Splitit Payments posts record sales and revenue on the back of COVID-19

Splitit Payments在2020年第二季度创造的收入(240万美元)超过了2019年全年的收入(42.7万美元)。

Yet another indirect beneficiary of coronavirus, instalment payments company Splitit Payments (ASX: SPT) has published record performance figures for the second quarter of this year – declaring it had experienced “accelerated consumer growth”.

The company reported that its growth accelerated across all of its key performance indicators during the June quarter including strong surges in merchant sales and revenues.

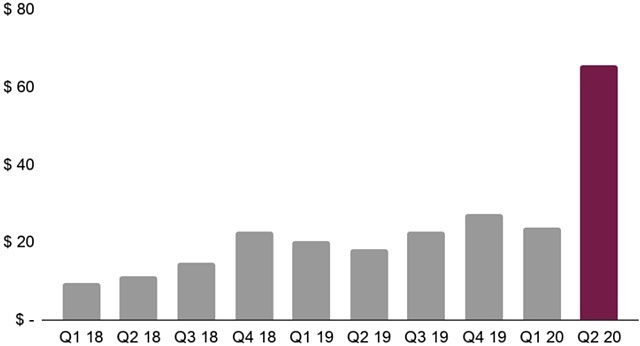

Sales grew by a healthy 176% to US$65.4 million in Q2 2020 compared to the previous quarter and a hefty 260% improvement compared to Q2 2019.

Splitit cited the addition of “new large merchants” in the first half of this year as the reason why its two largest addressable markets continued to swell with the US market improving by 261% and Europe by 240%.

Splitit’s merchant sales volume over time.

As a result, Splitit generated $2.4 million in revenue in Q2 2020, up 460% compared to Q2 2019, which surpasses the company’s entire revenue figure from last year.

The company said it continues to attract larger merchants wanting to provide instalment solutions to their credit card customers and improve conversion rates, especially as e-commerce expansion accelerates.

“This has seen average order value rise by a further 21% to US$893 over Q1 2020, with more than 90% of all transactions being e-commerce or mobile payments,” the company said.

As further proof that business metrics are peaking in all areas, Splitit reported that the total number of merchants the company engages doubled to over 1,000 since this time last year.

Merchant growth has been driven by increasing demand in key verticals from newly-signed brands.

The likes of Purple, Daily Sale, Quiet Kat, Dreamcloud, Bedmart, Scorptec, Tatami Fightwear, Sofa Club and Alpina Watches all signed up to Splitit’s platform over the past three months.

When looking at nominal customer numbers, total shoppers peaked at 309,000 in Q2 this year, up 85% compared Q2 2019 while 12-month active shoppers (customers that were active for a year or more) reached 141,000, up 92% on a year-on-year basis.

“June saw a continuation of the strong business momentum we experienced in April and May,” said Brad Paterson, chief executive officer of Splitit.

“Consumers are making better use of their existing credit to preserve cash, while demand from higher value merchants is ramping up, supported by the accelerated shift towards e-commerce as a result of COVID-19.”

“While we continue to tightly manage our expenses in light of global economic uncertainty, our business model supports more efficient consumer budgeting during these uncertain times, and continues to deliver enormous benefit to merchants by significantly improving consumer conversion on their sites,” he said.

Partnering up

In other news, Splitit revealed that multiple integrations could soon bear fruit and make their presence felt on the company’s balance sheet.

Splitit confirmed that its planned integration with Stripe Connect is complete, with beta testing of new and accelerated merchant onboarding now underway.

The company said Stripe Connect functionality would be deployed “later in Q3 [2020]”, which is expected to generate additional merchant acceptance and further acceleration of merchant sales as Splitit progresses towards its goal of enabling merchants to self-onboard “in minutes”.

The rationale behind the integration is that will improve Splitit’s funded model process by automating acceptance and movement of money for all funded transactions and significantly improving the merchant experience by introducing multi-currency support and improved reporting tools.

Splitit has also launched its integration with Blue Snap, the payment platform for B2B and B2C businesses.

Blue Snap supports online and mobile sales, marketplaces, subscriptions and invoice payments, which allows Splitit to reach fast-growing e-commerce merchants to offer instalment payments directly on their platform.

Additionally, last month, Splitit announced an initial five-year agreement with Mastercard to accelerate the adoption of its instalment solution by leveraging Mastercard’s network of global partners. The duo said its plans to launch pilots in three markets before extending the agreement globally.

According to Splitit, it plans to integrate its instalment solution with Mastercard’s systems as a network partner to enable merchants to deliver “seamless and secure” consumer experiences at checkout, both offline and online.

“These partnerships provide access to multiple merchants and payment networks through our globally scalable business model and extend our product offering to enable a superior customer experience. Over the coming months we will continue to focus on enhancing the experience for both merchants and consumers while driving further industry innovation with our partners,” said Mr Paterson.

Splitit shares were up 12% to $1.525 in morning trade.