Weekly review: market slips as Brexit and Chinese/US trade decisions delayed

WEEKLY MARKET REPORT

The Australian share market recorded its first down week for a month as a series of “unknown’’ events were simply kicked further down the road.

The meeting between US President Donald Trump and Chinese President Xi Jinping has now been pushed back until April or even later, the Brexit deadline has been extended but it is still anybody’s guess what the final outcome will be and even Australian politics has now solidly moved into pre-budget election mode.

That means trade will continue to be an intractable issue, Brexit will keep bubbling along with no end in sight and even the local political situation will be volatile as the budget rumours begin and the phony election campaign finally moves into overdrive.

Uncertainty hampers market

Growing uncertainty over these and other issues eventually proved too much for the share market, with the ASX 200 trading in positive territory most of Friday before losing four points or 0.1% to close at 6,175 points.

That meant the market had fallen 0.08% for the week.

It was losses by the heavyweight financial, materials and healthcare sectors that won the tug of war against gains in the energy, retail, telco and industrials sectors.

Company specific news moves prices

There was plenty of company specific news driving share prices as well with shares in CIMIC Group (ASX:CIM) jumping 2.3% to $49.51 after its construction services joint venture won a new contract to service Woodside Petroleum’s (ASX: WPL) Karratha gas plant, which will add about $190 million in additional revenue.

Woodside shares also rose 0.86% to $35.29.

On the bad news side of the ledger Carnegie Clean Energy (ASX: CCE) went into voluntary administration three days after the WA Government terminated its contract to build a wave farm.

Carnegie shares had already been suspended from the start of March because it failed to lodge its earnings results.

When those results were lodged on March 5 they showed the renewable energy company produced a loss of $45 million for the half year and only had remaining cash of $1.68 million which was obviously not enough to keep going without a significant cash injection.

Franchising problems deepen

Franchising heavyweight Retail Food Group (ASX: RFG) was also hit hard as reaction continued to the parliamentary inquiry which accused the company’s management of being either “unethical” or “incompetent” for signing up new franchisees into difficult situations.

In the wake of the report RFG said it “supports any changes which will be of benefit to the franchising industry” but the shares remained on the nose.

Over two days they fell 18.6% to just $0.16, although the company described as inaccurate a media report that it was contemplating the appointment of administrators.

RFG Is a major player in franchising with chains including Donut King, Gloria Jean’s, Brumby’s Bakery, Pizza Capers, Michel’s Patisserie and Crust Gourmet Pizza Bar.

Small cap stock action

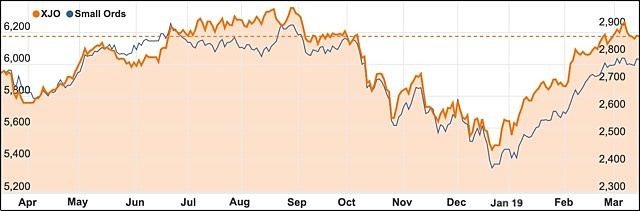

The Small Ords index gained 0.56% this week to close at 2,785.5 points.

ASX 200 vs Small Ords

Among the companies making headlines this week were:

Catalyst Metals (ASX: CYL)

Drilling at Catalyst Metals’ Boyd’s Dam zone returned a 1m interval grading 1,380g/t gold, which is Catalyst’s highest-ever recorded assay.

Boyd’s Dam is within the Four Eagles joint venture between Catalyst and Gina Rinehart’s Hancock Prospecting’s wholly-owned subsidiary Gold Exploration Victoria Pty Ltd.

Other notable results from Boyd’s Dam were 10m at 5.1g/t gold from 75m; 10m at 3.0g/t gold from 55m; and 19m at 5.0g/t gold from 73m.

The jointly owned project is along Victoria’s Whitelaw fault corridor, with the state currently playing host to a revival in gold exploration, particularly in the Fosterville goldfields.

Ausmex Mining Group (ASX: AMG)

Ausmex Mining Group has identified a conductive anomaly that is about 2,000m long, 400m wide and up to 500m deep.

Geophysical data reviews and 3D modelling has led to the anomaly’s identification, with Ausmex claiming the result was “outstanding” and indicates the potential for a large iron-oxide-coper-gold or iron-sulphide-copper-gold system at the Queensland tenements near Cloncurry.

According to Ausmex, the anomaly extends underneath its Mt Freda mining lease and plunges south towards Newcrest Mining and Exco Resources’ tier one Canteen joint venture.

Ausmex had contracted GeoDiscovery Group to undertake the geophysical data review which included helicopter-borne sub-audiomagnetic, detailed regional magnetic data and a versatile time domain electromagnetic (VTEM) surveys as well as 3D modelling.

Berkut Minerals (ASX: BMT)

Berkut Minerals has managed to amalgamate a ground position in Queensland’s Mt Isa region for the first time in 20 years.

Earlier this week, Berkut announced it had executed agreements with Superior Resources (ASX: SPQ), Diatreme Resources (ASX: DRX), Syndicated Metals (ASX: SMD) and private entity Carnaby Resources Ltd to secure 320sq km of tenements in the region.

The tenements include the historic Tick Hill mine that produced 511,000oz of gold at 22.5g/t.

Under the deal, Berkut will also pick up about 972sq km of land in WA that is prospective for gold, base metals, nickel and platinum group elements.

