Fatfish Blockchain to bolster investment portfolio via Abelco merger

Fatfish Blockchain has accepted a $12.7 million offer for the merger of its Swedish subsidiary Fatfish Global Ventures AB.

Technology venture capital firm Fatfish Blockchain (ASX: FFG) has received a binding offer regarding its Fatfish Global Ventures (FGV) investee company from Swedish-based Abelco Investment Group.

Abelco currently invests in a variety of companies including within the technology and engineering sectors that require capital to develop further.

Its most notable investment is in cryptocurrency portal QuickBit, a company worth around $130 million by market capitalisation with Abelco holding a 6.76% stake.

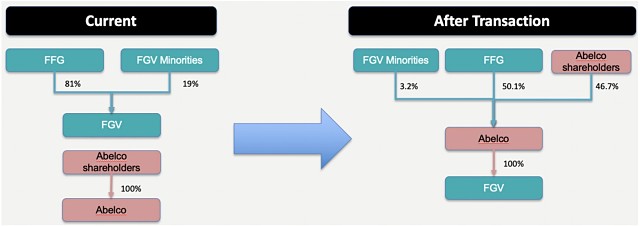

Under the proposed offer, Fatfish said it intends to dispose of 81% of its shareholding in FGV to Abelco in return for listed shares worth $12.7 million or 50.1% of the enlarged share capital of Abelco. It has been proposed for the transaction to be settled via the issuance of 704 million new shares in Abelco at an issue price of SEK 0.12 per share.

Importantly, Abelco has obtained an exemption from the Swedish Security Council to excuse Fatfish from having to undertake a mandatory bid for all outstanding shares in Abelco.

Furthermore, the de-facto merger offer has already been accepted by Fatfish’s management team but must still be approved by Fatfish shareholders.

The current and post transaction structure.

In a statement to the market, Fatfish said the transaction represented an “alternative path for FGV to pursue its listing in Sweden that can fast-track the [company’s] growth”.

FGV is currently headquartered in Stockholm and is actively investing and building internet ventures across Europe and Asia.

The merger is set to create a leading investment company with an international presence ranging from Europe’s Nordic countries to South East Asia and sporting a portfolio of more than 20 investments in various companies within the tech sector.

Fatfish also holds cryptocurrency and blockchain ventures such as crypto mining start-up Minerium and one of the largest crypto-asset exchanges in the world Kryptos-X.

“We are extremely excited to be working with Abelco and welcome this offer,” Fatfish Blockchain chief executive officer Kin Wai Lau said.

“From a shareholder’s perspective, we are impressed by the Swedish market and its advanced position and capabilities regarding start-ups in most areas, including fintech and other digital services.”

“Being able to combine this with combined organisational strength of Abelco and FGV through our offices in Stockholm and Singapore and our portfolio holdings provide good conditions for accelerated growth in Europe, with a focus on the Nordic region, as well as the market in Southeast Asia,” said Mr Lau.

Global tech strategy

Fatfish’s strategy is to partner with various entrepreneurs to facilitate building tech ventures with the potential to scale regionally or globally through its so-called “seed-to-exit” approach.

The term refers to a continued management and oversight strategy that involves multiple capital raising rounds while ensuring investee companies perform as expected in order to become fully-fledged commercially successful companies that can stand on their own two feet.

The venture capital company claims it has built a significant pipeline of opportunities at various stages of development, particularly in South East Asia, one of the fastest emerging growth markets globally.

“Currently, we are employing a dual-growth strategy by investing in both consumer internet services and blockchain technologies, in addition to making a bold play for control of the entire blockchain ecosystem,” the company said.

iCandy update

One of Fatfish’s most prominent investments is game developer iCandy Interactive (ASX: ICI).

In 2018, iCandy launched a blockchain game called Cryptant Crab, which represented the first blockchain game to be designed and developed entirely in South East Asia.

In a regulatory filing, Fatfish confirmed that iCandy is now seeking to complete a stock market listing in Canada to promote its brand recognition and presence in North America – a region undergoing a surge in investor interest in gaming and eSports.

Fatfish stated iCandy intends to raise up to C$3 million (A$3.3 million) as part of its proposed dual listing.

Just recently, iCandy announced that it will co-found an organisation called Esports Pro League (ESPL) by investing 100,000 Singapore dollars (A$108,000) in order to acquire a 42.55% stake in the global eSports tournament and media network.

The overarching plan is for iCandy to assume a leading role in developing an integrated and open ecosystem for tournaments that will be rolled out across 16 countries within Asia, Europe and the US.

iCandy said that it anticipates the first season of ESPL to launch in February 2020 with commercial returns to be generated from growing consumer participation, sponsorship and third-party deals involving other gaming industry companies.