ASX looks to unleash blockchain technology on the Australian stock market

ASX managing director and CEO Dominic Stevens believes using blockchain technology to replace CHESS will enable the development of new services and reduce costs, while placing Australia at the forefront of innovation in financial markets.

Blockchain technology has well and truly hit Australian shores in recent years, with the Australian Stock Exchange set to become the world’s first blockchain/distributed ledger technology (DLT) enabled stock exchange.

More than a dozen blockchain-focused companies have already made their way to the public market via the ASX, with the latest blockchain adopter being none other than ASX Limited (ASX: ASX) itself.

Small Caps first reported on the ASX’s intended move into blockchain in December last year, with the past eight months delivering amiable market conditions for the ASX to prepare its trailblazing technology that has yet to be implemented by any other exchange, including US and European giants such as the NYSE, LSE and Euronext.

However, US-based NASDAQ, the NYSE, the Tokyo Stock Exchange, Deutsche Bourse and India’s Securities Exchange Board have all made tentative first steps into the world of blockchain by settling an initial trickle of trades to trial the technology, or, have appointed commissions to study the feasibility of using blockchain in future.

To see what blockchain technology is capable of, one need only turn to finance, supply-chain management, record keeping and cryptocurrencies to name just a few industries that have been bolstered by its introduction in recent years.

Blockchain is not just a means of supporting crypto-currencies such as Bitcoin and Ethereum – the technology has the potential to revolutionise any marketplace it touches, streamline the way financial data is stored and transmitted between market participants and last but not least, secure the stability of trading venues that struggle to deal with fluctuations in market activity.

ASX to the rescue?

Speaking at the ASX Ltd’s annual financial results conference this week, managing director and current chief executive officer Dominic Stevens said that the ASX is “safely liberating the source of truth information in real-time” such that it can be used by participants and other providers to build new services across the value chain.

As part of a concerted move, ASX says it is on course to implement DLT that will reduce the risk, cost and complexity of Australia’s stock market, prepare it for cutting-edge service innovation, and, ultimately, unleash service innovation across an ecosystem of interconnected users.

If that wasn’t enough, the ASX says its blockchain-powered DLT technology will remove the need for periodic reconciliation altogether by allowing market participants to obtain precise real-time market information “without having to ask the ASX”.

Financial results pave way for blockchain shift

In the past financial year, the ASX delivered strong operating performance with revenues growing in all four of its distinct businesses. The results mean that the ASX continues its multi-year streak of year-on-year revenue, EBITDA and profit increases.

ASX saw its annual operating revenue grow 7.7% (A$58.6 million) to A$822.7 million. On a broader measure, its EBITDA was up 7.5% (A$44 million) to A$627 million.

The swelled numbers were partially helped by listings and issuer services revenue increasing 14.5%, with capital raisings growing by a healthy 46% over the past year including a total of A$81.7 billion raised by ASX-listed companies.

According to Mr Stevens, this year’s results were the company’s best growth figures in eight years with the increases being broad-based across the firm, and achieved against a backdrop of a subdued equity trading market which saw limited growth in the demand for trading, clearing and settlement services.

“We believe the financial services industry is in a period of great change, and many aspects of this change are being driven by forces that help increase demand for ASX’s existing services,” said Mr Stevens.

“Additionally, ASX is investing in infrastructure that will support the products and services that will be valuable to our customers in the future. This sees a number of exciting strategic growth opportunities emerging,” he said.

The ASX expects to lift its capital expenditure from A$54 million in 2018 to around A$75 million in the 2019 financial year, which includes the costs for the ongoing development of the DLT.

From financial results to technical performance

The ASX hopes to accomplish its ambitious blockchain plans by introducing a replacement to its current CHESS clearing system – a new blockchain-powered system dubbed “DLT-based CHESS”.

The replacement system has been termed as a “foundational piece of technology”, not only for the ASX as a company and a trading venue, but for the whole Australian issuing and investment community.

According to the ASX, it has been working on its DLT system for almost three years as part of a large work program that is now seeing light at the end of the tunnel. Once completed, the new CHESS system will become the first industrial-scale application of DLT in critical financial market infrastructure anywhere in the world.

It is hoped that its multi-faceted move towards blockchain and DLT will provide significant value for consumers, investors and companies and is expected to serve as a “great business enabler for our customers and a significant enabler of innovation for issuers and investors,” according to Mr Stevens.

In addition to its CHESS upgrade, the ASX is also reinvigorating its 20-year-old secondary data centre.

The ASX plans to upgrade this centre to a new state-of-the-art, third-party facility that will allow it to take advantage of the more modern and sophisticated features that already exist at its primary facility.

Why the move from CHESS?

The prime improvement over the old CHESS system comes in the form of streamlined data processing.

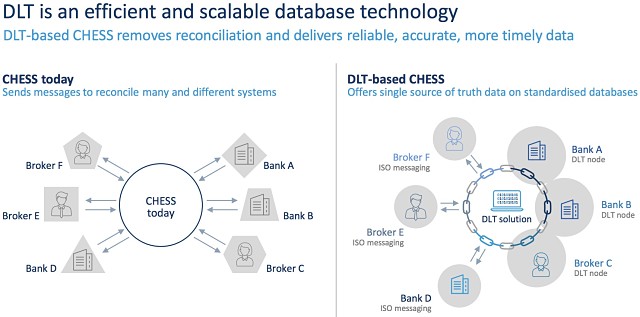

In the current CHESS system, participants send messages back and forth to the CHESS database to make sure their trades are reconciled appropriately.

This process is repeated thousands of times per day, can often be prone to errors, and understandably, becomes expensive to maintain.

One of the major roadblocks in the current system is that databases used by different participants often vary, meaning there are multiple versions of software duplicating records and making reconciliation a never-ending battle between client and clearer.

With DLT implemented, instead of sending multiple streams of messages to reconcile a large number of available databases, participants connect via “nodes” that are linked via the network’s distributed ledger – and forming a perfect chain of title that cannot be altered, according to Mr Stevens.

After evaluating feedback from customers, the ASX says it is currently “finalising the work plan” for DLT-based CHESS to go online sometime between September 2020 and March 2021.

The date is still more than two years off but does mean that Australian capital markets are set on a path toward market digitisation in the form of advanced computing being able to provide previously-impossible functions such as real-time reconciliation, instant trade settlement and lower commission costs for Australian investors.