Alt Resources (ASX: ARS)

WA gold explorer Alt Resources announced its third resource upgrade in 12 months for its Bottle Creek project.

The resource was almost doubled to total 5.6 million tonnes at 1.72 grams per tonne gold for 309,000oz.

This latest upgrade now brings Alt’s global resources across its Mt Ida and Bottle Creek assets to 6.8Mt at 1.85g/t gold for 406,000oz gold and 3.8Moz silver.

Bottle Creek hosts a historic mine that produced around 93,000oz gold between 1988 and 1989.

Northern Cobalt (ASX: N27)

Northern Cobalt this week confirmed the potential for its Snettisham vanadium project in southern Alaska to also contain gold mineralisation after wrapping up a 3D magnetic geophysics model.

The company is moving rapidly to firm up Snettisham with 3D modelling of a magnetic survey completed last month.

The magnetite body is approximately 2.5km long, up to 600m wide and over 2km deep from less than 50m beneath surface.

Strike Resources (ASX: SRK)

Perth-based Strike Resources is the latest company to lock-up some lithium brine prospective land in Argentina after executing an agreement to secure the Solaroz project.

The project encompasses 120sq km and is in proximity to concessions held by Lithium Americas Corporation and Orocobre (ASX: ORE).

Under the agreement, Strike will acquire 90% of Argentinian company Hananta SA which will secure the project from its vendors.

To secure the project, Hananta will pay $9.33 million in cash plus Strike shares over four years, with the largest payments to be made once Strike has undertaken enough exploration to confirm the project’s prospectivity.

Jaxsta (ASX: JXT)

Music technology company Jaxsta has signed a commercial data access agreement with Warner Music, giving it authorisation to use Warner’s data world-wide in return for royalty fees.

The agreement will give Jaxsta access to Warner’s relevant music data to incorporate on its platform which is due to be launched by the end of June.

Jaxsta now has 28 licencing data agreements under its belt, which it has secured over the last 18 months, including deals with The Recording Academy, Sony Music Entertainment and Universal Music Group, which was signed earlier this week.

The company’s platform will collate and authenticate data from publishers and other industry stakeholders with the aim of its platform becoming the “go-to source” of official music information.

Takeover space heats up

It was a big week for merger and acquisition activity in the small cap arena with takeover bids made across several sectors.

Verdant Minerals (ASX: VRM)

In the resources sector, Verdant Minerals executed a scheme implementation agreement with US-based CD Capital Natural Resources Fund III LP.

The deal between Verdant and the UK-private equity firm may see Verdant eventually delist from the ASX.

If the deal goes ahead, Verdant will receive much-needed capital to advance its flagship Ammaroo phosphate project in the NT.

The agreement values Verdant at $40.5 million and the company’s shareholders would receive $0.032 per share – a 113% premium to the company’s closing price of $0.015 on 8 March.

Appen (ASX: APX)

Over in the artificial intelligence field, Appen has agreed to acquire US-based Figure Eight with the combined entity to create an end-to-end training data solution for AI applications.

“We now have the best of both worlds – our highly-efficient crowd management platform and scalable, skilful multi-lingual crowd, combined with Figure Eight’s innovative software-as-a-service platform,” Appen chief executive officer Mark Brayan said.

To acquire Figure Eight, Appen will pay $248 million with the deal due to be completed in early April.

Appen expects to fund the acquisition via a $285 million fully-underwritten placement to institutional shareholders at $21.50 per share.

Gindalbie Metals (ASX: GBG)

Ansteel has made a welcome play for Gindalbie Metals – agreeing to snap up the beleaguered play at a 90% premium to its 30-day volume weighted average price.

Gindalbie’s board has unanimously voted in favour of the acquisition, which will also involve Gindalbie demerging its wholly-owned subsidiary Coda Minerals to its shareholders.

Once the takeover has occurred, Coda will retain the Mt Gunson assets and $10.64 million in cash and will apply for an ASX listing.

Rationale behind Gindalbie’s Coda demerger is to enable the company to pursue Mt Gunson without being hampered by Gindalbie’s $231 million-worth of contingent liabilities, which are a result of its interest in Karara Mining.

Keybridge Capital (ASX: KBC) and Yowie Group (ASX: YOW)

Struggling confectioner Yowie Group has been offered a life line after investment firm Keybridge Capital launched an off-market takeover offer.

Keybridge’s offer values Yowie at $0.092 per share, which is a 31.4% premium to Yowie’s most recent closing price of $0.07.

Despite the offer, Yowie’s board has advised shareholders to take no action, describing the offer as “highly opportunistic” and “unsolicited”.

Yowie’s recent sales performance has fallen short of the company’s expectations, however, the company’s chairman Louis Carroll said the company was “confident” it could prosper in the US market.

The week ahead

There are a few things to watch out for in the coming week, with the US Federal Reserve decision probably the most important.

Although there is unlikely to be any change in official interest rates, the commentary will be closely monitored for any hints about how long the Fed might delay any rise in rates.

It is a similar situation here in Australia with the Reserve Bank’s minutes from its March monetary policy meeting.

While we know rates didn’t change and that the RBA is now in a “neutral’ setting, any indications that it is considering a rate cut would be huge news.

There will also be a lot of attention paid to February’s jobs figures, given that the RBA is relying on the ongoing strength of the job market to leave rates on hold.

There will also be a couple of speeches by RBA Assistant Governor’s Christopher Kent (Financial Markets) and Michele Bullock (Financial System).