Weekly review: late rally drags Aussie market back out of correction

WEEKLY MARKET REPORT

After a torrid week of losses, Australian investors managed to drag the ASX 200 index just back out of correction territory.

While a 2.2% or 149.8 point rise to 6988.1 points would normally be cause for celebration, after a week in which the market fell into a rapid 10% correction and was down 2.6% for the week, it was more like a nervous sigh of relief without much conviction.

What is for sure is that after a long and largely uneventful run up the roller coaster incline since the 30% plus COVID-19 swoon in March 2020, the big dipper ride is on again for earnest.

The big dipper is off for another ride

Everybody knows there is going to be a lot of scary ups and downs from here on and there is no sense of anything but short-term relief that we had a good recovery day.

The problem, of course, is that inflation and interest rates are marching upwards and nobody knows for sure how high they will go.

That sort of uncertainty is just something that must be endured as the price of entry for the higher returns available on the share market with rising prices on Friday rewarding some adventurous traders and bolstering sagging private and superannuation portfolios.

One strong day fails to save the week

Even one day of recovery came nowhere near to making up for four consecutive days of falls, with every sector down for the week.

As you would expect, technology stocks were the biggest victims with that sector losing 8% for the week and 21.3% for the month so far

Technology stocks had rallied hard to very fancy price earnings multiples so once money markets started to price in rising official interest rates this year, they were prime targets for a belting.

BHP enjoys its Aussie return

One of the beneficiaries of the rally yesterday was the Big Australian, BHP (ASX: BHP), which this week listed all of its shares on the ASX after ending its London dual listing.

That change means that BHP moves from around 6% of the ASX 200 to representing a mammoth 10.9%, forcing index funds and other funds that measure themselves against the index to buy up BHP shares.

BHP shares rose 2.3% to $46.74 on Friday with more than 33 million shares traded as an estimated $4 billion of extra demand starts to find its target.

ResMed sinks on lower margins

In company specific news, ResMed (ASX: RMD) posted a quarterly 12% revenue increase but a 1.4% cut in gross margin to a still impressive 57.6% as demand for its sleep apnea treatments remained strong.

ResMed shares fell 0.5% to $31.25.

Big gold and copper miner Newcrest Mining (ASX: NCM) enjoyed a 10.1% quarterly increase in gold production and a 11.3% quarterly reduction in its all-in-sustaining costs.

It is on track to deliver its FY22 guidance, and also expects production to increase in the next quarter, with shares falling 6.4% to $21.50.

Shares in gold miner Ramelius Resources (ASX: RMS) fell 8% to $1.32 after announcing that it expects gold production to be at the lower end of its FY22 guidance.

Small cap stock action

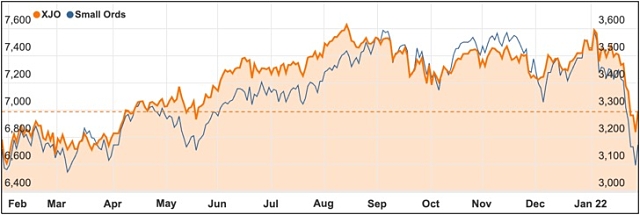

The Small Ords index fell 4.15% this week to close at 3171.2 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Group 6 Metals (ASX: G6M)

Construction has begun at Group 6 Metals’ Dolphin tungsten mine on Tasmania’s King Island, with a new chief executive officer also appointed to lead the mine’s restart.

This week, Group 6 kicked-off stripping and stockpiling of vegetation and topsoil after its first dozer arrived on site.

To lead the mine’s restart, the company has appointed Keith McKnight as chief executive officer.

Credit Clear (ASX: CCR)

Following its acquisition of ARMA last month, Credit Clear has secured two significant new clients with the contracts expected to bring in up to $2 million in additional revenue over the next 12 months.

ARMA has signed the new onboards which Credit Clear describes as a leading Australian utility operator and a global fintech.

“Adding two significant clients in the month after the acquisition is an encouraging sign that clients value our combined and enhanced capabilities,” ARMA chief executive officer and co-founder Andrew Smith noted.

Blue Energy (ASX: BLU)

Blue Energy has revealed a more than 300% increase to gas resources at its wholly-owned permit ATP 854 in Queensland’s Surat Basin.

Gas resources (3C) at the permit have now increased from 101Pj to 398Pj.

This has boosted Blue’s total corporate 3C recoverable gas resources across its whole portfolio by 7% to 4,476Pj.

Altech Chemicals (ASX: ATC)

Emerging battery material producer Altech Chemicals has unveiled the Silumina Anodes product name for its high purity alumina coated silicon and graphite anodes.

The synthesised and patented product is an HPA-coated composite silicon and graphite anode for the lithium-ion battery.

Altech describes the products as a mini-breakthrough – made using its patented process and technology.

Argenica Therapeutics (ASX: AGN)

As it readies for phase 1 clinical trials to begin of its lead candidate ARG-007 in stroke patients, Argenica has finished the drug’s toxicology and genotoxicity preliminary pre-clinical studies.

The studies were critical to identifying suitable dose ranges for the trials under the principles of Good Laboratory Practice (GLP) and resulted in “no observed adverse effect”.

Argenica plans to complete preliminary study activities, ethics submission preparation and set of clinical trial site by the end of the current quarter, with recruitment to begin as soon as ethics approval has been secured.

The week ahead

All eyes will be on the Reserve Bank board this week as it meets for the first time this year with strong expectations that it will drop its QE (quantitative easing) bond buying program.

Most analysts expect the February 1 meeting to leave the official cash rate at 0.1%.

The big question is what sort of guidance will be given about interest rate rises this year, with some expecting rises to happen as early as August.

Inflation is now solidly in the RBA’s sweet spot but is threatening to follow the US inflation rate even higher which is why many economists are tipping several rate rises this year.

Other local things to watch out for include consumer confidence figures, home prices, lending figures, retail trade, new car sales, international trade, inflation expectations and building approvals.

Overseas there are a few things to check in the United States with releases on manufacturing, job openings, construction, productivity, services, factory orders and nonfarm payrolls.

However, given the current volatility on share markets, what is happening on Wall Street will be the most watched indicator of all.