Weekly review: rising property helps the Aussie share market shine

WEEKLY MARKET REPORT

The Australian share market has overcome offshore valuation jitters to push towards 11-month highs, as rising property prices help to push up bank stocks and other financials.

An almost guaranteed continuation of dovish, money printing behaviour from the Australian Reserve Bank has all but locked in continuing price gains for real estate this year and that is also good news for the share market – especially banks that get to write more and bigger loans.

By the end of the week the ASX 200 index was 3.5% higher at 6840 points, up 1.1% on Friday alone.

That was helped by the big banks with NAB (ASX: NAB), Westpac (ASX: WBC), ANZ (ASX: ANZ) and Commonwealth Bank (ASX: CBA) all at least 1% higher.

Potential for higher dividends driving bank stocks

There is also the attraction of potentially higher dividends returning for the banks now that regulatory pressure and frozen mortgages have eased dramatically, with Commonwealth Bank’s results which are due on Wednesday to be closely watched for higher pay-outs.

Additionally, with the RBA pledging to keep interest rates low for years, investors are keen to find yield wherever they can and the share market is a prime target.

REA Group riding rising property to increase investor yields

Playing nicely to the yield and property themes was REA Group (ASX: REA), with shares up 1.6% after property listings rose by 13% thanks to the buoyant market.

REA’s net profit jumped by 17% to $173.4 million while the company behind www.realestate.com.au raised its dividend by 7% to $0.59.

Technology was the other trend driving the market with the IT index firming 2.2% on Friday, boosted by an almost record high for buy now pay later company Afterpay (ASX: APT) of $151.

News Corp kicks some digital goals

One of the biggest individual contributors was a strong quarterly result from News Corporation (ASX: NWS) which saw its shares jump 13.9% to $28.41.

Digital advertising dollars improved strongly, book publishing revenue rose by 23%, and there was double digit revenue growth for digital property.

Heading in the other direction was shares in South32 (ASX: S32) which slumped by 2.9% its plans to expand a major coal mine in Wollongong in NSW were rejected by the Independent Planning Commission due to risks to Greater Sydney’s drinking water catchment.

Small cap stock action

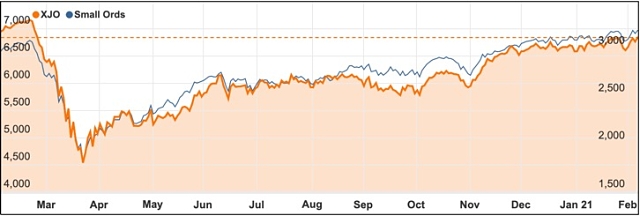

The Small Ords index rose 3.63% this week to close at 3190.3 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Rent.com.au (ASX: RNT)

Rent.com.au’s share price rocketed this week after it revealed Bevan Slattery led a $2.75 million investment round in the company.

The company undertook a placement issuing 55 million shares to raise $2.75 million with Mr Slattery’s investment vehicle Capital [b] Trust scooping up $2 million-worth of the shares and becoming a major shareholder.

Mr Slattery is a well-known Australian technology entrepreneur and said Rent was a disruptive platform with “great potential” and the ability to scale.

King Island Scheelite (ASX: KIS)

Another small cap to make headlines this week was King Island Scheelite with news it had collared a $10 million loan from the Tasmanian Government.

The loan will support King Island’s planned redevelopment of its wholly owned Dolphin tungsten project on Tasmania’s King Island.

King Island executive chairman said the company was “delighted” to secure the funding support, which will “significantly enhance” the company’s financial strength and flexibility.

BlackEarth Minerals (ASX: BEM)

Aspiring graphite miner BlackEarth Minerals has inked a memorandum of understanding to supply US company Urbix Inc with high-grade graphite concentrate.

Urbix is developing a downstream processing facility in the US, with BlackEarth to supply graphite concentrate from its Madagascan project as well as sourcing other high-grade concentrate via supply agreements.

Additionally, BlackEarth and Urbix are looking at forming a joint venture that includes potentially developing a facility in Madagascar or WA to produce a substantial supply of purified graphite for the growing electric vehicle and alternative energy markets.

Incannex Healthcare (ASX: IHL)

Incannex Healthcare has achieved encouraging results from a in vivo study evaluating its IHL-675A drug’s anti-inflammatory activity on pulmonary neutrophilia.

Pulmonary neutrophilia is a known key underlying cause of chronic obstructive pulmonary disease, asthma, bronchitis and other inflammatory respiratory conditions.

After achieving positive results in evaluating the drug against SAARDS which can be a fatal side effect of COVID-19, Incannex has broadened its potential treatment markets for IHL-675A.

Zicom Group (ASX: ZGL)

Equipment manufacturer Zicom Group has received S$60 million (A$59.2 million) in orders to design and supply liquefied natural gas propulsion systems for oil tankers.

Singapore-based Zicom will supply the systems to a shipyard in the People’s Republic of China’s Guangzhou region. The systems will be used for several vessels which are being constructed for an undisclosed “leading” European oil tanker owner.

Zicom chief executive officer Sim Kok Yew said the contract represents the company’s gathering momentum in the marine sector.

De.mem (ASX: DEM)

AGL Energy has awarded De.mem a $550,000 contract to supply water treatment equipment to one of its Australian power stations.

The contract continues De.mem’s expansion into Australia’s power generation sector and follows a $400,000 contract in September for an ultrapure water treatment system.

De.mem chief executive officer Andreas Kroell said the power generation sector is an important market for the company due to it requiring large volumes of the highest quality treated water for use in boilers, turbines and cooling towers.

Anax Metals (ASX: ANX)

Pilbara explorer Anax Metals has uncovered broad zones of copper, lead, zinc, gold and silver mineralisation while drilling the Mons Cupri target within the Whim Creek project.

Drilling hit mineralised zones up to 62m thick and containing numerous high-grade intervals.

Notable results were 62m at 1.9% copper, 1.03% zinc from 78m, including 7m at 4.75% copper and 2.74% zinc; 18m at 5.2% zinc, 2.48% copper and 1.53% lead, including 3m at 10.34% zinc; and 11m at 5.01% zinc, 5.22% lead and 0.87% copper.

Whim Creek has a current JORC resource of 6.9Mt at 0.93% copper and 1.83% zinc.

The week ahead

The coming week will replace the guesswork and predictions that have been informing the share market for months with some cold, hard figures due as a raft of company earnings results are announced.

There are plenty of influential results for the first week with Argo Investments (ASX: ARG), Boral (ASX: BLD), Challenger (ASX: CGF), James Hardie (ASX: JHA), Insurance Australia Group (ASX: IAG), Commonwealth Bank (ASX: CBA), Unibail-Rodamco-Westfield (ASX: URW), Transurban Group (ASX: TCL), Downer EDI (ASX: DOW), Telstra (ASX: TLS), AGL Energy (ASX: AGL), Newcrest Mining (ASX: NCM) and Computershare (ASX: CPU) just a sample of some of the companies reporting.

Business and consumer confidence numbers are probably the statistical highlights in Australia while overseas there is inflation data being released in the US and China which will give traders an idea on how the world’s two largest economies are recovering.

It is a really big week for holiday interruptions with the Lunar New Year holiday keeping the Shanghai Stock Exchange closed for five straight sessions starting on 11 February.

The New Zealand Stock Exchange will also be closed on Monday for Waitangi Day and markets in Singapore, Hong Kong, Japan, Indonesia and the Philippines will also all shut for at least one day.