected 25-40% of fraudulent clicks and thus improved its return on advertising spend by 25%.

Rappi also said the product saved its growth team close to one-third of its time through the removal of manual analysis of fraud mitigation.

Revenue growth

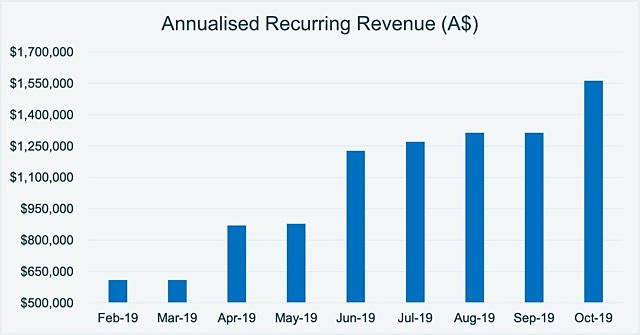

Since TrafficGuard’s commercial launch in February, Adveritas has seen “significant revenue growth momentum” including a 160% uplift in annual recurring revenue to about A$1.6 million.

Just this month, Adveritas chief executive officer Mathew Ratty said the company has achieved increased revenue growth “of at least 20%”.

The company has also listed campaign management platforms and integrated partners as another growth strategy, as well as targeted expansions in North America and emerging markets such as Asia Pacific and Latin America.

Recent deals

In less than a year, Adveritas has managed to clinch deals with several tier-1 global clients under contracts worth between A$200,000-$350,000 per annum and said multiple enterprise trials with other “prominent brands” are underway.

Earlier this month, the company announced it had revised contract terms with two clients, Colombian on-demand food delivery business Rappi and WPP mobile agency MUV.

The upgraded deal with Rappi follows an initial deal made in April. Adveritas said due to “increased traffic volumes”, Rappi has agreed to commit to a 50% raise of its monthly subscription fee to US$22,500 (A$33,000) per month.

MUV’s revised deal increases its monthly subscription fee to US$10,000 (A$15,000) and extends the contract by up to 15 months. In addition, Adveritas said the upgraded contract provided “further fee upside” due to the potential for excess data usage fees.

Another recently signed client is Indonesian “super-app” Go-Jek, which operates a US$9.5 billion (A$14 billion) Google-backed ride-sharing business as well as 18 other on-demand services across the Asia Pacific region.

Go-Jek’s initial 12-month contract, announced in July, entails a monthly TrafficGuard licence fee of US$17,500 (A$25,000) for “an agreed tier of service”.

According to Adveritas, a recently established sales force in New York, Los Angeles and San Francisco in the US is expected to result in “client trials and new client wins” in North America in the second quarter.

In addition, the company said new clients from emerging markets were anticipated in the second quarter, and from European clients in the third quarter.